US Fed Chair warns tariffs will likely raise inflation, cool growth

Source: AFP

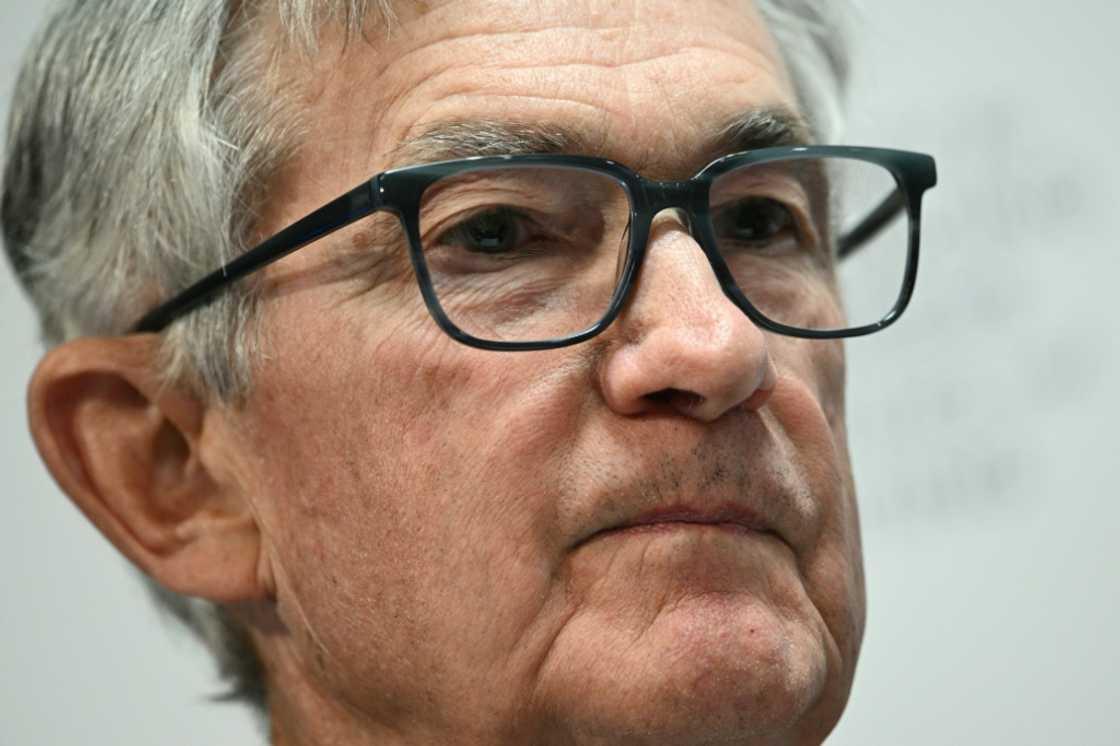

US President Donald Trump's tariffs risk higher unemployment and will likely cause inflation to rise and growth to slow, Federal Reserve Chair Jerome Powell said Friday.

"It is now becoming clear that the tariff increases will be significantly larger than expected," Powell told an event in Virginia.

"The same is likely to be true of the economic effects, which will include higher inflation and slower growth," he said, adding that it was "too soon" to consider making changes to US monetary policy.

Source: AFP

Trump's announcement earlier this week of heavy levies against top trading partners has rocked global markets as investors have grappled with the prospect of higher import costs on everything from shoes to shrimp.

The larger-than-expected measures announced Wednesday stack on top of earlier country-specific levies, meaning that China, for example, will now face a new levy totaling 54 percent.

Other top trading partners will also see higher rates, with the European Union now facing a 20 percent tariff from April 9, and India looking at a 26 percent levy.

The Trump administration has also targeted specific sectors of the economy, recently slapping a 25 percent tariff on automobiles not made in the United States.

Trump calls for cuts

Source: AFP

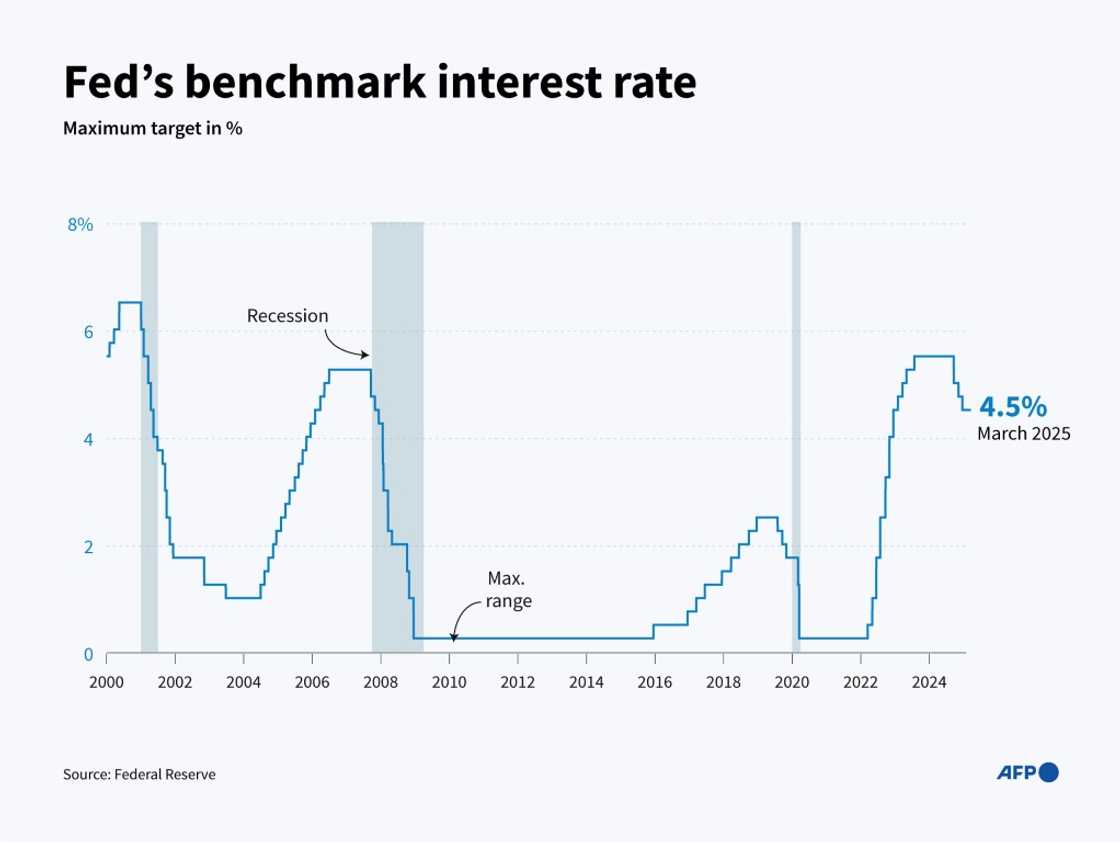

Powell's comments suggest the Fed is in no rush to cut its benchmark lending rate from its current elevated level of between 4.25 and 4.50 percent, as it continues its struggle to bring inflation down to its long-term two- percent target.

In recent months, the Fed's progress in bringing inflation down to target has stalled, while growth has remained solid and the unemployment rate has hugged close to historic lows.

Faced with this data, the Fed voted last month to extend its pause in rate cuts, and signaled it wanted to see how the new administration's policies would feed through into the economy before taking any action.

But policymakers -- now including Powell -- have warned that tariffs could cause prices to rise, with the extent of the price increase likely determined by the rollout of the levies, and how consumers and business respond.

Ahead of Powell's speech on Friday, Donald Trump took to his Truth Social account to insist that his tariff policy would not change despite the market reaction, and called on Powell to act.

"This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates," he wrote. "He is always 'late,' but he could now change his image, and quickly."

"CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!" added Trump, who first nominated Powell to run the Fed, before turning against him during his first term.

Source: AFP