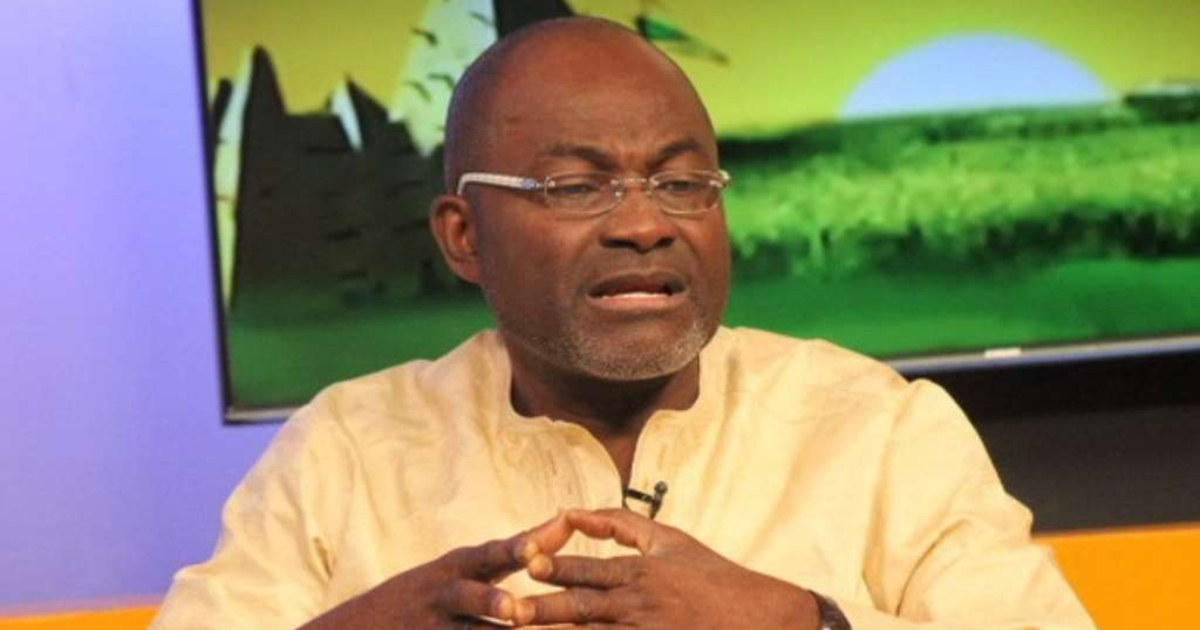

Kennedy Agyapong Criticises Banks In Ghana For Charging High Interest Rates

- Assin Central legislator Kennedy Agyapong has expressed worry over high interest rates charged by commercial banks in Ghana

- Interacting with students of the Kwame Nkrumah University of Science and Technology (KNUST) the MP said the situation affects local businesses and job creation

- He has urged commercial banks in Ghana to change the current regime of high interest rates to allow Ghanaian business compete on the global market

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

Outspoken MP, Kennedy Agyapong, has criticised commercial banks in Ghana for charging high interest rates on loans they make to businesses.

Source: UGC

The Assin Central legislator made the comments when he interacted with students of the School of Business of the Kwame Nkrumah University of Science and Technology (KNUST) in Kumasi.

Discussions with the students among other things focused on the skyrocketing interest rates being charged by banks.

"Interest rates in Ghana are very ridiculous and make it virtually impossible for local businesses to compete favourably with foreign companies," Kennedy Agyapong was quoted by a Pulse Ghana report.

PAY ATTENTION: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

He urged commercial banks to reduce the interest rates to allow small businesses to borrow and to start up or expand their businesses.

He said this would ultimately create jobs and put money in the pockets of Ghanaians.

He attributed the high rates to the high cost of operations and operational inefficiencies, bad debts, inadequate collateral, and generally high lending risks in the country.

He indicated that most commercial banks added their profit margins to the loans they gave out, which ended up raising the interest rates.

"Many businesses have been complaining about this," he noted.

He said high interest rates were the reason most Ghanaian companies would rather import finished goods, instead of producing them locally.

The Bank of Ghana raised its main interest rate by 200 basis points to 19% to curb inflationary pressures and promote macroeconomic stability.

The policy rate is the rate at which the BoG lends to commercial banks in the country and serves as the benchmark interest rate for onward lending to businesses.

In March, the Bank of Ghana raised its policy rate by 250 basis points to 17% - the largest hike in its history - to stem runaway inflation in one of West Africa's more prosperous nations as the government cut spending to reduce the budget deficit and save a sliding local currency.

Survey reveals majority Of Ghanaians have reduced volume of momo transactions over E-levy

YEN.com.gh has reported in a separate story that a survey by think tank IMANI Centre for Policy and Education has found that 83% or 8 in 10 Ghanaians have reduced their volume of mobile money transactions since the implementation of the e-levy on May 1, 2022.

Many of them said they have reduced the volume of their transaction by 51% to 100%.

The study conducted in collaboration with Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) also suggests that many Ghanaians are likely to stay away from mobile money transactions for a long time.

PAY ATTENTION: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: YEN.com.gh