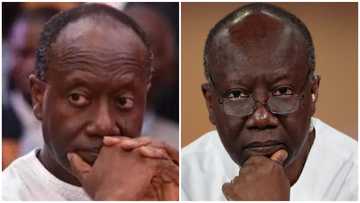

E-Levy: Ofori-Atta Reviews Controversial Tax Downwards To 1% From 1.5% In 2023 Budget

- The controversial E-Levy has been reduced to 1% from 1.5% tax rate in the 2023 budget

- The finance minister has meanwhile removed the daily threshold of 100 Ghana cedis on transactions

- Ken Ofori-Atta said the reduction is part of efforts to aggressively mobilise domestic revenue

Finance minister Ken Ofori-Atta has reduced the rate of the controversial Electronic Transactions Levy (E-Levy) by 0.5% to 1% in the 2023 budget.

However, the daily threshold has been removed. This means 1% tax will affect any amount of money sent through mobile money and other electronic platforms.

The minister made the announcement while presenting the 2023 budget statement and economic policy of Nana Akufo-Addo administration to Parliament on Thursday, November 24, 2022.

Source: UGC

The finance minister said the reduction of the E-Levy from 1.5% to 1% is part of a raft of measures to “aggressively mobilise domestic revenue”.

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

He also announced an increase in Value Added Tax (VAT) by 2.5% in line with the agenda of ramping up domestic revenue.

“The budget is, therefore, anchored on a seven-point agenda aimed at restoring macro-economic stability and accelerating our economic transformation as articulated in the Post-COVID-19 programme for economic growth,” he announced.

The seven-point agenda are as follows:

i. Aggressively mobilise domestic revenue;

ii. Streamline and rationalise expenditures;

iii. Boost local productive capacity;

iv. Promote and diversify exports;

v. Protect the poor and vulnerable;

vi. Expand digital and climate-responsive physical infrastructure; and

vii. Implement structural and public sector reforms.

Ken Ofori-Atta stated that to achieve the agenda in 2023, the three critical imperatives that must realised would include a successful negotiation of a strong IMF programme.

Also, coordinating an equitable debt operation programme, and attracting significant green investments are the other two.

2023 Budget: Finance Minister Announces 2.5% Increase In VAT To Support Roads And Digitalisation Agenda

Read also

2023 budget announces ban on public sector employment, use of V8s and other austere measures

Meanwhile, YEN.com.gh has reported in a separate story that the government has announced an increment in the rate of the Value Added Tax (VAT) rate by 2.5%.

The finance minister Ken Ofori-Atta explained that the increment is necessary as it will lead to a massive infrastructural drive in the country.

Presenting the 2023 budget statement to Parliament, Ofori-Atta said increasing the VAT rate will also directly support the government’s digitalisation agenda.

New feature: Сheck out news that is picked for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Source: YEN.com.gh