Fidelity Bank And First National Bank Suspended From Forex Trading For 30 Days: BoG Cracks Whip

- Two of Ghana's top banks have been sanctioned by the central bank for breaching rules on interbank forex trading rules

- Punitive sanctions have been taken against Fidelity Bank and First National Bank Ghana by the Bank of Ghana

- Their forex trading licences have been revoked, and they are not permitted to do any forex transactions for 30 days

- The central bank said in a statement that it hopes the punishment will deter participants in the forex market from breaching forex trading rules

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

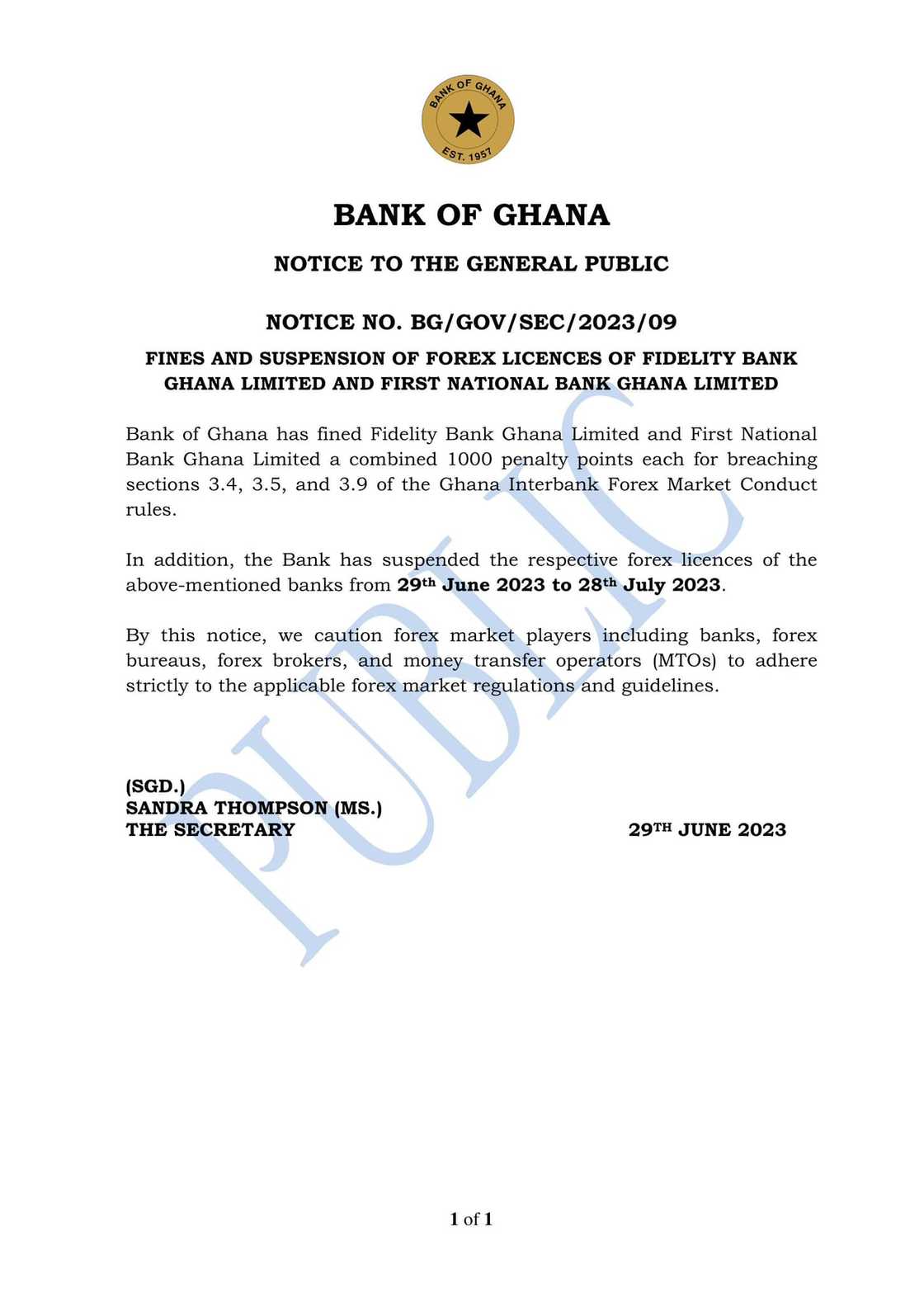

The central bank has taken punitive action against Fidelity Bank and First National Bank Ghana for breaching the country's rules on forex trading.

The Bank of Ghana has, therefore, slapped with a combined penalty of 1,000 penalty points on each of their banks for their offences.

Source: Getty Images

The central bank announced in a statement that the forex licences of the two banks have been temporarily suspended for 30 days.

Source: Facebook

The suspension starts from June 29, 2023, until July 28, 2023, the statement explained.

The central bank says it hopes the punishment would deter participants in the forex market, including banks, forex bureaus, forex brokers, and money transfer operators (MTOs), from breaching regulations and guidelines governing the forex market.

One of the rules Fidelity and First National is said to have broken is section 3.4 of the Ghana Interbank Forex Market Conduct.

It states as follows:

“Licensed Foreign Exchange Dealers (LFXDs) are required to update indicative quotes for buying and selling US dollars at regular intervals, on the Reuters and Bloomberg information systems."

Ghana's top banks post heavy losses due to Domestic Debt Exchange Programme

Meanwhile, YEN.com.gh has reported in a separate story that the government's debt restructuring drive has caused top banks in Ghana to record significant losses in 2022.

Ghanaian banks have been posting their 2022 performance, and it shows top banks like Standard Chartered Bank and GCB Bank bled money.

GCB Bank's audited accounts show the bank recorded a GH¢593.4 million net loss for the year ending December 2022, a first since 1993.

Bank of Ghana bans money bouquets

Also, the Bank of Ghana has warned against the use of cedi banknotes for gift bouquets and hampers with immediate effect.

The central bank's Dominic Owusu explained on March 30, 2023, that when cedi notes are folded in bouquets and hampers, they deface, compelling the central bank to spend huge funds to replace them.

He said the use of cedi notes for bouquets and hampers flouts existing policy on Ghana's legal tender.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: YEN.com.gh