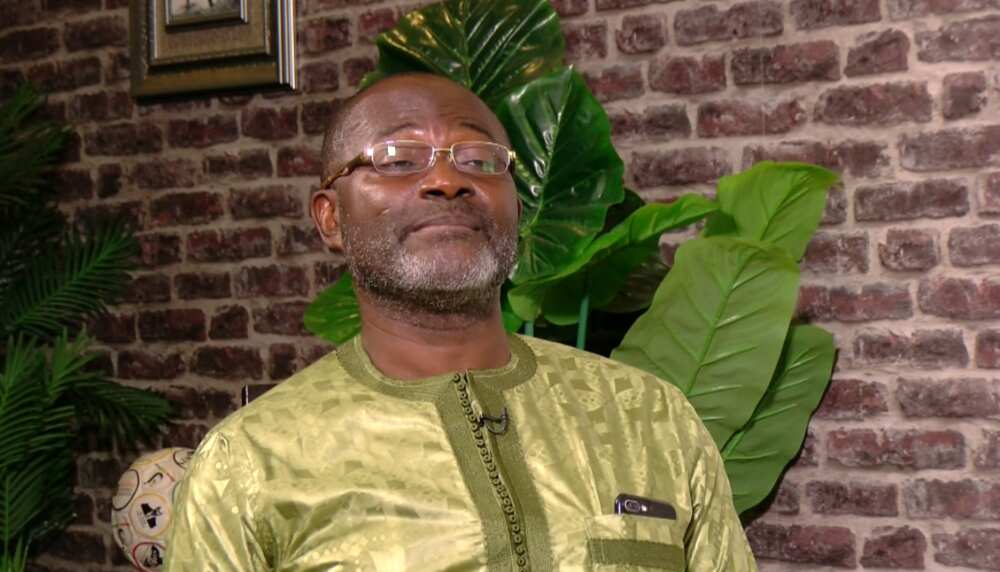

Kennedy Agyapong calls for review of interest rates; says they are too high

- Kennedy Agyapong, the Member of Parliament for Assin Central, has called for a review of interest rates

- He argued that the current rate of 26% is not conducive for the growth of businesses

- According to him, the government, which claims to be working hard at industrialisation, should do something about the rate

Our Manifesto: This is what YEN.com.gh believes in

Member of Parliament (MP) for Assin Central, Kennedy Agyapong, has called for a review of the interest rate in Ghana.

According to him, the current rate of 26 percent is too high and could lead to the collapse of businesses.

In his opinion, the high interest rate is a clear indictment on a government that aims at creating more jobs in the country.

Source: UGC

READ ALSO: Government to increase tax-to-GDP from 13% to 20% to help fund GHc100 billion CARES programme

Per a Ghana Web report, he noted that the high rates have foiled attempts to establish businesses that could be expanded to create jobs.

He revealed that foreigners enjoy lower rates and, as such, they have taken over all the big companies.

He further indicated that a country that intends to build its economy needs to build individuals who can then own businesses.

He added that Ghanaians are unable to expand businesses and banks have subsequently taken over such enterprises.

Kennedy Agyapong noted he has heard President Akufo-Addo speaking about industrialisation, but before that is done the interest rate should be reviewed.

In other news, banks in Ghana have eased their stance on credit facilities to businesses regardless of the high risk of default on debts, a report by the Bank of Ghana (BoG) has revealed.

The BoG’s Credit Conditions Survey for June 2020 showed non-performing loans have increased to 15.7 percent of banks’ assets in June from the 14.5 percent recorded in March 2020.

For the next two months businesses can, therefore, access credit with ease.

READ ALSO: Vodafone cancels all charges on MoMo transfers to other networks

Enjoyed reading our story? Download YEN's news app on Google Playstore now and stay up-to-date with major Ghana news!

Want to be featured on YEN.com.gh?

Send us a message on our Facebook page or on Instagram with your stories, photos, or videos.

Source: YEN.com.gh