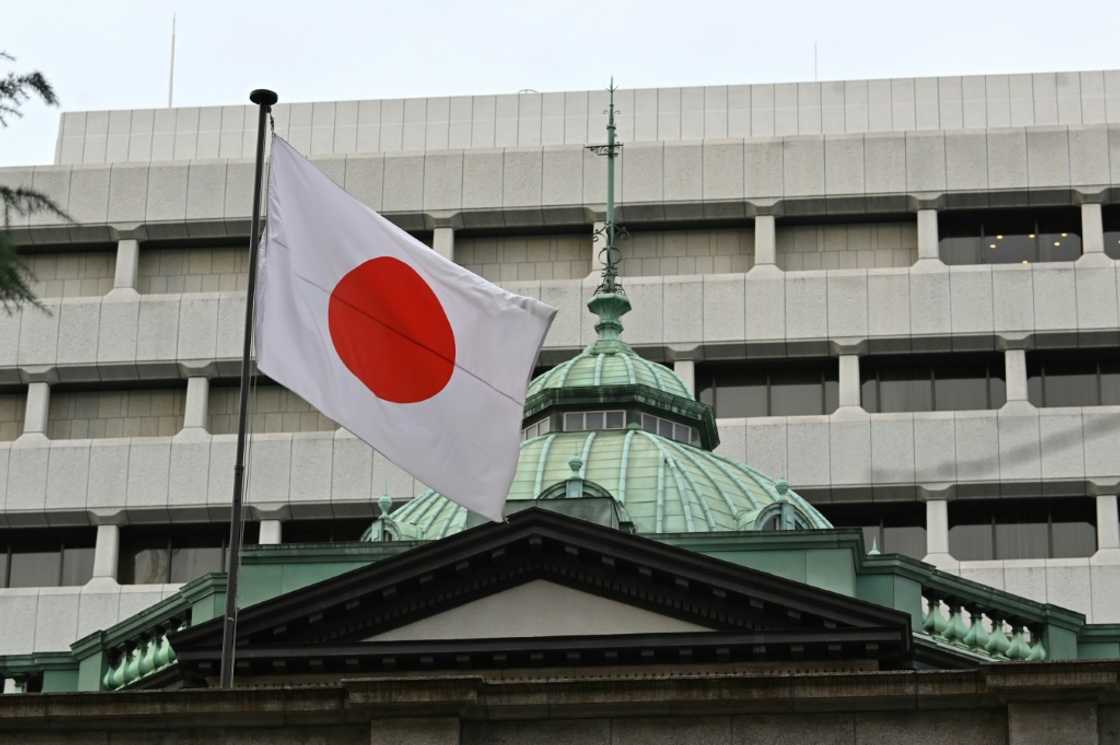

Yen drops, Asian markets mixed as Japan hikes interest rates

Source: AFP

The yen weakened and Tokyo stocks rose Tuesday after the Bank of Japan hiked interest rates for the first time in 17 years as it shifted away from its long-running ultra-loose monetary policy.

With inflation consistently holding above officials' two percent target and recent wage talks ending with bumper rises, the BoJ finally felt confident to pivot from a policy that has been an outlier in the global economy as other countries ramped up borrowing costs.

Officials "assessed the virtuous cycle between wages and prices, and judged it came in sight that the price stability target of two percent would be achieved in a sustainable and stable manner", it said.

The hike was the first since 2007.

The move comes as several major central banks this week hold gatherings that will decide on interest rates, including the United States, United Kingdom and Australia.

The BoJ also said it would scrap its programme of allowing government bond yields to move within a tight range -- known as yield curve control -- and stop buying risk assets such as exchange-traded funds and real estate investment trusts.

While the moves were a major change from a long-running policy, traders took them in their stride, with Japanese stocks rising and yen down against the dollar owing to fading expectations for US rate cuts this year.

"As the Bank of Japan made significant policy changes, crossing what can be seen as a Rubicon in its monetary approach, the moves had been extensively communicated to the market beforehand," said SPI Asset Management's Stephen Innes.

"Consequently, the adjustments were largely anticipated, and the markets had priced them in almost perfectly."

Still, there is a concern that tighter Japanese policy could disrupt financial markets as investors switch their cash to Japan in search of better returns as other central banks prepare to begin cutting.

Other Asian markets were mixed.

There were also gains in Sydney, Singapore, Taipei, Manila, Jakarta, Bangkok and Wellington.

Hong Kong and Shanghai were down at the break, while there were also losses in Seoul and Mumbai.

Investors are also gearing up for the Federal Reserve's latest policy decision Wednesday.

While it is forecast to keep rates on hold at a two-decade high, it will release its "dot plot" outlook for the rest of the year, with the December report pointing to three cuts.

But with recent data suggesting inflation remains sticky -- including consumer and wholesale prices last week -- the economy in rude health and the labour market still strong, there is talk that the new guidance could point to just two.

Investors have revised their view lower consistently over recent months, with June pencilled in as the first likely move.

Key figures around 0430 GMT

Tokyo - Nikkei 225: UP 0.1 percent at 39,775.37

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 16,550.90 (break)

Shanghai - Composite: DOWN 0.4 percent at 3,073.03 (break)

Dollar/yen: UP at 149.84 yen from 149.16 yen on Monday

Euro/dollar: DOWN at $1.0871 from $1.0873

Pound/dollar: DOWN at $1.2716 from $1.2727

Euro/pound: UP at 85.48 pence from 85.42 pence

West Texas Intermediate: DOWN 0.2 percent at $82.03 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $86.73 per barrel

New York - Dow: UP 0.2 percent at 38,790.43 (close)

London - FTSE 100: DOWN 0.1 percent at 7,722.55 points (close)

PAY ATTENTION: Stay informed and follow us on Google News!

Source: AFP