Bank of Ghana Accused Of Illegally Writing Off Government Debt: Minority Slams BoG Over GH¢48.4B Loan

- The Minority in Parliament has disclosed that the central bank of Ghana has illegally written off government debt to the tune of GH¢48.4 billion

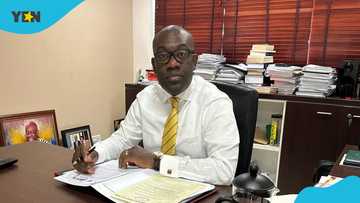

- Dr Cassiel Ato Forson, Minority Leader, told Parliament on Thursday, August 3, 2023, that MPs must approve such a move first

- The Minority Leader made the comments when he rose to take part in debates on the 2023 mid-year budget review presented by finance minister Ken Ofori-Atta on July 31, 2023

Don't miss out! Get your daily dose of sports news straight to your phone. Join YEN's Sports News channel on WhatsApp now!

The Bank of Ghana has been accused of perpetuating illegality by writing off government debts on the blindside of Parliament.

During debates on the 2023 mid-year budget review, on Thursday, August 3, 2023, the Minority in Parliament said the central bank has written off close to GH¢48.4 billion without the approval of legislators as the law mandates.

Read also

Cecilia Dapaah stolen cash scandal: Police reveals Attorney-General is taking over the case

“The entire Government of Ghana’s debt restructuring programme must be submitted to Parliament for scrutiny,” said Minority Leader Dr Cassiel Ato Forson said.

Source: UGC

The economy has not turned the corner

The Minority Leader also disagreed with the finance minister Ken Ofori-Atta during the budget presentation that Ghana's economy has begun showing signs of recovery.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

"We have not turned the corner. We have not even seen a corner from where we are as a country. In fact, we are still in the woods. We are nowhere near the corner, let alone turn it," he said sarcastically.

Ofori-Atta announces plan to include pension funds in controversial DDEP

Meanwhile, YEN.com.gh has reported in a separate story that the finance minister disclosed that he is negotiating with pension fund managers to include pension funds in the controversial domestic debt exchange programme.

Read also

Oppong Nkrumah speaks after long silence: Information minister commends Gh¢21bn cut in 2023 budget

Ken Ofori-Atta made the announcement on Monday, July 31, 2023, while presenting the 2023 mid-year budget review.

He also said the DDEP took a toll on banks and other institutions and that the total capital shortfall of the financial sector as of November 2022 stood at about Gh¢23.8 billion.

Central bank posts loss due to domestic debt exchange programme

In other business news, YEN.com.gh reported that the Bank of Ghana lost GH¢55.12 billion due to haircuts that its investments suffered under the controversial Domestic Debt Exchange Programme (DDEP).

BoG's holdings of marketable and non-marketable instruments were exchanged for lower-yielding instruments under the DDEP, the BoG said in its 2022 annual financial statement.

BoG governor Dr Ernest Addison said he was working to ensure equity was restored to a positive path by the end of 2027.

The loss generated criticisms for the central bank, with some policy analysts saying that its policies have been reckless.

But in a sharp rebuttal, the Bank of Ghana said claims that it lost close to GH¢60 billion in 2022 due to reckless spending are unfounded.

Director of Research at the central bank, Dr Philip Abradu-Otoo, said if not for the DDEP, the loss would not have been recorded.

He, however, disclosed that there are ongoing efforts to inject adequate capital into the central bank.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: YEN.com.gh