Asian markets fluctuate after Wall St record; eyes on China

Source: AFP

Equities swung in Asian trade Thursday following another record day on Wall Street fuelled by inflation data that reinforced expectations for a US interest rate cut next week, while traders also remained hopeful for more measures to stimulate China's economy.

Seoul's Kospi ticked higher for a third straight day, eating further into the losses sustained in a sell-off that came in the wake of South Korean President Yoon Suk Yeol's short-lived martial law declaration.

Hopes that the Federal Reserve will lower borrowing costs for a third time in a row next week were bolstered Wednesday by figures showing the US consumer price index rising in line with expectations in November.

While the gauge continues to sit above the central bank's two percent target, swaps markets indicate there is a 98 percent chance policymakers will make the reduction.

On Wall Street, the Nasdaq ended above 20,000 points for the first time, while the S&P 500 was a whisker away from its own record.

However, analysts warned the outlook for 2025 was less clear.

"Evidence in recent months suggest the decline in inflation has lost momentum while economic activity and the labour market have remained resilient," said National Australia Bank senior forex strategist Rodrigo Catril.

"These dynamics suggest that after cutting in December, the Fed looks set to sit on the sidelines for a while with an increasing risk that the coming pause won't be a couple of months, but rather a couple of quarters."

Adding to the uncertainty is the presidency of Donald Trump, who takes back the White House next month and has pledged to slash taxes and regulations and ramp up tariffs -- measures some warn could reignite prices.

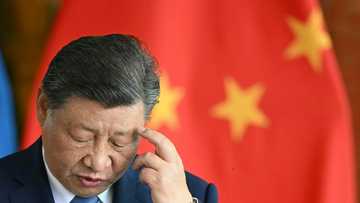

In Asian trade, Hong Kong and Shanghai edged up as dealers kept an eye on China amid hopes that leaders will unveil more help for the economy, which is struggling under the weight of weak consumer spending and a chronic property crisis.

President Xi Jinping and other key officials announced on Monday their first major shift in policy for more than a decade, saying they would "implement a more active fiscal policy and an appropriately relaxed" strategy.

That sparked hopes for more interest rate cuts and the freeing up of more cash for lending.

Beijing has already unveiled a raft of measures to kickstart growth but observers said there was concern at the lack of concrete action.

The "cautious market response in China suggests that investors are sceptical about the government's commitment to substantial, direct financial interventions -- essentially the 'helicopter money' that many believe is necessary to invigorate the economy", said SPI Asset Management's Stephen Innes.

Meanwhile, it emerged that economic officials in outgoing President Joe Biden's administration would meet their Chinese counterparts for talks on Thursday in a final effort to strengthen ties before Trump returns.

Shares in Seoul rose again as lawmakers prepare for a second impeachment vote on Yoon at the weekend, after the first fell short on Saturday, with the leader of his own party urging members to attend the meeting and vote "according to their conviction and conscience".

Still, the president remained defiant and vowed to "fight with the people until the very last minute".

The won continues to hover around two-year lows of 1,430 per dollar amid the uncertainty sparked by the December 3 crisis.

Among other Asian markets, Tokyo gained more than one percent on a weaker yen, while Singapore and Taipei also rose. There were losses in Sydney, Wellington, Manila and Jakarta.

The euro remained under pressure ahead of an expected rate cut by th European Central Bank later on Thursday, while France's President Emmanuel Macron fights to appoint a new prime minister following the removal of Michel Barnier last week.

Key figures around 0230 GMT

Tokyo - Nikkei 225: UP 1.3 percent at 39,881.10 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 20,210.71

Shanghai - Composite: UP 0.1 percent at 3,437.20

Euro/dollar: UP at $1.0502 from $1.0498 on Wednesday

Pound/dollar: UP at $1.2763 from $1.2752

Dollar/yen: DOWN at 152.20 yen from 152.40 yen

Euro/pound: DOWN at 82.30 from 82.31 pence

West Texas Intermediate: DOWN 0.1 percent at $70.24 per barrel

Brent North Sea Crude: FLAT at $73.51 per barrel

New York - Dow: DOWN 0.2 percent at 44,148.56 (close)

London - FTSE 100: UP 0.3 percent at 8,301.62 (close)

Source: AFP