What happens if US fails to lift debt limit by June 1?

Source: AFP

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

The United States is now less than a week away from reaching its national borrowing limit, with the Treasury repeatedly warning it could run out of money to pay bills as early as June 1, threatening a catastrophic default.

Both US President Biden and House Republican Speaker Kevin McCarthy continue to rule out a debt default and insist a bipartisan solution can be found to lift the current spending cap, known as the debt ceiling.

But though the murmurs of a possible deal have grown in recent days, no such agreement has yet materialized as lawmakers head into the long Memorial Day weekend.

With each day that passes, the chance of the United States stumbling into a scenario where it cannot pay all its existing bills -- known as the "X-date" -- is growing.

'Hard choices to make'

Source: AFP

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

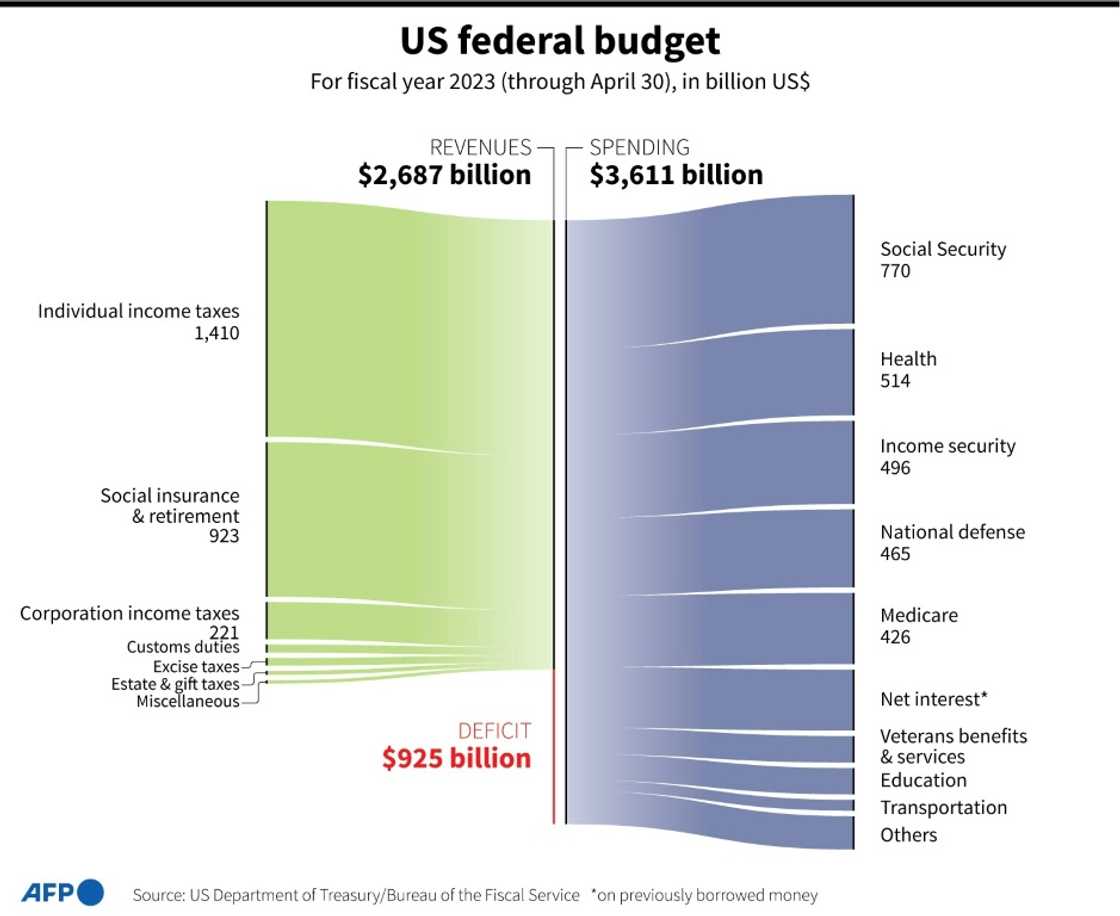

In mid-January, the federal government reached its borrowing cap of more than $31 trillion. Since then, it has used special accounting measures to extend the life of the money it is allowed to spend without raising the borrowing limit.

But it can only do so for so long before it runs up against the debt ceiling. At that point, it will only be able to spend what it brings in through taxes.

While the precise date the United States could run out of money to pay its existing bills is hard to pinpoint, the Treasury has warned that the X-date could arrive as early as June 1.

Spending commitments in excess of fresh revenues are expected to be around $80 billion on this day, according to Treasury data analysis conducted by the nonpartisan Bipartisan Policy Center.

Of this, the largest expense is Medicare spending, which is estimated at $47 billion, followed by veterans' benefits payments and military pay and retirement.

Between June 1-15, the Treasury will have a funding shortfall of more than $100 billion, according to the BPC estimates.

If the United States hits the debt ceiling, "there will be hard choices to make about what bills go unpaid," Janet Yellen said recently.

With both parties to the negotiations insisting the United States will not default on its debts, that leaves government spending as the place where these hard decisions will have to be made.

Treasury could choose to defer certain payments for Social Security, Medicare and Medicaid programs, which help tens of millions of people with pension and healthcare costs.

Alternatively, it could pause some payments across the board, which would lessen the impact on Social Security and healthcare recipients, but increase the number of government services affected.

Default 'not an option'

If the Treasury Department makes it to June 15 far without defaulting on any of its financial obligations, employees should be able to breathe a small sigh of relief.

Around $80 billion in revenues are due from quarterly individual and corporate income taxes, according to BPC, far exceeding the $22 billion that's due to be spent.

This would breathe fresh life into government coffers, keeping Treasury afloat for a little while longer, assuming no significant unexpected outflows of funds are required.

But given that tax revenues consistently bring in less than the government spends, this plan is not a sustainable one.

"Default is not an option, and all responsible lawmakers understand that," the White House said in a recent statement.

At some point, Republicans and Democrats will have to reach agreement to lift the debt ceiling, or institute dramatic spending cuts.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP