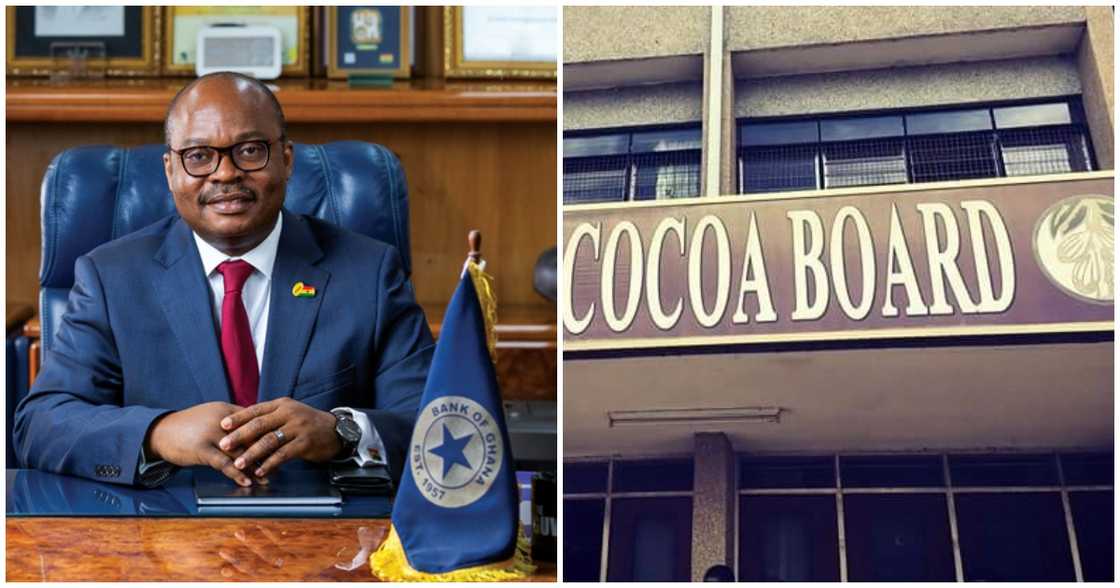

Bank of Ghana Explains Why COCOBOD Bills Were Withdrawn From Investors’ Account

- Bank of Ghana has said the maturities of investors in COCOBOD bonds will be rolled over for another six months

- The central bank has explained that the first six-month cocoa bill that matured on Thursday, January 19, 2023, had a face value of GH¢940.42 million

- The BoG said that bond was significantly undersubscribed, compelling stakeholders to take some drastic decisions

- The statement further announced that commercial banks, the BoG and COCOBOD have agreed that all institutional investors will roll over their maturing Cocoa bill

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

Bank of Ghana has clarified last week's bizarre directive to commercial banks to withdraw COCOBOD bond payments made into investors' accounts.

The bonds matured on Thursday, January 19, 2023, and monies were paid into investors' accounts accordingly.

However, on Friday, the banks rolled over the cash unilaterally, explaining that the central bank directed them to do so.

Source: UGC

Although some analysts have said the banks had no right to debit the accounts of investors without their consent, the central bank said in a statement issued on Monday, January 23, 2023, that the auction failed.

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

The BoG disclosed that the six-month cocoa bill that matured had a face value of GH¢940.42 million.

"BoG went through the usual processes to reissue, on behalf of COCOBOD a new six-month Cocoa bill to raise funds to cover the maturing obligation, but unfortunately, the auction failed was severely undersubscribed resulting in a shortfall of GH¢855.42," the statement said.

The statement further announced that the commercial banks, the BoG and COCOBOD have agreed that all institutional investors will over their maturing Cocoa bill.

The statement also said Cocobod has given assurance that the outlook for the 2023 crop season is good, and Cocoa purchasing is ahead of 2022 figures.

"We therefore expect that this short-term cash flow challenges facing Cocoa Board will be resolved soon to enable Cocobod meet its obligations to investors," the statement allayed concerns of investors.

BoG slammed for asking banks to roll over COCOBOD Investors’ bonds without their concern

Meanwhile, YEN.com.gh has reported that the Bank of Ghana received flak last week after it emerged that it directed commercial banks to take back money paid to investors who bought COCOBOD bonds.

Although the bonds matured on Thursday, January 19, 2023, and the maturities were paid into investors' accounts, the money was withdrawn from the credited accounts on Friday.

The banks did this unilaterally, prompting concerns from investors who had gone to the bank to access the money from their accounts.

The banks could not provide a convincing reason for the sudden turn of events. But on Monday, the BoG explained that the bonds were undersubscribed.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: YEN.com.gh