Domestic Debt Exchange: NPP MP Warns Ghanaians Against Panic Withdrawals Of Funds

- The Member of Parliament for Nhyiaeso is cautioning against panic withdrawals by Ghanaians

- Dr. Stephen Amoah says such withdrawals will negatively affect local investors and their initial deposits

- His caution comes amid the launch of the country’s Domestic Debt exchange programme by the minister of finance

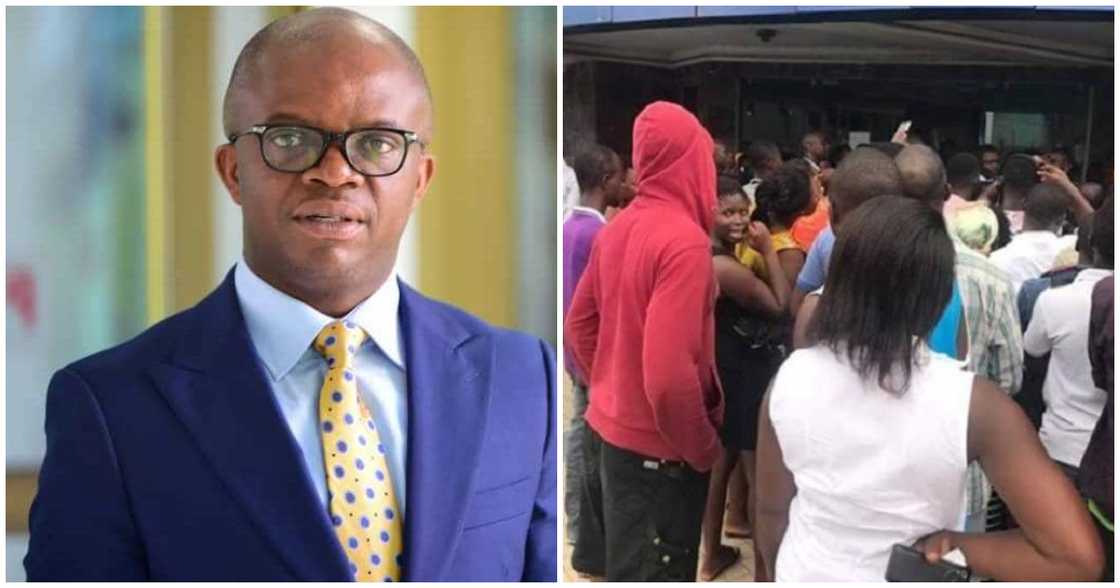

A member of parliament on the ticket of the governing New Patriotic Party (NPP), Dr. Stephen Amoah, is cautioning against panic withdrawals.

According to the MP for Nhyiaeso in the Ashanti region, such withdrawals of investment funds will only lead to a drastic reduction of initial deposits.

Source: Facebook

Ken Ofori-Atta Launches Ghana's Domestic Debt Exchange Programme

This comes amid reports of panic withdrawals by a section of the populace after the minister of finance, Ken Ofori-Atta, launched Ghana’s Domestic Debt Exchange programme.

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

Dr. Amoah, in his caution, urged bondholders to hold on with their withdrawals till the economy is a bit more stabilized since there’s a possibility that the returns on their bonds will increase.

".....you must either wait for your bond to mature, wait for the economy to improve, or make a panic withdrawal. If you do this, the market’s implied forces, not the bank or the government, will reduce your returns, so people should understand this clearly,” he stated.

Domestic Debt Exchange Programme Involves Swapping Existing Domestic Bonds With Longer-Dated Ones

The Debt Exchange scheme, which would involve replacing current domestic bonds with longer-dated notes with maturities ranging from five to fourteen years in 2037, was introduced by the Akufo-Addo-led administration on Monday.

These new bonds have a zero percent annual coupon in 2023, a five percent annual rate in 2024, and a ten percent annual coupon from 2025 till maturity.

Read also

2023 budget: A.B.A Fuseini storms Parliament with kenkey and fish to show ‘true state of economy’

Domestic Debt Exchange: Minority In Parliament Vows To Resist Attempts To Restructure Ghana’s Debt

Earlier, YEN.com.gh reported that the minority in parliament had indicated its readiness to employ all legal means available to block the proposed Domestic Debt Exchange programme announced by the minister of finance, Ken Ofori-Atta.

According to the minority leader, Haruna Iddrisu, his side cannot support the policy in its current form.

Addressing the media in Accra on Monday, December 5, 2022, the Tamale South MP insisted that the opposition MPs will not accept the proposed debt restructuring programme saying it cannot be allowed to proceed.

New feature: Сheck out news that is picked for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Source: YEN.com.gh