2023 Budget: Finance Minister Announces 2.5% Increase In VAT To Support Roads And Digitalisation Agenda

- The government has announced an increment in the rate of the Value Added Tax (VAT) rate by 2.5%

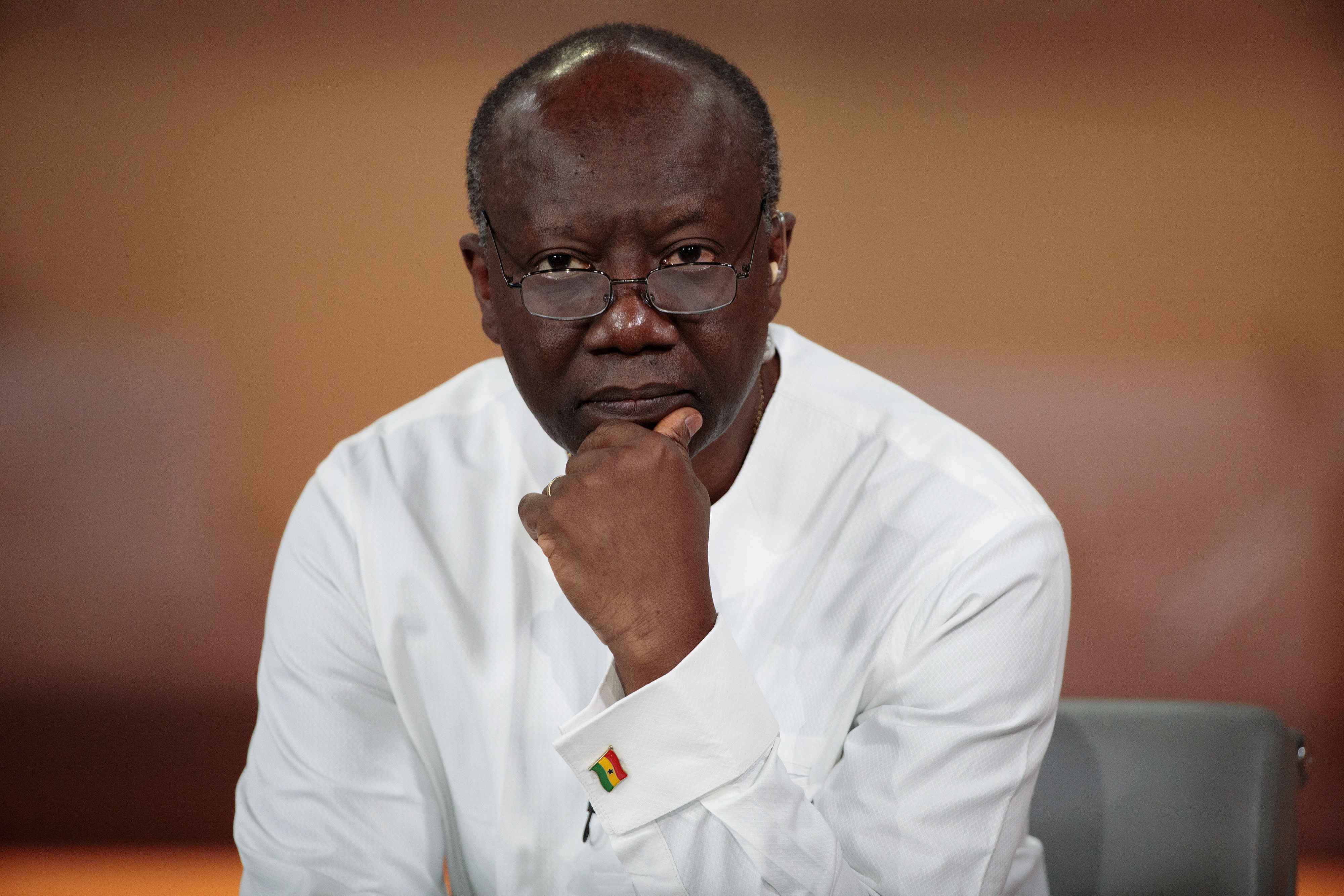

- Finance Minister Ken Ofori-Atta says the increment is necessary as it will lead to a massive infrastructural drive in the country

- Presenting the 2023 budget statement to Parliament, Ofori-Atta said increasing the VAT rate will also directly support the government’s digitalization agenda

PAY ATTENTION: Read the hottest World Cup news, gossip, analytics and predictions

The Akufo-Addo-led government has announced an increment in the Value Added Tax (VAT) rate by 2.5%.

According to the finance minister, Ken Ofori-Atta, the move is necessary as it will help the government’s massive infrastructural drive.

Source: Getty Images

Presenting the 2023 budget statement and economic policy document of the government, Ofori-Atta announced several measures being put in place to ensure the country moves from its current financial crisis.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

2023 Budget: VAT To Go Up By 2.5% To Construct More Roads - Ofori-Atta

In justifying the VAT rate, which has been increased by 2.5 per cent, the minister said it would directly support the construction of roads in the country and the digitalization agenda of the NPP government.

“The demand for roads has become the cry of many communities in the country. Unfortunately, with the current economic difficulties and the absence of dedicated source of funding for road construction, it is difficult to meet these demands. In that regard we are proposing the implementation of new revenue measures. The major one is an increase in the VAT rate by 2.5 percentage points," he said.

The proposed increment and introduction of new taxes are coming when the ordinary Ghanaian is reeling from economic hardships.

2023 Budget: GUTA, Minority Vow To Resist Increment In VAT Rate

The minority caucus in parliament and the Ghana Union of Traders (GUTA) have all served notice they will kick against the 2.5 per cent increase in Value Added Tax (VAT) which they say will further compound the plight of the ordinary Ghanaian.

MP for Asuogyaman, in an earlier interview, said introducing taxes at this time smacks of insensitiveness.

On his part, the president of GUTA, Dr Joseph Obeng, said they are already overburdened with taxes and would thus lead traders across the country to reject any new taxes contained in the budget statement.

GUTA Predicts This Year’s Christmas Will Be Affected By Current Economic Hardships In Ghana

Earlier, YEN.com.gh reported that GUTA predicted the current economic crisis would negatively impact this year’s Christmas festivities.

The current economic challenges in the nation, which have resulted in a lack of money in the system, will influence consumers' purchasing power as well as traders' routine business operations, according to Dr Joseph Obeng, president of GUTA.

New feature: Сheck out news that is picked for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Source: YEN.com.gh