IMF says world economy resilient to shocks but 'limping'

Source: AFP

PAY ATTENTION: Be the first to follow YEN.com.gh on Threads! Click here!

The IMF kept its 2023 global growth forecast unchanged on Tuesday but warned that the economy is "limping along" as inflation remains high and the outlooks for China and Germany were downgraded.

The IMF's updated World Economic Outlook still sees growth of 3.0 percent for this year but it cut its forecast for 2024 to 2.9 percent, down 0.1 percentage points from its July report.

"The economy continues to recover from the pandemic and Russia's invasion of Ukraine, showing remarkable resilience," said the IMF's chief economist, Pierre-Olivier Gourinchas.

"Yet growth remains slow and uneven. The global economy is limping along, not sprinting," he said at a news conference during the institution's annual meetings in Marrakesh, Morocco.

Source: AFP

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

Inflation, which has fallen sharply since last year, is predicted to remain elevated at 6.9 percent this year, up slightly from July, and 5.8 percent in 2024, up 0.6 percentage points.

Central banks have raised interest rates sharply in efforts to contain inflation.

The move could have knock-on effects on growth, but the IMF warned central banks against easing the monetary tightening too soon, adding that it still expects the global economy to have a "soft landing" -- a slowdown that avoids recession.

"The news on inflation is encouraging, but we're not quite there yet," Gourinchas said.

US outperforms China, Europe

Gourinchas pointed to "important divergences" between countries.

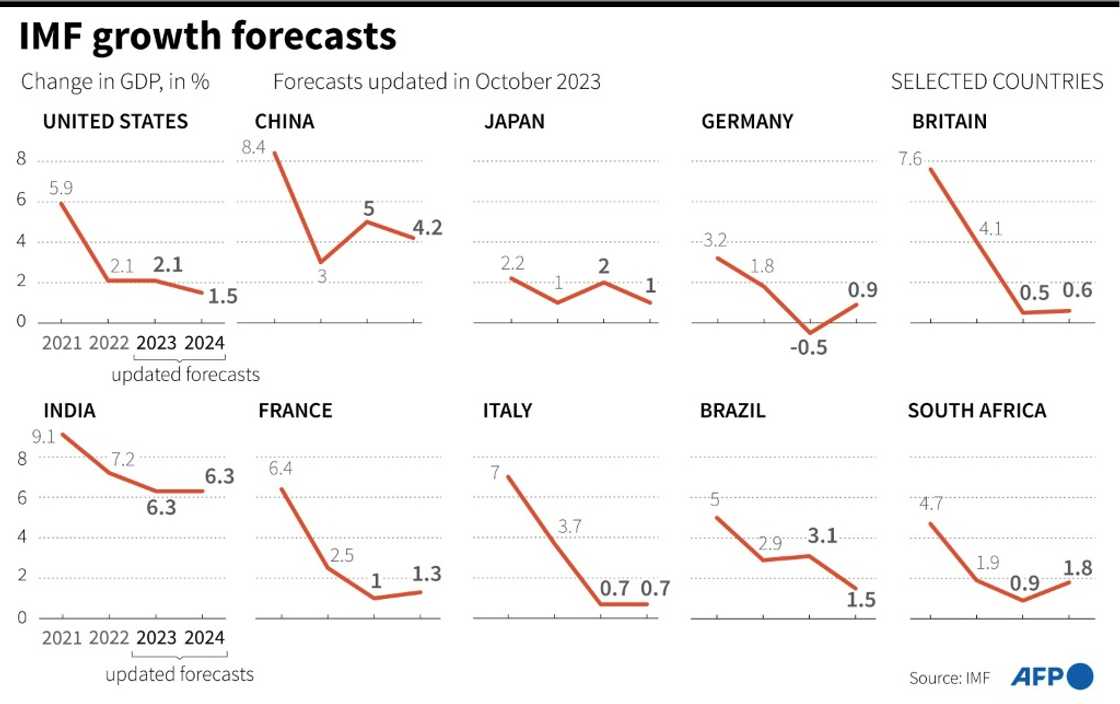

The United States is performing better than other major economies, with the IMF upgrading its growth forecast from 1.8 percent to 2.1 percent for this year. It will slow to 1.5 percent next year, but it is 0.5-percentage-points higher than in the IMF's July outlook.

By contrast, China's outlook for the next two years was lowered under the weight of a real estate crisis threatening the world's second biggest economy.

The Chinese economy is now expected to grow by 5.0 percent this year -- down from 5.2 percent previously -- and slow further to 4.2 percent in 2024, down from 4.5 percent.

Source: AFP

Chinese authorities need to take "very forceful, and very sizable action ... to really bring back confidence in the (property) sector," Gourinchas told AFP in an interview.

In the press conference, Gourinchas said Chinese policymakers "have room" to ease monetary policy and provide fiscal support.

"These are measures we would encourage the authorities to take," he added.

German recession

The picture is also gloomy in Germany, with the IMF seeing a deeper recession in Europe's biggest economy -- the only G7 country to have a contraction.

The German economy is expected to shrink by 0.5 percent this year -- instead of 0.3 percent previously -- and grow by 0.9 percent in 2024 instead of 1.3 percent.

The wider eurozone is forecast to grow by just 0.7 percent this year, down 0.2 percentage points from July, and by a reduced 1.2 percent in 2024.

Gourinchas told AFP that the eurozone was hit harder than the United States by the rise in energy prices following Russia's invasion of Ukraine, as the region is an importer.

"The US is not an energy importer, so when the price of energy goes up, if anything, they become richer," he said.

He also pointed to more resilient US consumer spending, a lesser impact from interest rate hikes and higher government spending.

Gaza conflict

Among other countries, the IMF sharply raised Japan's economic outlook to 2.0 percent for this year, pointing to "pent-up demand, a surge in inbound tourism, and accommodative policies, as well as by a rebound in auto exports."

India's growth forecast was lifted for this year to 6.3 percent, in line with its unchanged outlook for 2024.

The growth outlook for the Middle East and Central Asia was cut by half a percentage point to 2.0 percent for this year, dragged down by a lower forecast for oil-rich Saudi Arabia.

Gourinchas said it was "too early" to assess the impact that the conflict between Israel and Hamas could have on the Middle East economy.

In sub-Saharan Africa, the outlook has worsened slightly, with growth expected to reach 3.3 percent, down 0.2 percentage points amid a projected slowdown in the Nigerian economy.

Russia's economy has remained more resilient than many economists expected since its invasion of Ukraine began in February last year.

The IMF sharply raised its growth forecast once more to 2.2 percent for this year, up 0.7 percentage points from July. Its growth outlook for next year was cut slightly to 1.1 percent.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP