UK PM Truss under fire as pound sinks

Source: AFP

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

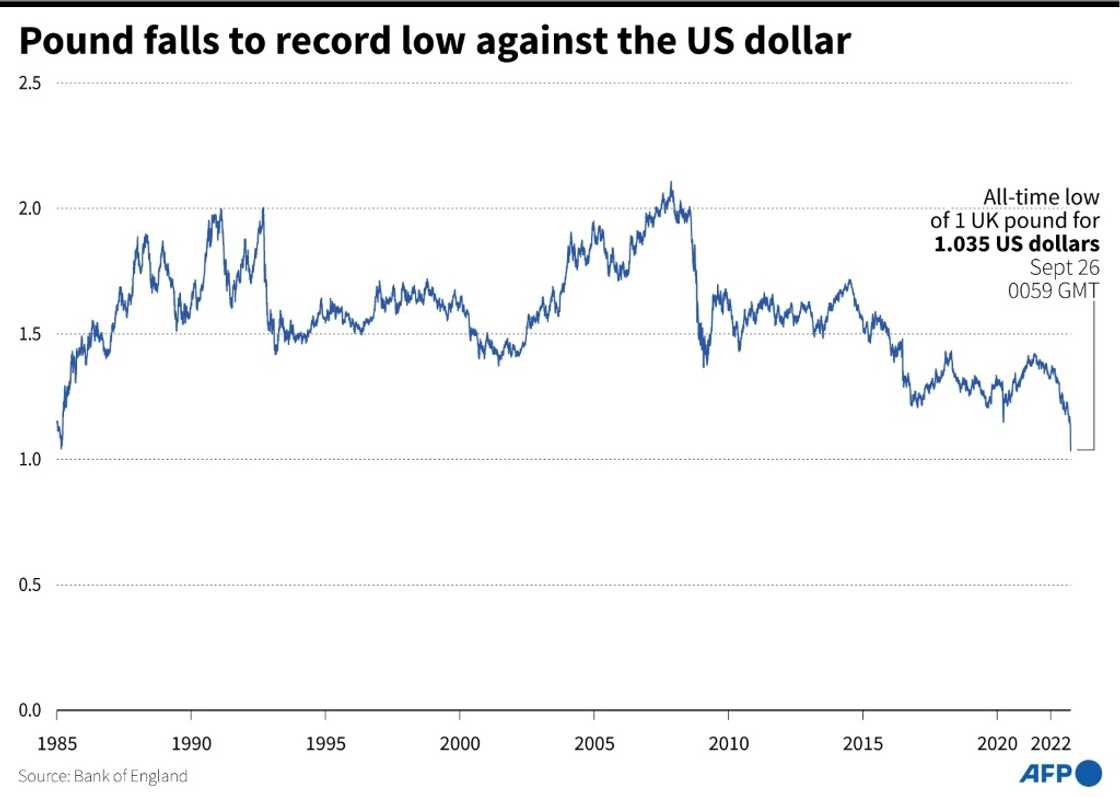

The government of new British Prime Minister Liz Truss on Monday came under pressure after the pound hit a record low against the dollar following last week's huge tax-cutting budget.

The main opposition Labour party lambasted Truss for the massive spending plans, which some economists warn could further fuel inflation.

Labour's finance spokeswoman Rachel Reeves described the situation as a "national emergency" and likened Truss and her chancellor of the exchequer Kwasi Kwarteng to "two desperate gamblers in a casino chasing a losing run".

"The message from financial markets was clear on Friday and this morning that message is even more stark: sterling is down. That means higher prices, as the costs of imports rise," she said.

"The cost of government borrowing is up. That means that more taxpayers money will go into paying the interest on our government debt.

"And in turn that means the cost of borrowing for working people will now go up to with higher mortgage repayments," she told Labour's annual conference in Liverpool, northwest England.

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

Britain has been facing a cost-of-living crisis with soaring energy prices coupled with inflation and wage stagnation.

Pound sinks

Kwarteng was appointed finance minister by Truss earlier this month after she took office following a leadership battle to replace Boris Johnson as head of the ruling Conservative party.

On Friday Kwarteng unveiled a multi-billion-pound package to support households and businesses.

He also slashed taxes, bringing forward a plan to cut the lowest rate of income tax and reducing the highest to 40 percent from 45 percent to kickstart the economy.

But investors were spooked by the huge amount of borrowing likely needed for the package, which critics said would benefit the rich far more than the poorest hit by the cost-of-living crisis.

Source: AFP

The cost of the energy support measures alone have been calculated at £60 billion ($65 billion) for only six months.

But economists estimate the whole tax package at between £100-200 billion.

The pound on Monday struck an all-time low at $1.0350 before regaining some ground to stand at $1.0728 around 1115 GMT.

The pound had already suffered a series of 37-year lows against the greenback this month on UK recession fears propelled by high inflation.

'Back to 1970s'

Economist Nouriel Roubini, known for his pessimistic predictions and having anticipated the subprime crisis, said on Twitter he believed Britain was headed "back to the 1970s".

"Stagflation and eventually the need to go and beg for an IMF (International Monetary Fund) bailout.... Truss and her cabinet are clueless," he said.

The Bank of England (BoE), which on Thursday raised its rate by 0.50 percentage points to 2.25 percent, may need to meet urgently to raise the rate again.

The markets now believe that the rate could rise two percentage points by November, when its next meeting is scheduled.

Without intervention this week, the pound could well fall below parity to the dollar soon, warned Lee Hardman, analyst at MUFG, Japan's largest bank.

The tension between the Bank of England and the Treasury was now "palpable", added Susannah Streeter, analyst at Hargreaves Lansdown, with members of the Central Bank wanting to limit inflation by weakening demand and political leaders who want to boost it.

Sky News, citing unnamed sources, said the Bank of England was due to issue a statement.

While inflation reached 9.9 percent in the UK -- the highest in the G7 -- the central bank also estimated that the country had entered recession during the third quarter.

The pound is not the only currency in difficulty against the dollar: since the beginning of the year, the yen has lost 20 percent, while the euro has fallen by 15 percent.

Source: AFP

During the pound's previous historic low, in 1985, several large countries, including the United States, had signed the Plaza agreement, which aimed to voluntarily depreciate the greenback.

"Are we getting closer to a 'Plaza moment'?" said John Velis, analyst at BNY Mellon.

"The USD real exchange rate is currently as high as it was at that time, but the spirit of cooperation doesn't yet seem to be present among the major economies in the world now," he said.

New feature: Сheck out news that is picked for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Source: AFP