Ex SVB head says social media 'fueled' run on doomed bank

Source: AFP

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

The former head of Silicon Valley Bank blamed the lender's sudden collapse on a "social media fueled run" on it, according to congressional testimony released Monday.

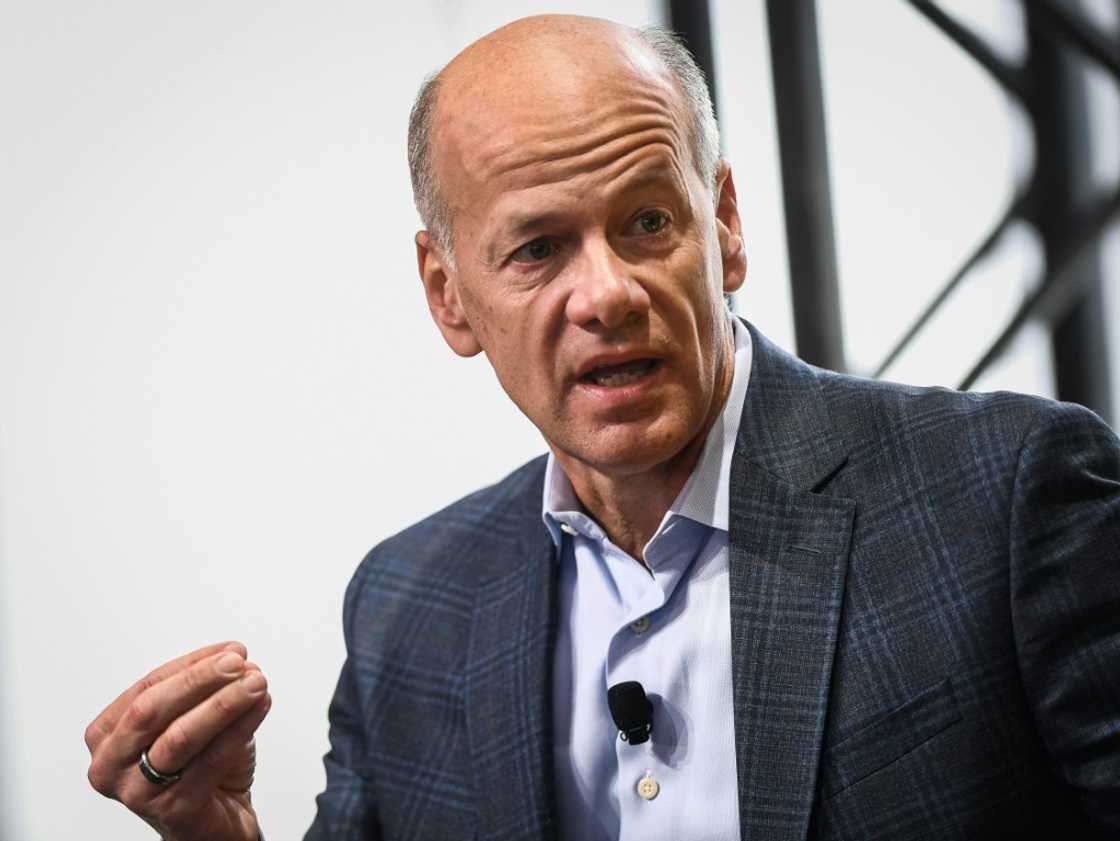

In a written statement ahead of his first major public appearance Tuesday since the bank's sudden March demise, former chief executive Gregory Becker defended SVB's risk management practices and suggested the 40-year-old California lender fell victim to forces beyond its control, such as the Federal Reserve's abrupt shift in monetary policy to counter inflation.

Becker is expected to face tough questioning Tuesday from the Senate Banking Committee.

Part of his written statement focused on the events of March 8, when SVB announced it sold $21 billion in assets that day -- at a loss of $1.8 billion -- to raise cash due to a deposit flight.

The bank at the time "had sufficient liquidity and was adequately capitalized," Becker said.

But later that day another lender, Silvergate Bank, announced it would wind itself down and liquidate -- a statement that Becker described as a catalyst for SVB's ultimate demise.

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

Even though the two institutions "were very different banks," SVB had been mentioned in a February newspaper article which discussed the two firms' securities portfolios.

"Silvergate's failure and the link to SVB caused rumors and misconceptions to spread quickly online, leading to the start of what would become an unprecedented bank run," Becker said in his testimony.

SVB was seized by federal regulators on March 10.

Federal Reserve Vice Chair Michael Barr has called SVB's demise a "textbook case of mismanagement," calling out the lender for its disproportionate number of uninsured deposits and its meager hedging strategy to mitigate interest rate risk.

SVB had invested heavily in US government-backed securities during a period of ultra-low Federal Reserve interest rates, reassured by Fed statements that inflation would be "transitory" and not demand rapid rate hikes, Becker said.

When the Fed aggressively lifted rates, SVB's holdings tumbled in value. While other banks also experienced these paper losses, SVB was forced to sell some of the assets to raise quick cash.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP