Kenya eyes budget deficit with new tax hikes

Source: AFP

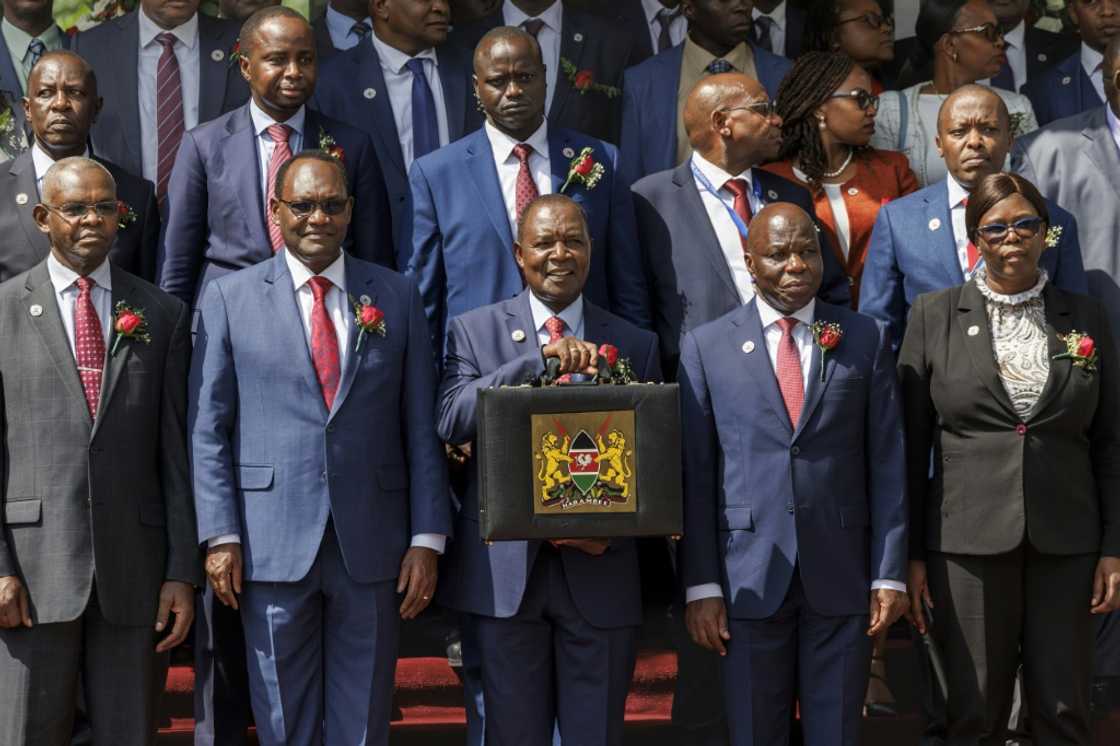

Kenya's finance minister on Thursday presented the East African nation's biggest ever budget, alongside contentious tax proposals to help plug a hole in the public finances.

Critics say the new tax levies will weigh heavily on a population already saddled with a biting cost-of-living crisis.

Finance Minister Njuguna Ndung'u presented the four-trillion-shilling ($31.1-billion) budget for 2024/25 to parliament, up from 3.75 trillion shillings it approved last June for the current fiscal year.

He also submitted a separate finance bill aimed at aggressively filling the coffers of the cash-strapped government and cut the budget deficit to 3.3 percent of GDP from 5.7 percent this year.

"The policies and structural reforms outlined in this budget have laid a firm foundation to protect this fragile recovery for a sustained socio-economic transformation," Ndung'u said.

"Financing development is critical to this economic transformation, that is why raising adequate tax revenues is a core pillar for this economic transformation and growth."

The bill -- defended by the government as needed to cut reliance on external borrowing -- has drawn sharp criticism from politicians, employed Kenyans and industry groups.

It contains a host of tax hikes expected to hit the financial services, manufacturing and retail sectors.

Among the most contentious provisions is a motor vehicle tax set at 2.5 percent of the value of the car and the reintroduction of VAT on bread.

Source: AFP

Another round of tax hikes last year led to several opposition protests which sometimes degenerated into deadly street clashes between police and demonstrators.

Parliament must pass the final version of the bill before June 30.

Economic analysts say while the "hostile" taxes could slow the economy, the bill is expected to pass because of the large parliamentary majority Ruto's party enjoys.

"The biggest impact is that we might end up slowing down the economy and if the economy slows down, the government might not raise as much taxes as expected," XN Iraki, economics lecturer at the University of Nairobi, told AFP.

Financial consultant Erastus Omolo Kwaka agreed, saying: "A hostile tax environment does not benefit the country."

Kenya's parliamentary budget office warned in March that the tax authority was likely to miss its revenue target for the current financial year ending June 30 by as much as $2.6 billion.

'Punitive government'

Opposition leader Raila Odinga has described the new taxes as "insensitive as they are callous".

"We cannot afford taxation measures whose end result is to inflict more pain on the poor who expect relief," he said last week.

But fresh protests are less likely over the new taxes after Odinga's rapprochement with Ruto to back his bid to chair the African Union Commission from next year.

"We are complaining about high rates of unemployment but taxing the few with jobs into poverty," high school teacher Ivy Kirui, 36, told AFP.

"This has turned out to be a very punitive government and catch me dead if I ever vote for them again."

Kenya is one of the most dynamic economies in East Africa but a third of the 51.5 million people lives in poverty.

Overall inflation has remained stubbornly high, at an annual rate of 5.1 percent in May, while food and fuel inflation stood at 6.2 percent and 7.8 percent respectively, according to central bank data.

'Live each day at a time'

"I no longer know if the politicians have our best interest at heart. For now, I just live each day at a time," said 51-year-old cobbler John Shitanda.

The government has forecast average GDP growth of 5.2 percent between 2024 and 2026.

Source: AFP

The World Bank said last week that while Kenya's real GDP growth had accelerated last year to 5.6 percent from 4.9 percent in 2022, it was expected to slow to five percent this year.

The recovery of the key agricultural sector -- following improved weather conditions -- drove 2023's growth, it said, with tourism also contributing to a stronger performance.

Kenya's total public debt amounts to around 10 trillion shillings, or around 70 percent of GDP, with the International Monetary Fund this week agreeing an additional $1.1-billion funding.

PAY ATTENTION: Stay informed and follow us on Google News!

Source: AFP