E-Levy Passage Boosts Investor Confidence In Ghana’s Bonds - Bloomberg

- Investors are responding well to Ghana's bonds after the passage of the E-Levy

- According to Bloomberg, the austerity measures announced by the finance minister to mitigate the economic hardships also impressed investors

- An analyst said these positive investor responses will also affect Ghana's risk premiums

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

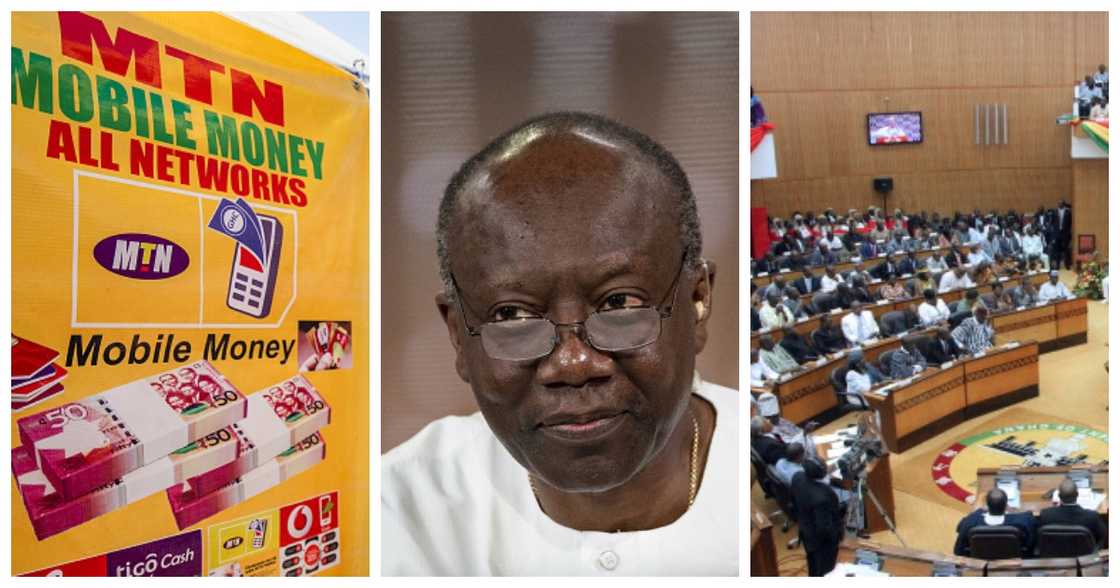

The passage of the E-Levy on Tuesday and recent austerity measures announced by the finance minister have boosted investor confidence in Ghana's bonds on the international market.

Bloomberg reports that the E-Levy passage and Ken Ofori-Atta's measures to mitigate the economic hardships reassured investors that Ghana is bent on reviving the fiscal economy.

Source: Instagram

Investors believe the recent bond rally may reflect some of the government's measures recently put in place.

According to the report, Ghana's dollar bonds sold off from 85-90 cents on the dollar to around 60 cents.

Download YEN's news app on Google Play now and stay up-to-date with all major Ghana news

Kevin Daly, an investment director at Aberdeen Standard, told Bloomberg that "the recent Ghana bond rally may reflect some of the measures the government put in place recently, but Ghana risk premiums are also benefiting from the broader risk rally on the back of better headlines on the Russia-Ukraine conflict".

Earlier this week, Finance Minister, Ken Ofori-Atta, outlined a raft of measures to reduce government spending as part of a general plan to mitigate the economic challenges.

At a press briefing on Thursday, March 24, 2022, he outlined strategies approved at a recent cabinet retreat to save the economy.

The finance minister said the government has resolved to cut spending by 10% aside from an earlier 20% cut.

The Minister also said his outfit was currently meeting with MDAs to review their spending plans to achieve the discretionary expenditure cuts for the rest of the three quarters.

Read also

E-Levy implementation starts in May after Akufo-Addo's swift assent to a controversial bill

According to the Minister, these measures will achieve the 7.4% deficit target set in the 2022 budget.

E-Levy: Five Main Transactions That Will Be Affected By The New 1.5% Tax

After Ghana’s Parliament passed the controversial 1.5% E-levy tax bill today, Tuesday, March 29, 2022, YEN.com.gh brings you the five central transactions that the new tax will affect.

According to the Finance Minister, Ken Ofori-Atta, the new levy will affect five principal transactions, key among them mobile money transactions.

The transactions that the tax will affect are as follows:

- Mobile money transfers between accounts on the same electronic money issuer (EMI)

- Mobile money transfers from an account on one EMI to a recipient on another EMI

- Transfers from bank accounts to mobile money accounts

- Transfer from mobile money accounts to bank accounts

- Bank transfers on a digital platform or application which originate from a bank account belonging to an individual to another individual

Our manifesto: This is what YEN.com.gh believes in

Source: YEN.com.gh