US inflation data unlikely to alter Fed plans to hold rates steady

Source: AFP

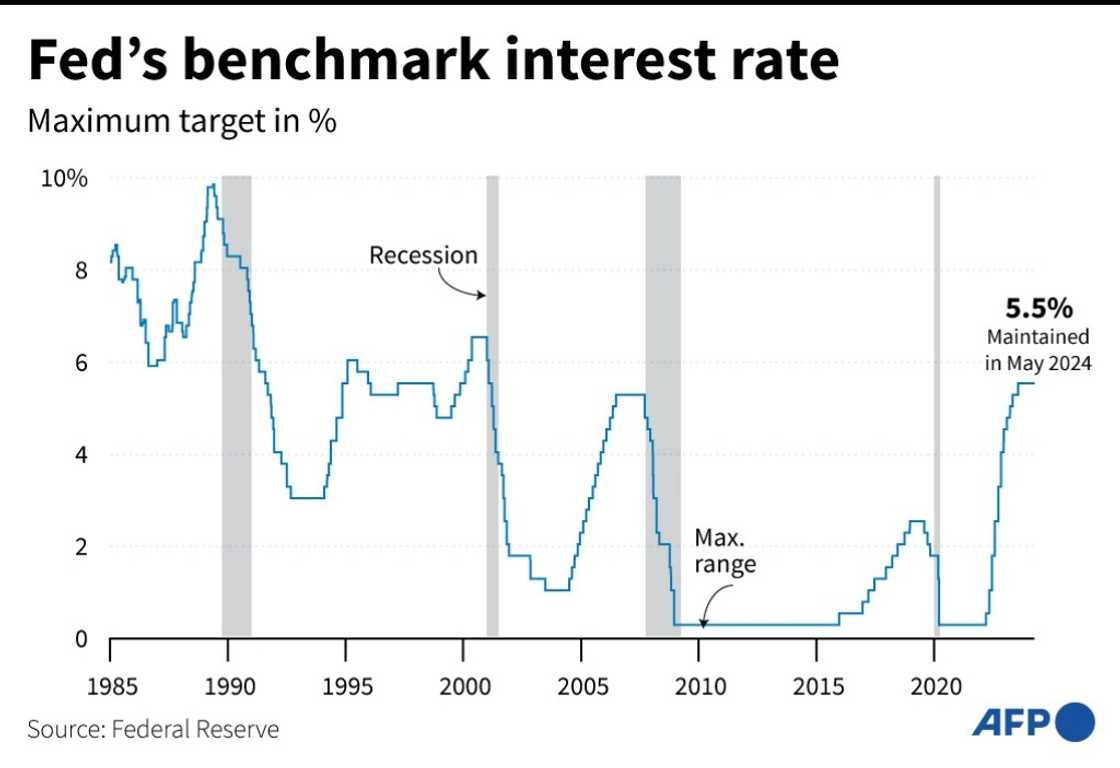

Fresh US consumer inflation data published Wednesday is unlikely to sway the Federal Reserve, which is widely expected to leave its key lending rate unchanged and lower the number of cuts it has penciled in for this year.

The May headline consumer inflation rate is expected to be little changed from a month earlier, according to the median forecast of economists surveyed by Dow Jones Newswires and The Wall Street Journal.

If the analysts are correct, inflation will remain stuck firmly above the Fed's long-term target of two percent, giving the US central bank an additional incentive to hold rates at a 23-year high of between 5.25 and 5.50 percent, and wait for the economic winds to change.

"We expect guidance from the Fed to signal a prolonged pause as the bar for hikes or several cuts remains high," Bank of America economists wrote in a recent investor note.

Pushing back the cuts

Source: AFP

The US Fed has a dual mandate from Congress to tackle both inflation and unemployment, and the data suggests it remains broadly on track to tackle both without pushing the US into recession -- despite the small uptick in headline inflation in the first few months of this year.

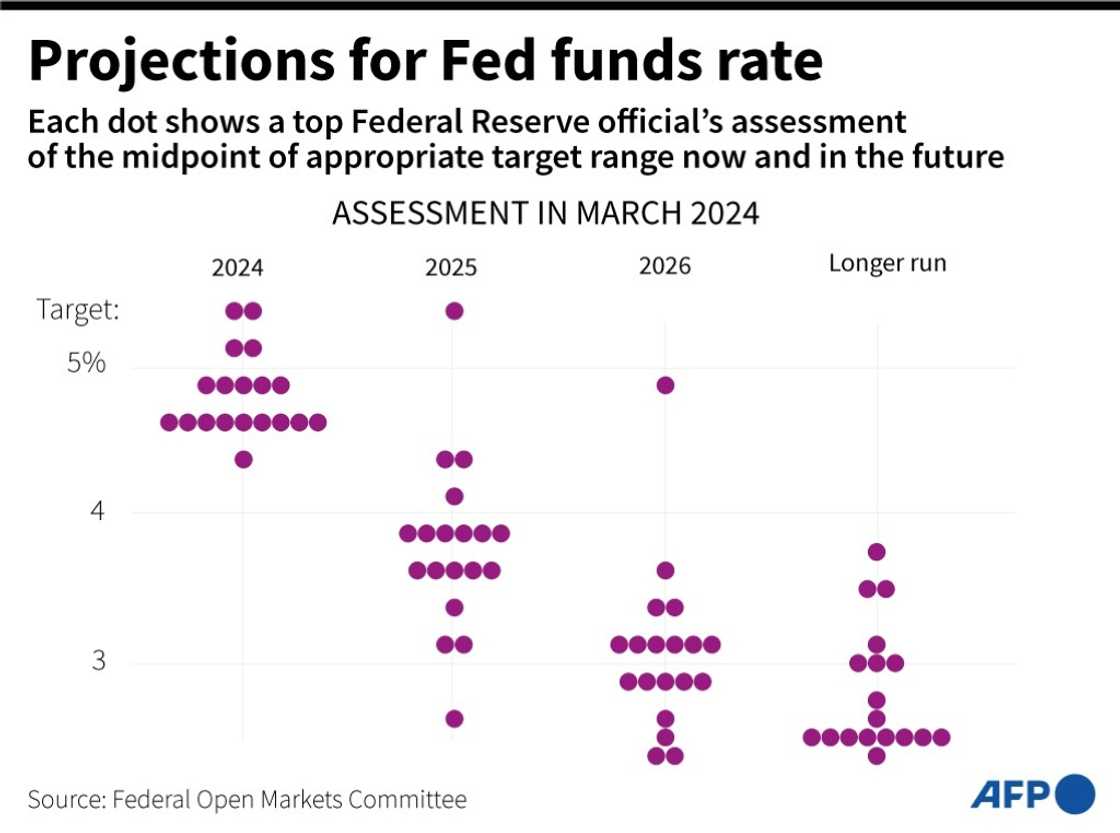

With cuts almost certainly off the agenda for this meeting, Wednesday's action is likely to center around the economic forecasts from the 19 members of the Fed's rate-setting Federal Open Market Committee (FOMC), which will be updated for the first time since March.

Analysts are looking to FOMC members to lower their individual forecasts for where rates will be at the end of the year in a chart known as the "dot plot," which reduces the median number of projected cuts this year from three down to two or fewer.

"We continue to expect the first rate cut in September," Goldman Sachs chief economist David Mericle wrote in a note to clients published on Sunday.

His team at Goldman sees the Fed moving to ease monetary policy every quarter after that, meaning a total of two 0.25-percentage-point cuts in 2024, and four in 2025.

"It only takes one dot moving higher to shift the median up to two 25bp (basis point) cuts -- which is our base case," economists at Citi wrote in a recent investor note.

"We'd be surprised to see the Fed drop two easings, but it's possible," economists at Pantheon Macroeconomics wrote in a note to clients on Tuesday, while also predicting the FOMC will forecast a median of two cuts this year.

Other analysts, including economists at EY and Barclays, expect the updated forecasts to show a median figure of just one rate cut for 2024.

"We anticipate the dot plot of median rate expectations will feature only one 25 basis points (bps) rate cut in 2024," EY chief economist Gregory Daco wrote in a note to clients.

Significant shift

Source: AFP

If the forecasts were to show just one cut this year, it would mark a significant shift from December, when inflation appeared to be firmly on the path towards two percent, and the financial markets were preparing for as many as six rate cuts this year.

By contrast, futures traders currently assign a probability of just over 50 percent that the Fed will make its first rate cut by September, although they see November as much more likely, according to data from CME Group.

Shortly after the interest rate decision is announced, Fed chair Jerome Powell will take questions from reporters during a press conference in Washington.

Powell has insisted in past public comments that the FOMC will remain "data-dependent" in its decision-making, and will not be swayed by politics.

Nevertheless, a September start to rate cuts would almost certainly thrust the Fed into the middle of a fractious presidential campaign between President Joe Biden and his Republican opponent, Donald Trump, who has repeatedly questioned the US central bank's independence.

PAY ATTENTION: Stay informed and follow us on Google News!

Source: AFP