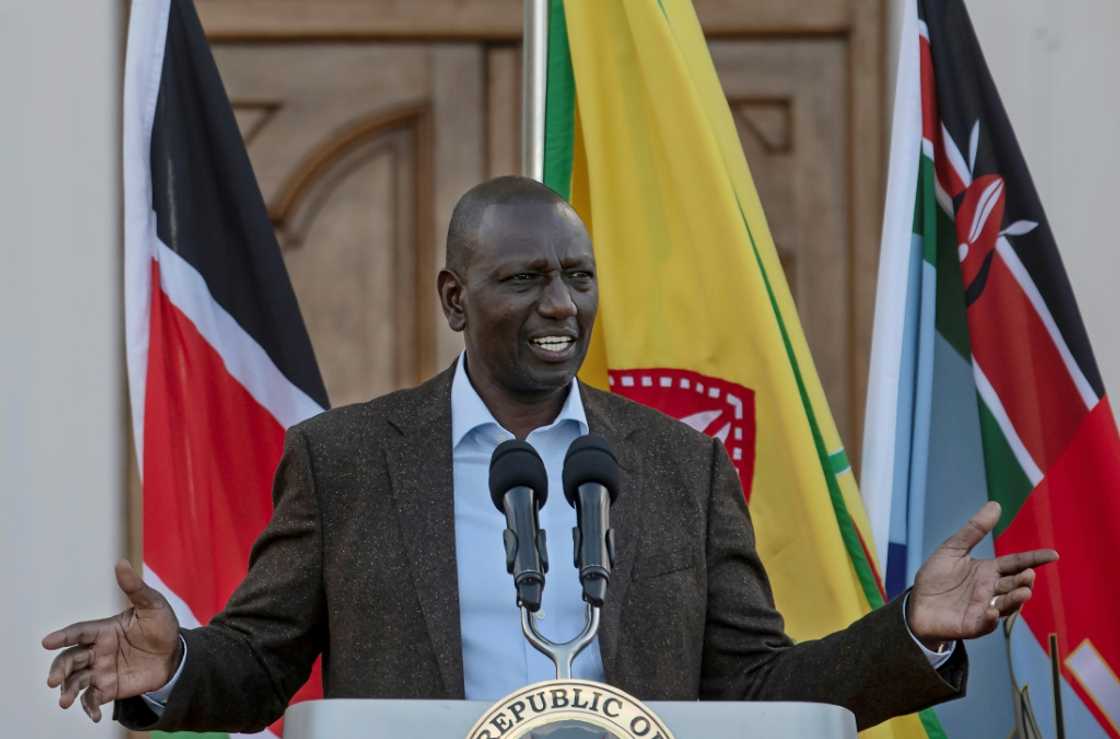

Kenya's Ruto signs contentious tax bill into law

Source: AFP

Celebrate Ghanaian celebrities and their love for luxurious cars! Click to check out Wheels on Yen by Yen.com.gh!

Kenyan President William Ruto on Monday signed into law a bill that raises taxes on a wide range of items, the presidency said, defying criticism that it will pile more economic hardship on citizens.

The new tax package was approved by parliament last week and will double the tax on fuel to 16 percent and introduce a new housing levy, a move expected to have a ripple effect in a country hamstrung by high inflation.

"President Ruto has assented to the finance bill. Signed at State House," the presidency said in a message to journalists, accompanied by pictures of him signing the document.

Ruto -- who took office in September after a bitterly fought election -- is seeking to fill the government's depleted coffers and repair a heavily-indebted economy inherited from his predecessor Uhuru Kenyatta, who splurged on major infrastructure projects.

Kenya is now sitting on a public debt mountain of almost $70 billion or about 67 percent of gross domestic product (GDP), and its repayment costs have jumped as the shilling sinks to record lows of around 140 to the dollar.

The new law -- expected to generate more than $2.1 billion -- will hike taxes on basic goods and services including food and mobile money transfers.

One of the most contentious provisions is a 1.5 percent levy on the salaries of all tax-paying Kenyans to fund an affordable housing programme.

The opposition led by Ruto's rival Raila Odinga has threatened fresh demonstrations over the tax package saying it will strain already squeezed incomes.

Earlier this year, the opposition staged several anti-government protests over the cost of living crisis which degenerated into sometimes deadly street clashes between police and demonstrators.

At least a dozen protesters were also arrested this month during a march against the tax proposals.

Critics accuse Ruto of rowing back on promises made during the August 2022 election campaign, when he declared himself the champion of impoverished Kenyans and pledged to improve their economic fortunes.

Kenyans are already feeling the pinch from soaring prices for basic necessities, along with a sharp drop in the value of the local currency and the worst drought in four decades.

Economic growth slowed last year to 4.8 percent from 7.6 percent in 2021, reflecting the global fallout from Russia's invasion of Ukraine and the drought buffeting the vital agriculture sector.

The Law Society of Kenya has vowed to challenge the taxes in court this week.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP