2023 Budget: Kumasi Business Owners Reject Ofori-Atta And Akufo-Addo's Policy Document

- Traders in Kumasi, the political "World Bank" of the governing NPP have kicked against the 2023 budget

- The business community says the budget presented by finance minister Ken Ofori-Atta is insensitive

- The Ashanti Business Owners Association say the 2.5% increase in VAT for instance will collapse their businesses

The business community in Kumasi, the Ashanti Region capital, has kicked against the contents of the 2023 budget presented to Parliament on Thursday, November 24, 2022.

The Ashanti Business Owners Association, which fronts for the business community the region, has said the budget presented by finance Ken Ofori-Atta could collapse their businesses.

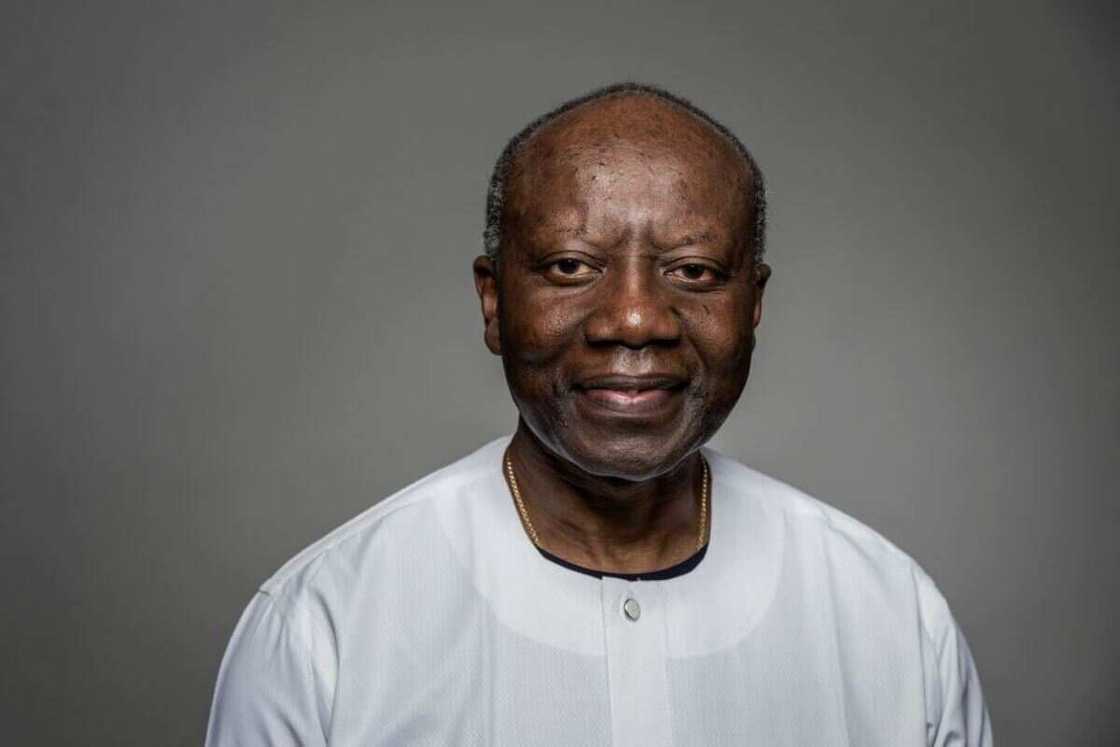

Source: UGC

Executive secretary of the association Charles Kusi Appiah-Kubi told Citi News that they are concerned about the tax hikes announced by the minister. They want Parliament to reject the budget.

“We are very disappointed. It gives us the impression that the government has lost touch with the realities on the ground.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Our disposable income has been affected; our working capital has been affected. In a situation where businesses are collapsing, the government should have been conscious in introducing measures that would save businesses…it is our prayer Parliament won’t approve the budget,” he said.

Appiah-Kubi said the increase in the Value Added Tax (VAT) by 2.5% would raise the cost of doing business in an already difficult economy.

The Ashanti Region is regarded the most favourable region for the governing New Patriotic Party (NPP). For years, residents of the region have voted massively for the party.

In the last election, votes from the region significantly helped to bring Nana Akufo-Addo to power.

Read also

"2023 budget empty, only full of grammar' - Dr Forson calls on Ghanaians to brace up for hardships

E-Levy: Ofori-Atta Reviews Controversial Tax Downwards To 1% From 1.5% In 2023 Budget

In a separate story, YEN.com.gh reported that finance minister Ken Ofori-Atta reduced the rate of the controversial Electronic Transactions Levy (E-Levy) by 0.5% to 1% in the 2023 budget.

However, the daily threshold has been removed.

This means 1% tax will affect any amount of money sent through mobile money and other electronic platforms.

The finance minister said the review of the E-Levy to affect any amount sent through selected electronic platforms and the increase in the VAT rate are part of a raft of measures to “aggressively mobilise domestic revenue” in 2023.

New feature: Сheck out news that is picked for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Source: YEN.com.gh