China's economic woes far from over, despite optimistic growth goal

Source: AFP

China's economic troubles are far from over and leaders admit the country will face an uphill struggle in hitting its goals for 2024, piling on the pressure for stimulus and reforms that experts say are needed to reverse the malaise.

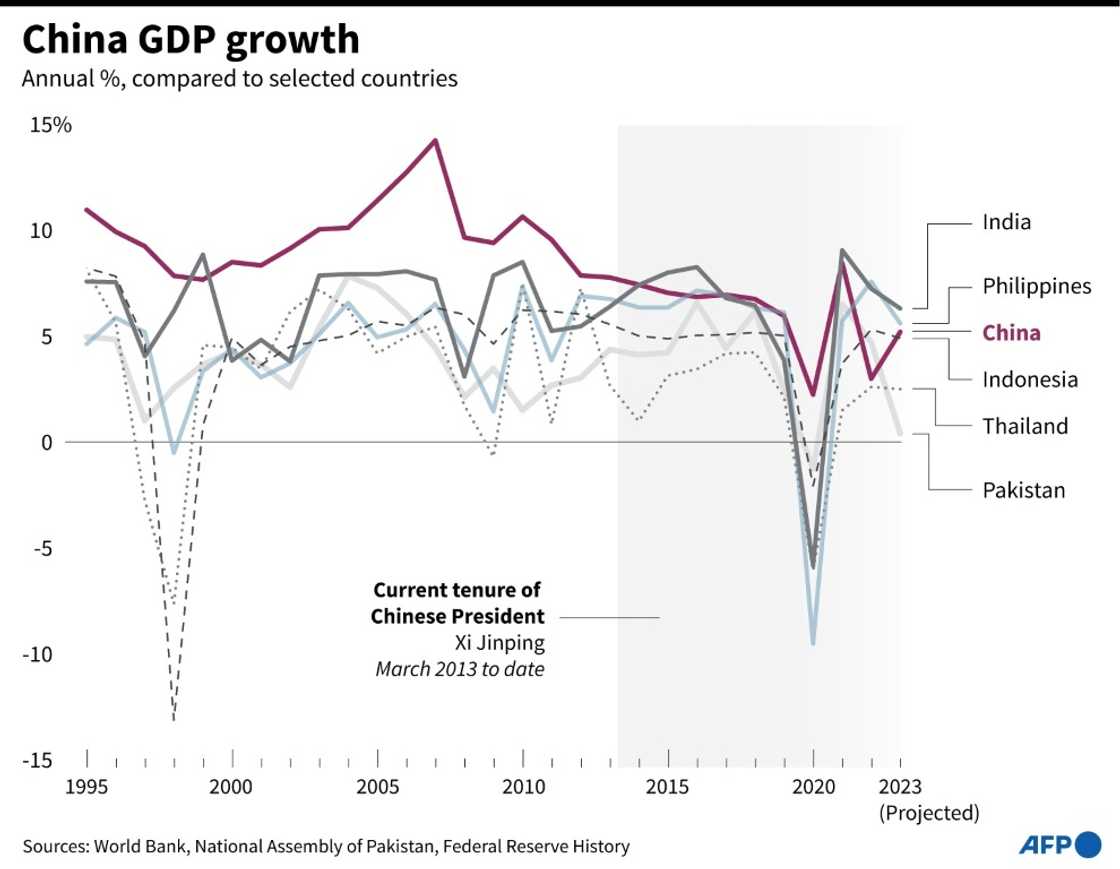

Beijing's leadership on Tuesday laid out an objective of "around five percent" gross domestic product (GDP) growth this year -- a dream of many developed Western nations but for China a far cry from the breakneck expansion that powered its rise.

It is also identical to last year's GDP target -- one of China's lowest in decades even as the economy was buoyed by the country's emergence from strict Covid rules that had stifled progress.

Beijing has been upfront that it believes hitting five percent growth will "not be easy" given the "lingering risks and hidden dangers" still present in the economy.

Economists agree.

"Although the growth target this year is the same as last year, it's actually more ambitious given the higher base in 2023," said Jing Liu, HSBC Global Research Greater China chief economist.

PAY ATTENTION: All celebrity news in one place! Follow YEN's Facebook Broadcast channel and read on the go.

Chief among the risks is China's real estate sector -- now under unprecedented strain with some major developers on the verge of bankruptcy and falling prices dissuading consumers.

Property in China experienced two decades of meteoric growth alongside rising living standards across the country and long accounted for more than a quarter of China's GDP.

But the sector has become emblematic of the challenges facing the wider Chinese economy -- overpowered by cheap debt and roaring demand, millions of unfinished homes now lie empty.

Debt to rights

Despite official efforts to offer fresh support, "the property sector has shown no signs of recovery", said Ting Lu, chief China economist at Nomura.

Source: AFP

Tuesday's government work report promised greater steps -- more investment in government-funded housing, efforts to assist in the "justified financing demands" of real estate firms, and a vaguely defined "new development model" for real estate.

"The property sector will likely remain a prolonged drag on growth," according to Lynn Song, chief Greater China economist at ING.

But economists were hoping that Beijing would signal a move beyond its traditionally cautious approach to bailouts -- what Chinese Premier Li Qiang this year likened to seeking "short-term growth while accumulating long-term risks".

"Fiscal policy has to turn more expansionary than last year," Larry Hu, chief China economist at the Macquarie Group, told AFP.

Beijing, he said, needs to "stabilize the property sector, with the government to step in as the buyer/lender" of last resort.

For many, Beijing's refusal to budge this year on its fiscal deficit-to-GDP target -- kept steady at three percent -- was a sign that big-ticket bailouts were not on the cards.

That goal "fell below expectations and signalled a cautious approach to fiscal policy", Stephen Innes, managing partner at SPI Asset Management, said in a note.

That's not to say that there is no help at all.

Tuesday's work report laid out 3.9 trillion yuan ($541.8 billion) in special-purpose bonds to be issued to shore up ailing government finances -- an increase, it said, of 100 billion yuan over last year.

On top of that, officials pledged an additional one trillion in "ultra-long special treasury bonds" for funding other major state projects.

Those packages will "give an extra boost", said Sarah Tan, an economist at Moody's.

"Local governments have felt the pinch from the woes in real estate given that a bulk of its revenues came from land sales to developers," she said.

"The dried-up revenue source has hindered the government's ability to support the sector in its darkest hour."

Not done yet

But many agree more will need to be done if the deep structural issues dragging down the world's number two economy -- from unsustainable borrowing to income inequality -- are to be fixed.

With the property market still nowhere near bottoming out -- prices continue to fall and several big-name developers continue to teeter on the brink -- some think Beijing will miss its five percent target.

"Our current baseline forecast for 2024 is 4.6 percent," Wang Tao of UBS told AFP.

"The property market has continued to fall and not yet reached the bottom," she explained.

That will continue to trouble consumers who have been hit hard by high youth unemployment and the broader economic uncertainty.

Chinese President Xi Jinping recently called for large-scale equipment renewal and trade-in of consumer goods in a bid to boost activity, though economists remain sceptical.

"Reviving the economy requires boosting household wealth and income, something China's leaders clearly aren't yet ready to do," said analysts at Trivium, a research firm specialising in China, in a note.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP