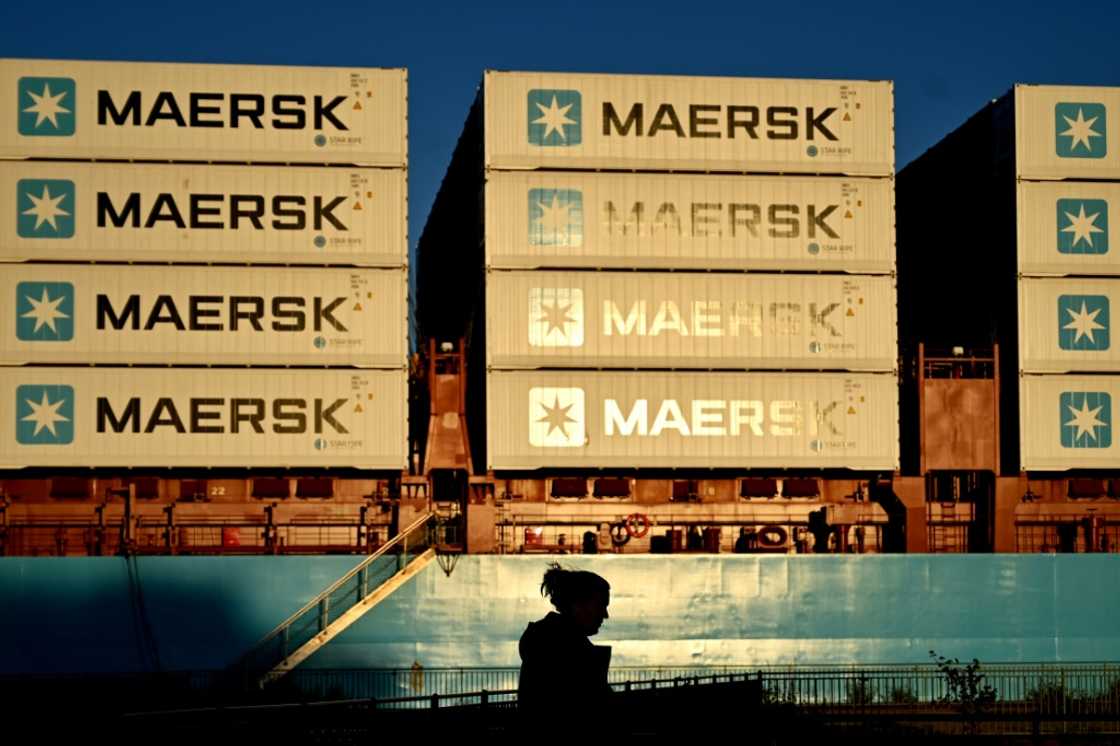

Shipping giant Maersk's profit sinks, warns of Red Sea risk

Source: AFP

Shares in shipping giant Maersk dived on Thursday after it warned of an uncertain 2024 earnings outlook linked to an oversupply of container vessels and Yemeni rebel attacks in the Red Sea.

The downbeat forecast came after its 2023 earnings were hit by overcapacity in the shipping sector, which caused a drop in freight rates.

The group reported a more than sevenfold drop in its net profit last year to $3.8 billion, compared to $29.2 billion in 2022.

Its revenue reached $51 billion compared to $81.5 billion the previous year.

Freight rates had soared in 2022 due to capacity shortages amid high demand following the end of Covid pandemic restrictions.

"The high demand eventually started to normalise as congestions eased and consumer demand declined leading to an inventory overhang," Maersk said in its earnings report.

This "correction" resulted "in rapid and steep declines in shipped volumes and rates" starting at the end of the third quarter of 2022, it added.

The "oversupply challenges" in the maritime shipping industry are expected to "materialise fully" over the course of 2024, Maersk said.

The group lowered its 2024 forecast for its core profit -- earnings before interest, tax, depreciation and amortisation -- to a range of between $1.0 billion and $6.0 billion.

"High uncertainty remains around the duration and degree of the Red Sea disruption, with the duration from one quarter to full year reflected in the guidance range," Maersk said.

Maersk's stock price sank more than 13 percent on the Copenhagen stock exchange after the release of the earnings report, which also included the announcement of the suspension of its share buyback plan.

Chairman Robert Maersk Uggla and CEO Vincent Clerc said in the earnings report that "2023 ended with multiple distressing attacks on cargo ships in the Red Sea and the Gulf of Aden".

They noted that two of the company's ships had been targeted.

"We are horrified by the escalation of this unfortunate conflict," they said.

Maersk and other shipping companies have redirected ships away from the Red Sea, taking the longer and costlier route around the southern tip of Africa.

The Red Sea usually carries about 12 percent of global maritime trade.

'Price pressure'

Yemen's Iran-backed Huthi rebels have harassed ships travelling through the Red Sea since November.

They say they are targeting vessels linked to Israel, the United States and Britain, to show support for Palestinians in the war in Gaza.

Their attacks have triggered reprisals by US and British forces.

The Huthis have either attacked or threatened commercial vessels more than 40 times since November 19, according to the Pentagon.

Maersk reported a loss of $456 million in the last three months of 2023, with sales dropping 34 percent to $17.8 billion compared to the same period in 2022.

In a separate statement, Clerc said: "While the Red Sea crisis has caused immediate capacity constraints and a temporary increase in rates, eventually the oversupply in shipping capacity will lead to price pressure and impact our results."

Maersk also announced it would spin off its towage business, Svitzer, as a separate listed company.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP