UBA Africard: Activation, transaction limit, how to fund

United Bank for Africa (UBA) is one of the fastest-growing and leading financial institutions in Ghana. The bank is known for its outstanding and innovative technological systems that aim at increasing their customers’ experience. One of the latest technologies the institution has unveiled is the UBA Africard, which seemingly eliminates the need for visiting its branches to make transactions. It is set to enhance and promote branch-less banking.

Source: UGC

With UBA Africard Visa International, you can transact at the comfort of your home while taking your Asaana or Brukina. The card is accepted in almost all the payment sites online.

What is UBA Africard?

This is a prepaid card by the United Bank for Africa. You should note that this is a standalone card which doesn’t need an account number to function.

The prepaid card is not in any way linked to your regular bank account with any financial institution.

How do I get a UBA Africard?

You do not need to be a UBA customer or have a pre-existing account with the financial institution. However, you will need to walk to the nearest branch and present the following:

- A passport photograph

- Your national ID, passport, or DL

- A TIN

- 30 Cedis card processing fee

- Your initial deposit if any

Fill in the application form with the correct details. Remember to indicate whether you are applying for a personalized or instant card type. The former has your name written boldly, and you will need to wait for 5 to 7 business days for it to be processed. The latter is issued instantly after application.

READ ALSO: How to register and use MTN mobile money online

How to activate your UBA Africard

Whether you are issued with an instant or personalized card, you need to activate it before leaving the bank. To do so, you will need to employ the services of an ATM or customer care. Use the following procedure:

- Insert the card into an ATM

- Peel off the letter your Africard came with. On the orange tab, you will be able to see two different PINs. One is a passcode for online transactions and the other to activate your account.

- Tap continue on the screen

- Change to a new memorable PIN

You have successfully activated your card on an ATM card.

UBA Africard online portal

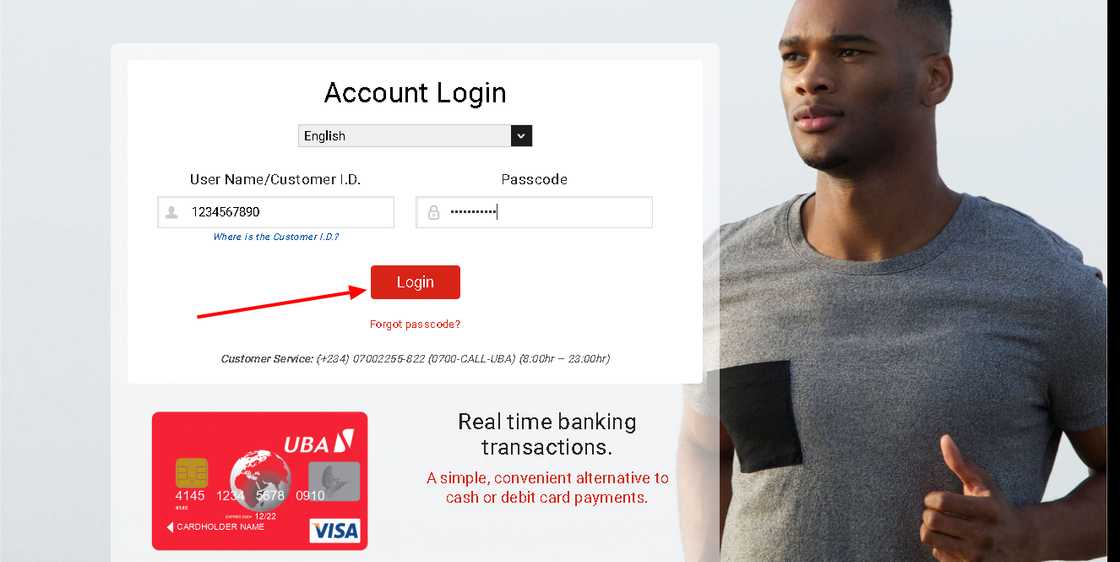

To access your account, use the following steps:

- Connect to the web: Use your mobile data, personal Wi-Fi, or LAN network.

- Open your browser: You can do so by navigating to the app list section on a mobile or tablet and then tapping on its icon.

- Go to the Africard portal.

- Enter your user name or customer ID: This is the ten digits' number found on your card.

- Enter your passcode: Refer to the sheet paper you were given when collecting your card.

- Tap login: This is a red button below the passcode text box.

UBA Africard forgot password or PIN

In case you forget your passcode or PIN, reset it without much hassle.

To reset your passcode, you will need:

- Your customer ID

- The last four digits of your account

- Access to your registered mobile phone number messages

- Internet

Use the following procedure:

- Go to the UBA portal: You need to connect to the web, open a browser, and paste the link to this website.

- Tap on “Forgot Passcode?”: This statement is in red.

- Enter your customer ID: This is just the 10-digit number found on the back of your card. To find it, just turn your card to its backside.

- Key in the last four digits of your card: Turn your Africard to the front. You will see numbers in groups of four or five in the middle. Identify the last four digits and type them in this text box.

- Tap ‘Confirm’: This is a grey button at the bottom of the page.

- Enter the one-time password: You will receive a message on your gadget with a code which you are supposed to enter it in this step.

- Type in your new passcode: It should be memorable and robust enough such that it cannot be easily guessed. Follow on-screen instructions to complete the process.

To reset your PIN, you can walk into any UBA branch then head to the customer care centre to have your issue sorted. Alternatively, you can call them using the contacts listed in this write-up for faster service.

How to fund UBA Africard

Source: UGC

There are two ways in which you can load or top up your prepaid card. The first method entails walking to the bank. Follow the steps below:

- Walk-in to any nearest branch: This could also be an agent around you

- Fill in the deposit slip: This document is offered for free by the bank

- Enter your account number: This is the client ID at the back of your card under your CVV information.

- Enter the amount: You can deposit any sum of money.

- Actual deposit: Tell the cashier that you are making a top-up to your Africard.

You should receive an SMS alert within a few minutes. This means that your ATM card is ready for use.

READ ALSO: GCB internet banking: application and online services

The second method involves using their mobile app or internet banking platform. You should have an existing account with UBA other than the Africard. Follow the steps below:

- Download and install the UBA mobile app: If you are using an iPhone, then head to the app store. Android users should download it from Google Play Store.

- Sign in: Use your client ID and PIN.

- Add your existing UBA account: Tap on the + button at the top right corner and enter its details.

- Tap “Send Money”: You should do so in your pre-existing UBA account.

- Enter the account number: Use your Africard client ID found at the backside

- Specify the amount: This highly depends on your balance,

- Authenticate the transfer: Enter your correct PIN to proceed.

You can now use your loaded Africard to do transactions.

If you choose the internet banking option, you should:

- Login to your account: Navigate to the UBA portal, enter your Client ID and passcode then sign in.

- Tap “Transfer to Card”: This option is on the top menu.

- Fill in the payment details: This includes card ID, its first digits, last 4 digits, and amount.

- Click on the “Continue option”: You can quickly locate it at the bottom of the page.

- Confirm the details.

- Authenticate the transfer: Enter either the OTP send to you or your secure password.

- Click on the ‘Submit’ button: This will initiate the transfer. If it was successful, then the next window will show a payment summary.

- Print a receipt: If you need to proof payment, tap on the “Print Receipt” button.

How to use UBA Africard?

Source: UGC

Your Africard can be used for various services, such as making online payments and shopping.

To make internet payments:

- Go to the payment page.

- Enter your Africard number.

- Specify its expiry date.

- Key in the CVC number found on the backside.

For any other payments,

- Give the card to the attendant.

- Let him/her key in the amount.

- Confirm if it is correct and enter your PIN.

- You should receive a transaction message on your mobile gadget.

To withdraw cash:

- Visit any UBA agent or ATM

- Enter the card PIN

- Specify the amount you want to withdraw

- Key in the exact amount

- Collect your receipt and money

How to check your balance on UBA Africard?

For the secure card portal, use the following steps:

- Navigate to the Africard portal: You should have an active secure internet connection.

- Sign in: Enter your client ID and your passcode and tap on the ‘Login’ button.

- Check your balance: You will be automatically taken to the homepage where details of your account are displayed. This will even include your account balance.

You can also go to an ATM, insert your card, and the amount in it will be displayed and a receipt issued.

The last way of ascertaining your Africard balance is by contacting customer care. They will ask you a few questions for verification and finally tell you how much funds you have on your card.

UBA Africard transaction limit

Source: UGC

The Bank of Ghana regulations applies here. You can never transfer more than $10,000 per year with a prepaid card. UBA Africard is one of such cards. This might be the only drawback if you shop for large and costly items regularly.

UBA Africard Ghana contacts

For complaints and queries use the following channels to reach out:

- Head office location: Heritage Tower Ambassadorial Enclave Off Liberia Road Ridge Accra P.M.B 29, Ministries Accra, Ghana.

- Phone number: +233 (0) 302 634 060

- Email: cfcghana@ubagroup.com

- Website: ubaghana.com

Applying, activating, loading, and using the UBA Africard is that simple. You can now shop from millions of outlets and online shops across the world with this card.

READ ALSO: Wave money transfer: how it works, limits, charges for sending to Ghana

Source: YEN.com.gh