How to check your SSNIT contribution online

Checking your Social Security and National Insurance Trust contribution has now been made easy. In the recent past, employers and employees would have to visit the SSNIT offices to follow up on the contributions. Today, however, one can easily use their digital devices to access SSNIT. It saves on time as well as allows you to access assistance very fast. This article provides you with detailed information about how to check your SSNIT contribution.

How to check your SSNIT contribution online

- First, you need to have a portal identification number. This ID is usually given once you enroll and re-enroll. To do this visit SSNIT offices near or contact their offices. You can also get the ID by visit the Biometric Terminal.

- Secondly, you can now login to the SSNIT website. On your right side, there is a sign-in button. Click it, provide your details as you follow all the steps. For employers, you will use the details sent to you after you enrolled. If you are a Scheme Member, your user name will be the Social Security Number. The password is the one that was sent earlier in your email.

- The third step is entering a new password and confirming it. You must also respond to the security question.

- Once you log in, you can choose the services that you want. They are arranged into public, employer, employee, pensioner and welfare association functions.

Now that you have learned how to check your SSNIT contribution, it’s good to know how to go about calculating it.

READ ALSO:NSS extension posting checking guide

SSNIT contribution calculation

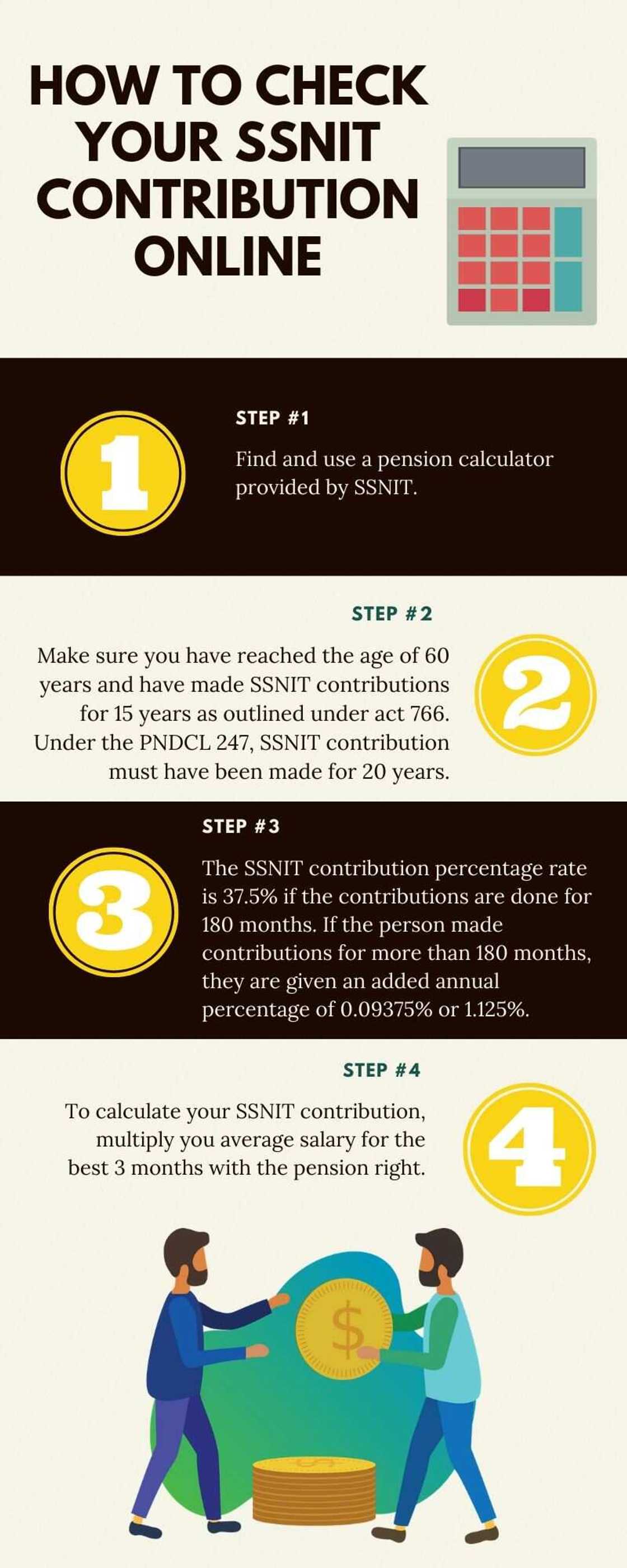

To calculate your SSNIT contribution, you must use a pension calculator provided by SSNIT. To qualify for old-age pension, the person must have reached the age of 60 years. Additionally, he/she must have made SSNIT contributions for 15 years as outlined under act 766. Under the PNDCL 247, SSNIT contribution must have been made for 20 years.

Source: UGC

The basis for calculating pension is the age, the average of the best salaries for three months and the earned pension right. The earned pension right is the rating given for monthly contributions.

The SSNIT contribution percentage rate for pension rights is 37.5% if the contributions are done for 180 months. If the person made contributions for more than 180 months, they are given an added annual percentage of 0.09375% or 1.125%.

To calculate your SSNIT contribution, multiply your average salary for the best 3 months with the pension right.

A reduced pension is also given to people who have reached 55 years. They must have made SSNIT contributions for 15 years as outlined under act 766. Under the PNDCL 247, SSNIT contribution must have been made for 20 years. As they approach the age of 60, their pension percentage continues to increase by 7.5%.

READ ALSO:How to use Ecobank Internet Banking

SSNIT contribution payment advice

SSNIT asks employees to make sure that the exact deductions made from their salaries by their employers are paid fully to SSNIT. Check your SSNIT contribution regularly to ensure this is done.

Moreover, employees should emphasize on their basic salaries being consolidated and their employers pay the contributions in total. By doing this, employees will get their pensions without much struggle.

As an employee, make it a habit to check your SSNIT contribution. It is very easy and your queries will be answered on time.

READ ALSO: Health insurance companies in Ghana 2020: List

Source: YEN.com.gh