Wave money transfer: how it works, limits, charges for sending to Ghana

Are you tired of the queues in banks and delays every time you want to send money to Ghana? Wave can help sort out your remittance errands in 30 seconds. This unique money remittance service has been working in Ghana since early 2014. Founded by Drew Durbin and Lincoln Quirk, the idea came about because of the challenges they had in remitting funds to their charity in East Africa. Their plan with this service is to provide quick and uninterrupted currency transfers to East and West Africa without charging sending fees. From its humble background, Wave money transfer has since then grown its network to include more countries where people can send money, including Ghana.

Source: UGC

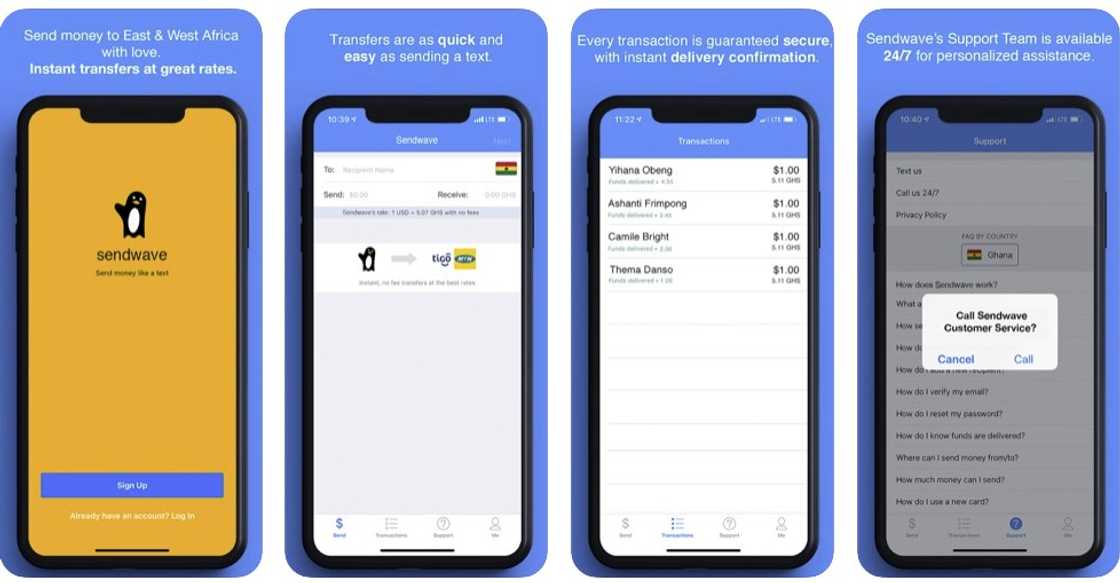

How does Wave work? Well, Wave operates within an app called Sendwave that you can install on your smartphone. For Wave money transfer app download, you can visit both either the Google Store for Android or the App Store for iOS.

To activate SendWave app, you will need to put in your name, address, details of your debit card that is linked to a debit account in your country of residence. This means that a sender cannot use PayPal or a credit card to complete the money transfer.

The bank account is required to also be in a country that is approved by Wave. The supported countries currently are the UK, USA, Ireland, Spain, Italy, and Canada.

Wave app review: Is it worth using?

If you have gone through several Wave money transfer app reviews, you have seen many people are satisfied with the app. The same replicates in reviews on both Google Play Store and the Apple App Store, where its score is 4 out of 5 stars demonstrating high customer satisfaction.

The app’s ease of use and ability to relay money fast makes it a more convenient option for Ghanaians. Besides, you can use it while in major countries abroad.

Does Wave work in Ghana?

Yes. You can send money to Ghana through Wave. When a sender completes a transaction, the recipient can receive the money instantly. The recipient should have an active phone connection with a service provider in Ghana, such as MTN or AirtelTigo.

READ ALSO: A step-by-step method of reversing an MTN transaction sent to a wrong number

How to send money through Wave

Source: UGC

To complete a Wave money transfer to Ghana, you need to input the recipient’s name, phone number, and the money you wish to transfer on the app. Wave will then convert your currency to Ghanaian currency. The transfer takes about 30 seconds. After this period, the recipient will receive the money in their mobile wallet.

The recipient can now visit any of the Wave money transfer agents in Ghana to receive their cash.

Wave money transfer rate

Wave does not charge any fees for money transfer transactions. Instead, they make their profit through the exchange rate they offer to their customers. Their rate varies between 1.5-5% lower than the market rate. Generally, the exchange rate will vary from day-to-day due to current economic factors that play a significant role.

Take, for example, if you want to send mobile money from the USA to Ghana. 1USD would be equivalent to 5.44 GHS against a competitor XE exchange rate of 5.7GHS. This means that the exchange rate is lower than the base rate offered by other platforms. However, the convenience in addition to the no-charge policy makes the company's services more attractive to its customers.

Wave money transfer limit

While Wave money transfer is fast and convenient, it does have limits on how much money you can send at a time. The initial limits of currency you can send when you start using the service are:

- $999 per day and up to $2,999 per month

- £750 per day and up to£2,500 per month

- €750 per day and up to €2,500 per month

However, a sender can provide more identity details to Wave for verification to aid in increasing their sending limits. The limits would rise as follows:

- $2,999 per day to up to $12,000 per month

- £2,500 per day to up to £10,000 per month

- €2,500 per day to up to €10,000 per month

The governments have imposed some of these limits in the different countries of operation and, therefore, Wave must comply. Wave is one of the players in the currency exchange market where competition comes from other websites and banks.

READ ALSO: List of top online jobs in Ghana that pay through mobile money

So, why should you use Wave?

Here are the reasons why many users opt for the currency exchange service.

- It is an app platform: Wave is an app-enabled platform that you can use on any smartphone.

- No fees: Fees charged by other platforms reduce the amount of money that the recipient would have otherwise received. By not charging fees, Wave provides the advantage of sending more money to Ghana.

- Fast transactions: Wave money transfer takes about 30 seconds, providing impressive speeds.

- Competitive exchange rates: Wave provides a fair exchange rate for the Ghanaian cedi compared to other money relay platforms despite the no-fee charge policy.

- Convenience: You can use this app to remit money anytime and at your convenience. It can be used anywhere in the world and is more efficient than queues in the bank on certain days of the week.

- No minimum limit: There is no minimum limit as to how much you should send as you can send as little as $1 to Ghana.

Source: UGC

Safety and privacy

Any money transfer platform needs to pass the ultimate safety test. Therefore, despite all the positive reviews that Wave enjoys, you may still wonder, “is Wave money transfer safe?”

Here are the measures they have put in place to ensure the safety of your activities:

Transaction encryption

All activities and personal details are run through 128-bit encryption which basically means that your transactions are cyber-secure.

Instant payment

After sending money, the intended recipient will receive it instantly. The money is not stored in between the transaction, which limits any theft loopholes. The instant nature of the transaction makes it safe.

Updates on transaction progress

The app provides updates on the progress of your transaction, which will give you peace of mind. This is done through updating the status to “Funds Delivered” on your app. It also sends an email to confirm that the recipient has received the money in their mobile wallet.

Adherence to laws and regulations

The platform is regulated by different agencies in the countries of operation to make sure that your information is well protected.

Wave contacts

There are several contacts that you can use as a customer to reach the Wave team. You can send them an email via any of these addresses depending on your query:

- aide@sendwave.comhelp@sendwave.com

- compliance@sendwave.com

The Wave customer service contacts for each country it operates in are:

- United Kingdom (UK) is +44 113 320 7935

- United States (US) is +1 888 966 8603

- Ireland is +353 1800 949 226

- Italy is +39 02 3057 8468

- France is +33 5 19 74 15 37

- Spain is +34 900 998 284

You call the company or email anytime as they have a 24/7 support team that is dedicated to answering customer queries.

Wave money transfer is a popular service that you can use to send money to your loved ones in Ghana. When you send money to Ghana through Wave, you stand to enjoy advantages such as convenience, speed, and safety of transactions. With 24/7 customer support, it is safe to say you can send money to Ghana in the simplest way possible.

READ ALSO: A detailed guide for becoming an MTN mobile money agent in Ghana

READ ALSO: List of paid online surveys available in Ghana

Source: YEN.com.gh