GTBank Ghana internet banking - new account registration and services

Due to the advancement in technology, life has become very easy. People are now able to get banking services from the comfort of their homes. This guide is majorly going to talk about the GTBank Ghana internet banking. This is a banking service that allows people to carry out different banking activities from the comfort of their homes, when on business trips , at work or anywhere away from their banks with much ease. You no longer have to drive long hours to get to your bank or wait for hours at the bank to get help. There are several advantages that GTBank Ghana internet banking boasts of. For instance, you will be able to make payments both locally and internationally, check your account balance and many more. This article is going to give you a clear picture of what to expect when you decide to include internet banking in your daily life.

Whether you are a business banker or individual banker, banking your cash in Ghana should be least of your worries, even on a busiest of days. Yes, internet banking is the new trend in town and so far its progress is commendable. If you are wondering how to enroll in this form of banking here at Yen we got your back. Below is our comprehensive outline that will see you enjoy the many benefits that come with GTBank Ghana Internet Banking. We hope to answer all your questions.

READ ALSO: List of new banks in Ghana 2018

GTBank Ghana internet banking- How to open an account

The idea of internet banking not only sounds great to any busy person, but it is also great considering its many benefits. Thanks to GTBank Ghana you are offered an opportunity to enjoy all the numerous benefits of internet banking, but first before we even get to the benefits you need to know how to open a GTBank Ghana Internet Banking account. This process is simple.

First and foremost if you are around a physical bank, you will need to visit the branch and let the bank assistant help you out. If you are not then you will visit the website’s homepage and download the internet banking registration form. Once you have the form, fill all the required areas with your details then find time to return the form to any nearest bank’s branch. Here all you will be profiled by the bank before an email from the bank is sent on your mail box. The email will contain the details of your logins.

It is important to note that to access GTBank Ghana Internet Banking you need first to be a member at the bank with an account.

GTBank Ghana internet banking login

READ ALSO: List of International banks in Ghana 2018

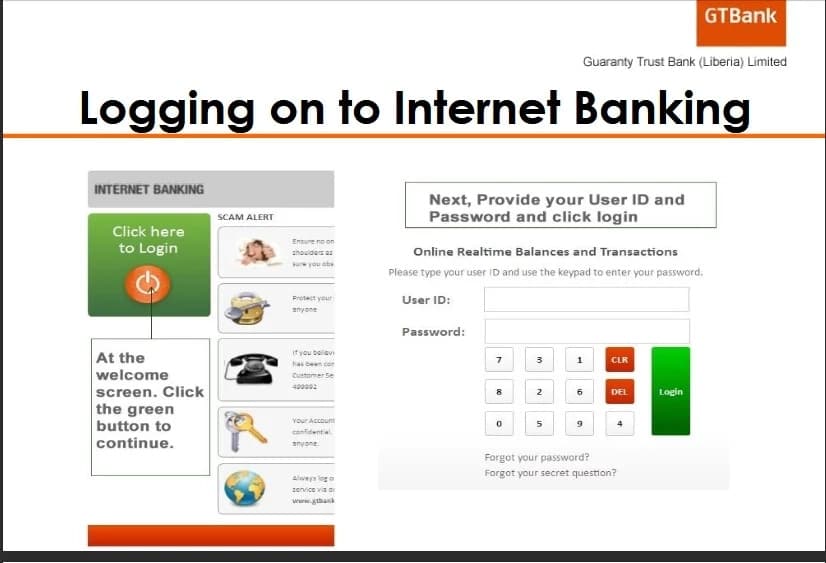

Before you start using your internet banking account you need first to configure it and the first step to doing this to log in to your account. Its simple, if you have an internet connection you can do all this at the convenience of your home. However if you are at the bank's offices the bank assistants might help you get started. Below are the steps you should follow

- Log on to www.gtbanklr.com

- Select the internet banking login menu on the homepage.

- Enter the user ID and password and then click the login button.

- Change the password to one of your choice.

Note the password must be secure and hard to hack.

While these process might look simple to some it might be difficult however this should not be any reason for alarm as you can always reach the bank assistants whenever need be. The following are the bank's contacts whenever you run into any difficulty with your internet banking registration and need further help:

- Email address: gh.corporateaffairs@gtbank.com

- Toll free call lines: 0800 124 000 or

24-Hour Customer Support / Service Hotlines:

(+233) 307 037 107 / 302 923 914 / 302 966 755

- whatsapp Only (+233) 504100011

Guaranty Trust Bank Ghana online banking

When it comes to guaranty trust bank Ghana online banking, you will never be disappointed due to the fact that it comes with undeniable convenience of managing finances faster than the traditional banking methods. This guide is going to educate you about the benefits, features and many more things you ought to know about guaranty trust bank Ghana internet banking.

READ ALSO: Cal bank internet banking in Ghana: How to sign up and check your balance

Some of the features of internet banking include, the ability to stop Cheques , transaction and account balance enquiry , third party and personal transfers ,bank draft requests , cash in transit , draft in transit , subscription payments pre-registered transfer and many more.

Some of the things you can do with guaranty trust bank Ghana online banking include:

- You are able to print your statement of accounts.

- The ability to confirm your Cheques and also request Cheque books.

- You are also able to pay both Ghana water and ECG Post Bills.

- It gives you the ability to transfer funds from your account to another GTBank client account.

- You are also able to not only change your password but also your personal details if there is need.

- You are also able to make standing orders through internet banking.

- Cancelling standing Order.

- Checking Deposit and Exchange rate

- Most importantly, you are also able to check your account balances and also account activities so that you keep track of your finances.

- Additionally, you are able to print your statements of accounts and many more.

Mentioned below are some of the benefits of Guaranty Trust Bank Ghana online banking:

The greatest advantage of internet banking is the ability to get access to your account all through the day and night. In short, you are able to carry out any banking activity anytime from the comfort of your You will also be able to office, home or job despite the time.

The other advantage of internet banking is that it is not only effective and cheaper but also makes it easier for clients to communicate with the bank in order to keep track of all the activities of their finances.

Security for ever online transaction is the other vital advantage of internet banking. Everybody wants privacy when it comes to finances. Internet banking is the best way to go as it offers the privacy you desire more than the traditional methods of banking.

Easy access to bank information and products from anywhere at any time is the other vital advantage of internet banking.

Online real time account monitoring is the other important advantage of guaranty trust bank Ghana online banking that you should not ignore.

GTBank Ghana mobile app

This guide is going to explain to you how you could operate your GTBank Ghana Account from your mobile phone through the gt bank Ghana mobile app.

Once you have successfully logged into your account, it is advised that you get an activation code for your card which enhances security for those interested in engaging in internet shopping using your bank card.

On the left side bar, you should look out for where to select the services you need .Once you find it, you should open the page and asses the listed services so that you find the services that will best serve your purpose due to the fact that not all services are selected by default. Once that is done, you are supposed to use your token whereby your banking account will at that point be a hundred percent ready for any transaction of your choice.

READ ALSO: Best Investment Banks in Ghana - Top 10

Did you know that you are able to transfer money anywhere in Ghana by just dialing *737*.You only need to select option 4.Once that is done, it is prudent that you choose account t debit and the client’s account which is also called the destination account .You should then select the amount of money you want to end and then key in your PIN so as to confirm your transfer.

The benefits of using this kind of service include:

- It is a convenient way of sending money

- The service is available all through the day and night. Therefore, it is easier to get access to it especially if you have an emergency.

- The transaction process is very fast due to the fact that it takes less than a minute.

- You could also use *737* to load airtime and data on your phone.

You only need to choose option two after dialing *737*.The second step involves selecting network and then entering the recipient’s phone number. After selecting the amount of credit to purchase, you are required to select account to debit and finally enter your PIN to complete the process.

You could also check your account balance and additionally locate Branch/ATM anywhere. Here is how you could easily check your balance.

So as to check your balances on your accounts, you are required to dial *737* on you Smartphone and then enter your PIN so that that the balance in your accounts are able to be displayed. There are several benefits of using this service that are listed below.

- First and foremost, it is not only fast and simple but also undeniably convenient.

- You have the ability to check your bank account from anywhere at any time.

- You do not have to spend a lot of time in the banking halls or filling many forms in order to serve your purpose.

- Finally it boasts of online display of balances on all your accounts.

With all the benefits mentioned above, it is crystal clear that if you are a GTBank Ghana client who has not yet activated this service in your mobile phone then you are missing out on a lot of things. The good news is that you only need to dial *737* and then select option 6.You should then choose the option you need from the three options that will be presented to you.

The options include:

1. Activate Service

2. Change PIN

3. Reset PIN

Wait no more, register and log in to your GTBank Ghana internet banking today and enjoy its amazing benefits.

Source: YEN.com.gh