E-Levy: Main Institutions Mandated By The GRA To Deduct 1.5% From May 1

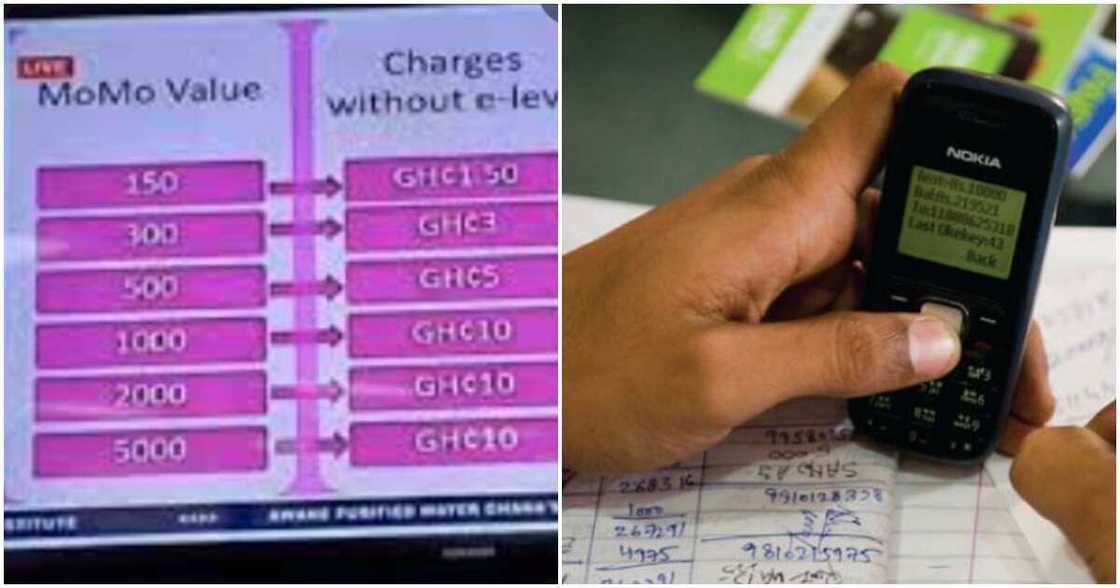

- The GRA has provided a list of companies mandated to charge the 1.5% E-Levy when implementation kicks in on May 1, 2022

- The list includes 26 Bank of Ghana-approved payment service providers and specialised deposit-taking institutions

- All commercial banks providing electronic transactions are also mandated to charge the applicable charges for E-Levy

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

As the May 1, 2022, E-Levy implementation date approaches, the Ghana Revenue Authority (GRA) has released a list of key institutions that will charge the 1.5% tax.

GRA’s Head of Compliance of the Domestic Tax Revenue Unit, Victor Yao Akogo, told Joy News that apart from the main entities with the licence to issue electron money, other entities will deduct the tax on behalf of the Authority.

Source: UGC

- Bank of Ghana approved electronic money issuers like MTN Mobile Money, the following payment service providers are mandated to charge the E-Levy:

- Airtel Mobile Commerce (Ghana) Limited

- GCB G-Money

- Yup Ghana Limited

- Vodafone Mobile Financial Services Limited

- Zeepay Ghana Limited

- AppsNmobile Solutions Limited

- Bsystems Limited

- Cellulant Ghana Limited

- Dreamoval Limited

- Emergent Payments Ghana Limited

- Etranzact Limited

- ExpressPay Ghana Limited

- Fast Pace Transfer Limited

- Global Accelerex Ghana Ltd

- Halges Financial Technologies Limited

- Hubtel Limited Payment

- IT Consortium Limited

- MFS Ghana Limited

- Moolre Limited

- Nfortics Ghana Limited

- Nsano Limited

- PaySwitch Ghana Limited

- Transsnet Payments Ghana Limited

- Techfin Innovations Ltd

- ZappGhana Limited

- Titan Payment Systems

Download YEN's news app on Google Play now and stay up-to-date with all major Ghana news

- All banks that provide electronic transactions are mandated to charge the applicable fees for E-Levy; and

- Specialised Deposit-Taking Institutions (SDIs) like Rural and Community Banks

President Nana Akufo-Addo signed the controversial E-Levy bill into law just two days after a one-sided Parliament of Majority MPs passed it.

Read also

E-Levy implementation starts in May after Akufo-Addo's swift assent to a controversial bill

With the bill now a law, the Finance Ministry and the Ghana Revenue Authority will begin implementing the collection of the 1.5% tax to be charged in some mobile money and electronic transactions.

E-Levy: Five Main Transactions That Will Be Affected By The New 1.5% Tax

After Ghana’s Parliament passed the controversial 1.5% E-levy tax bill on Tuesday, March 29, 2022, YEN.com.gh brings you the five central transactions that the new tax will affect.

According to the Finance Minister, Ken Ofori-Atta, the new levy will affect five principal transactions, key among them mobile money transactions.

The transactions that the tax will affect are as follows:

- Mobile money transfers between accounts on the same electronic money issuer (EMI)

- Mobile money transfers from an account on one EMI to a recipient on another EMI;

- Transfers from bank accounts to mobile money accounts;

- Transfer from mobile money accounts to bank accounts;

- Bank transfers on a digital platform or application which originate from a bank account belonging to an individual to another individual.

Our manifesto: This is what YEN.com.gh believes in

Source: YEN.com.gh