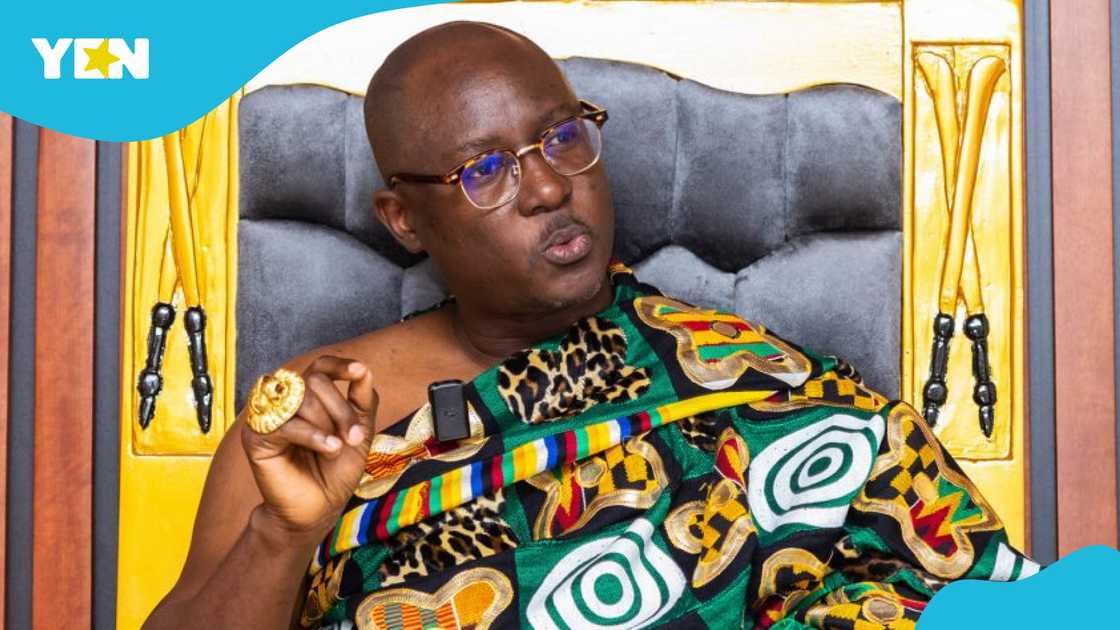

Kwahumanhene Told To Resign As ADB Board Chair Over Alleged Fraudulent GH¢2 Million Transaction

- The Bank of Ghana has directed Kwahumanhene Daasebre Akuamoah Agyapong II to resign as the Board Chairman of the Agricultural Development Bank

- The directive from the central bank came after allegations of misconduct involving a transaction amounting to GH¢2 million suspected to be fraudulent

- A whistleblower sent a petition against Daasebre Akuamoah Agyapong II to the presidency to outline his purported malfeasance

PAY ATTENTION: NOW You can COMMENT on our articles on the YEN website! Learn how to get started.

The Bank of Ghana has directed the Omanhene of the Kwahu Traditional Area, Daasebre Akuamoah Agyapong II, to step down as the chairman of the Agricultural Development Bank (ADB) Board.

The directive comes after allegations of misconduct involving a transaction amounting to GH¢2 million were suspected to be fraudulent.

Source: UGC

In a letter to Agyapong II, the central bank said his position was untenable after the controversy.

Citi News reported that the directive is in line with Section 103 (2)(d) Banks and Specialised Deposit-Taking Institutions Act, 2016 (ACT 930).

The allegations against Daasebre Akuamoah Agyapong II first came to public attention following a whistleblower's formal petition to the Office of the President.

In his petition, Aboagye is reported to have provided detailed accusations of misconduct involving the Board Chairperson and the said GH¢2 million transaction.

The transaction is said to be fraught with potential conflicts of interest and compromised fiduciary duties.

Daasebre Akuamoah Agyapong II was appointed chairman of the board of directors in 2021.

Increasing fraud toll on banks

Fraud cases in banks, Specialised Deposit-Taking Institutions and Payment Service Providers cost them about GH¢88 million.

Fraud cases increased to 15,865 in 2023, up from 15,164 in 2022, where fraud cost banks GH¢82 million.

According to the Bank of Ghana’s annual Fraud Report, this represented a 5% increase.

Bank of Ghana launches gold coins

YEN.com.gh reported that the Bank of Ghana has launched gold coins as an alternative investment asset available to the general public

The coins would be available in commercial banks across the country and would come in three different ounces

The central bank said the coins will help mop up extra liquidity in the banking sector.

It has indicated that people will need at least GH¢10,000 for the Ghana Gold Coin.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: YEN.com.gh