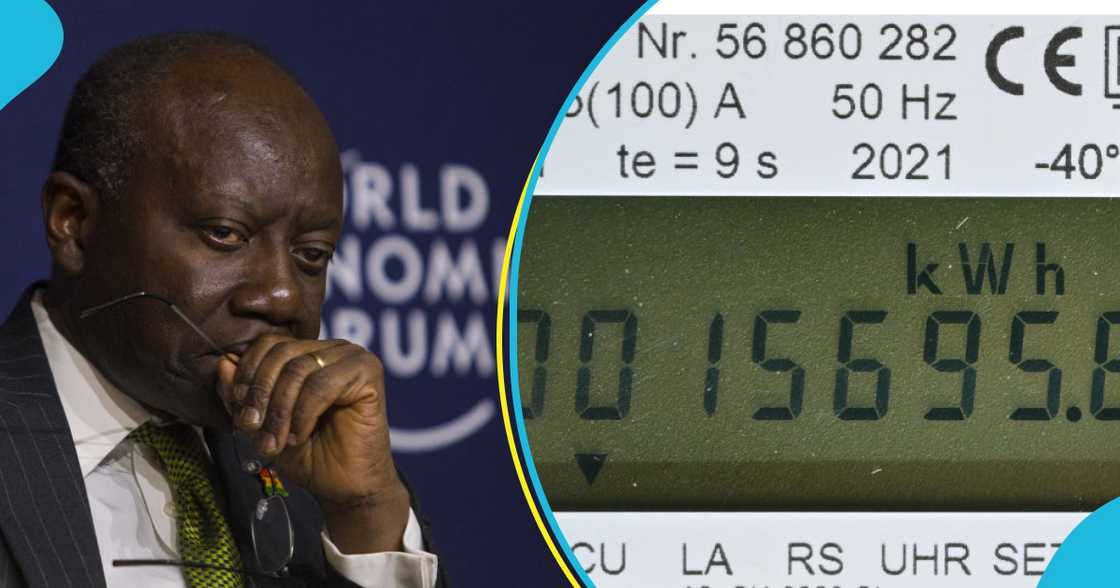

Government Now Charging VAT On Residential Electricity Purchases, Uses COVID-19 As Justification

- The government has been charging a Value Added Tax on a section of electricity consumers

- A letter from the Ministry of Finance has shown that this tax was implemented on January 1, 2024

- The Finance Ministry also said the VAT forms part of the implementation of the country's Covid-19 recovery

The government has been charging a Value Added Tax (VAT) on a section of electricity consumers in the country.

A letter from the Ministry of Finance has shown that this tax was implemented on January 1, 2024.

Source: Getty Images

This letter was addressed to the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO).

The tax will be charged to residential electricity customers above the maximum consumption level specified for block charges for lifeline units.

It added that the VAT forms part of the implementation of the country's Covid-19 recovery plan.

GPRTU threatens to increase transport fares by 60%

Trotro drivers have threatened to increase transport fares by 60% because of the new emissions levy.

The transport union is making the threat in response to the Emission Levy Bill, which takes effect in January 2024.

The Emissions Levy Bill imposes an annual charge of 100 cedis on all owners of petrol and diesel cars.

GRA cashing out from betting tax

The Ghana Revenue Authority has accrued GH¢15 million in its first two months from its recent tax on sports betting winnings.

The Authority has said it is targeting GH¢60 million by the current football season ends.

The GRA introduced a 10% withholding tax on betting on August 15, 2023, to raise about GH¢400 million annually.

No new tax on bloggers

Read also

Central Region Chiefs endorse lithium mining agreement after meeting government: “It is far better”

The GRA clarified earlier that no new tax is being created for bloggers, brand influencers, and MCs.

The Authority said it is trying to expand the tax net by ensuring the incomes of bloggers, brand influencers, and MCs are taxed.

While the GRA refuted speculation that it is creating a new tax, it has stressed that all income generation must be taxed.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: YEN.com.gh