US Fed expected to cut rates in last meeting of Biden era

Source: AFP

Don't miss out! Get your daily dose of sports news straight to your phone. Join YEN's Sports News channel on WhatsApp now!

The US Federal Reserve is widely expected to announce a quarter point cut to its key lending rate on Wednesday despite a recent uptick in inflation, in the central bank's last meeting of Joe Biden's presidency.

The Fed is also tipped to signal a slower path of cuts going forward amid uncertainty over the impact of President-elect Donald Trump's economic proposals.

The meeting on Tuesday and Wednesday this week is the last Fed rate decision before Biden leaves the White House on January 20, handing the keys back to the Republican Trump for a second term, and analysts expect major policy changes.

"The Fed is expected to be more gradual in its easing of monetary policy in view of the policies that will be put in place by the (Trump) administration," EY chief economist Gregory Daco told AFP, adding he still expects policymakers will vote for a rate cut this week.

While the Fed has a mandate to act independently of Congress as it tackles inflation and unemployment, it still has to consider the effects of the government's fiscal policy on the world's largest economy.

Trump has vowed to tackle the high cost of living, a top concern of voters who sent him back to the White House in November's election, which saw him defeat Vice President Kamala Harris.

But many analysts have voiced concern about some of his key policy initiatives, most notably his threats to implement sweeping tariffs on goods entering the United States and deport millions of undocumented workers.

"Those two together tend to simultaneously stoke inflation and stem growth," KPMG chief economist Diane Swonk told AFP, adding she nevertheless expected the Fed to announce a rate cut on Wednesday.

How many cuts?

Source: AFP

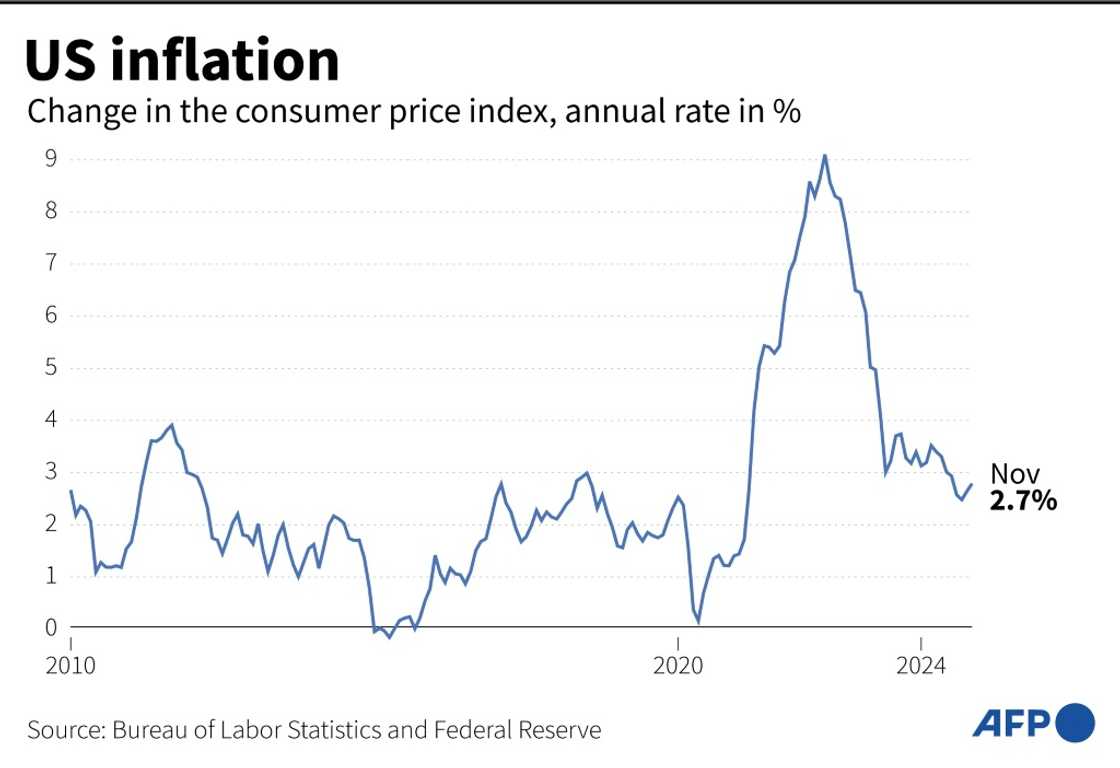

The Fed has cut rates by 0.75 percentage-points since September, pivoting from prioritizing its long-term inflation target of two percent toward better supporting the labor market.

The shift in the Fed's posture has been driven by the data: Its favored inflation gauge has fallen sharply in recent years and, despite a recent uptick, remains close to the two-percent target.

At the same time, US economic growth is still proving to be surprisingly robust. The labor market has weakened slightly, but remains resilient overall.

A quarter-point cut this week would bring the Fed's key lending rate down to between 4.25 and 4.50 percent -- a full percentage point lower than it was before policymakers started cutting rates earlier this year.

The futures markets were pricing in a probability of more than 95 percent on Friday that the Fed would move ahead with a quarter point cut, according to CME Group data.

But the picture for next year looks a lot less certain, with financial markets penciling in a chance of just under 65 percent that rates will be three quarters of a percentage-point lower at the end of 2025 than they are today.

That would suggest two additional quarter point rate cuts next year on top of the one expected on Wednesday.

'More gradual rate path'

Source: AFP

Alongside its rate decision, the Fed will also publish updated economic forecasts, which will include estimates of the number of interest rate cuts policymakers expect over the coming years.

In September, members of the Fed's rate-setting Federal Open Market Committee (FOMC) penciled in an average of four additional quarter point rate cuts in 2025, predicting that the bank's benchmark lending rate would fall to between 3.25 and 3.5 percent.

Given the slight uptick in inflation since then, some analysts now predict a possibly slower path of cuts next year.

In a recent note to clients, economists at Barclays predicted the Fed would cut by a quarter point on Wednesday, but "signal a more gradual rate path thereafter."

They predicted just two rate cuts in 2025.

"We continue to forecast consecutive 25bp (basis point) cuts in December, January, and March, followed by quarterly cuts in June and September," economists at Goldman Sachs wrote in a more bullish recent investor note.

But, they added, "the recent comments from Fed officials increase the risk that the FOMC could slow the pace sooner, possibly as soon as the January meeting."

Source: AFP