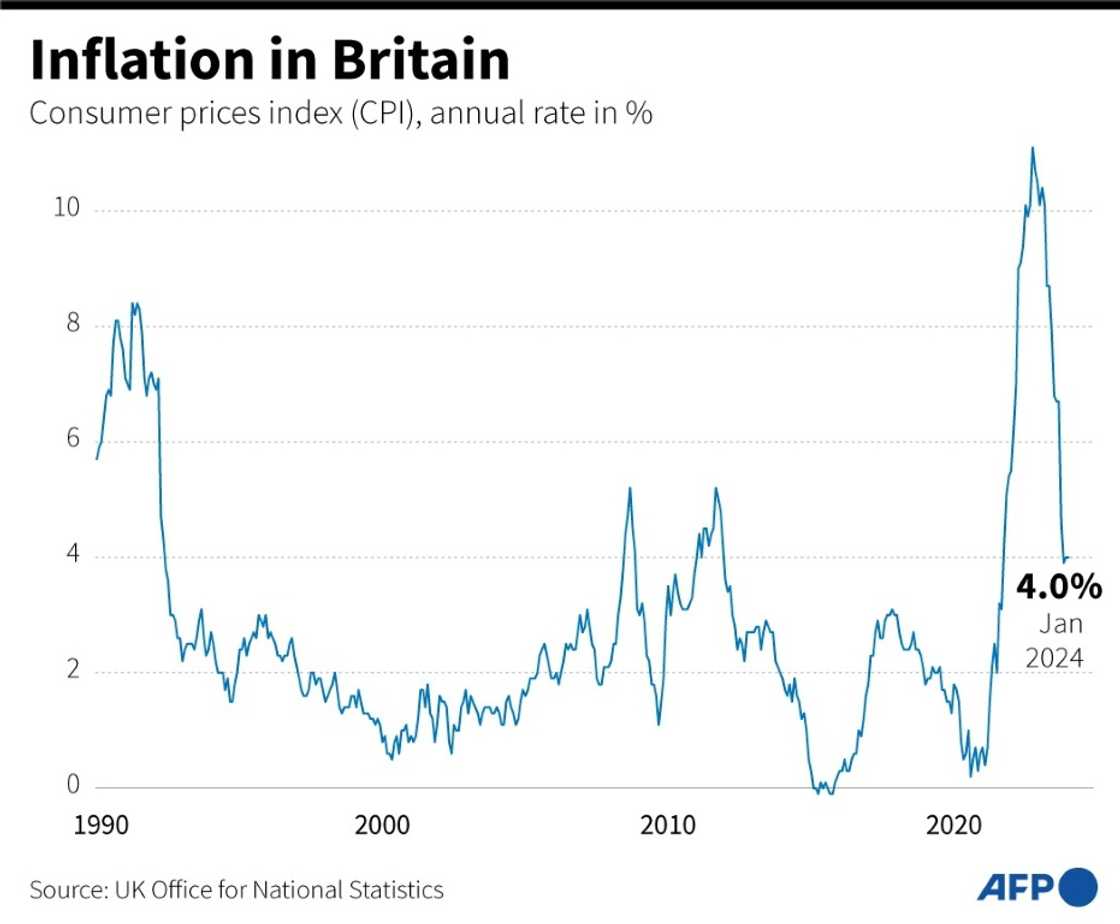

UK inflation holds at 4.0 percent in January: data

Britain's annual inflation rate remained unchanged in January from the previous month, confounding expectations for an acceleration, official data showed on Wednesday.

The Consumer Prices Index (CPI) stood at 4.0 percent last month, the Office for National Statistics (ONS) said in a statement.

That was double the Bank of England's target and compared with market expectations of an increase to 4.2 percent.

Higher gas and electricity bills were the main upward contributor to the rate, but this was offset by falling prices for furniture, food and non-alcoholic beverages.

"The price of gas and electricity rose at a higher rate than this time last year due to the increase in the energy price cap, while the cost of second-hand cars went up for the first time since May," said ONS chief economist Grant Fitzner.

"Offsetting these, prices of furniture and household goods decreased by more than a year ago and food prices fell on the month for the first time in over two years."

Source: AFP

Britain's Conservative finance minister Jeremy Hunt said in reaction that inflation was nevertheless on a downward trend.

"Inflation never falls in a perfect straight line, but the plan is working," said Chancellor of the Exchequer Hunt.

"We have made huge progress in bringing inflation down from 11 percent, and the Bank of England forecast that it will fall to around 2.0 percent in a matter of months."

The BoE has hiked borrowing costs to the highest level in 16 years as it tries to cool UK annual inflation.

Inflation has fallen sharply from a 41-year peak of 11.1 percent in October 2022.

Analysts said Wednesday's data showed that the central bank could decide to cut its main interest rate from 5.25 percent in the coming months.

"The ingredients remain in place... to start cutting interest rates in the next few months," noted EY analyst Martin Beck, who expects the first reduction in May.

He added: "Overall, the latest inflation data should reassure (policymakers) that the time to start cutting interest rates is approaching."

PAY ATTENTION: Stay informed and follow us on Google News!

Source: AFP