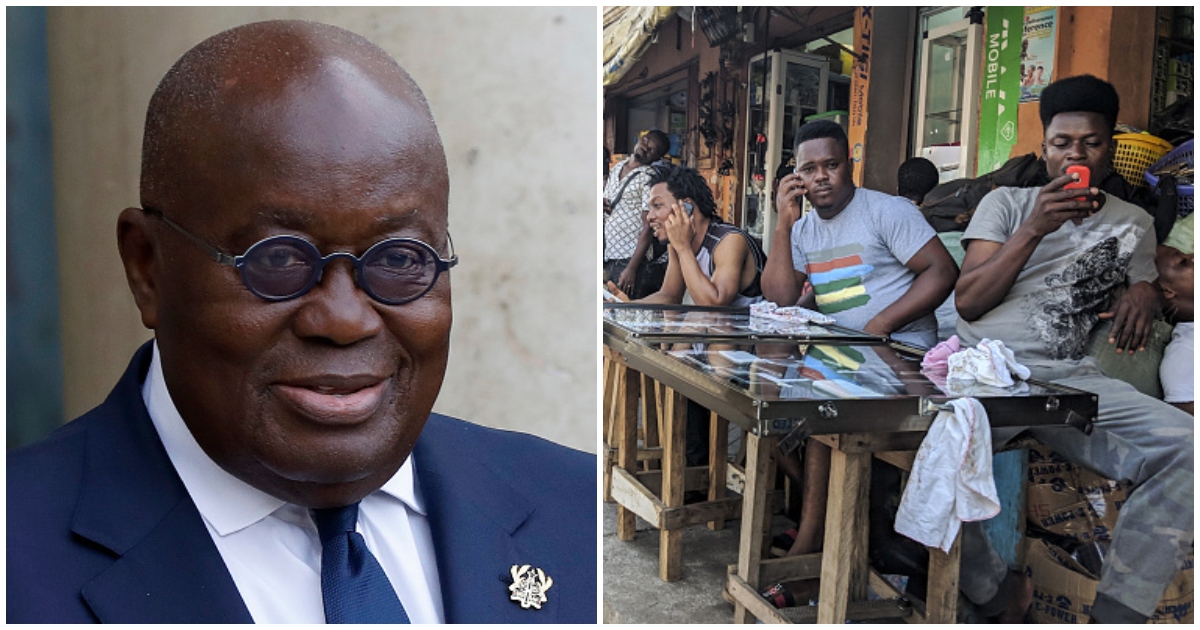

Akufo-Addo Justifies Taxes As Sacrifice Ghanaians Must Make For National Development

- The president of Ghana, Nana Akufo-Addo, is urging citizens to consider paying taxes as a sacrifice for the nation's development

- The president said paying taxes is also an important means of lifting the country from the economic challenges it finds itself

- The comments by the president at an event in Abuja follow calls on him to scrap taxes on petroleum products

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

President Nana Akufo-Addo has justified what many have described as the numerous taxes imposed on Ghanaians as the sacrifice needed for national development.

The president said while paying taxes are painful, they are important for the success of the shared effort to lift Ghana from the present economic challenges.

“All of these are the sacrifices that are required for us to make it, and we have to be prepared to do so. So, let us understand that we have to rise to the challenge and do it for ourselves,” Citi News quoted the president in a report on Friday, May 13, 2022.

Source: Getty Images

Nana Akufo-Addo reportedly made the remarks at the Summit of the Africa Finance Cooperation in Abuja, Nigeria.

Download YEN's news app on Google Play now and stay up-to-date with all major Ghana news

Huge taxes on fuel, the unpopular Electronic Transactions Tax (E-Levy), and the huge taxes on imports have been cited by individuals and businesses as problematic.

The president recently dismissed calls to reduce the taxes on petroleum products, explaining that it will significantly affect the government’s revenues. He said his administration would lose about GH¢4 billion of critical funds if the taxes on fuel were scrapped. Ghanaians currently pay 40% of the price of a litre of petroleum product as taxes.

Also, not long ago the government was compelled to calm agitations by the Ghana Union of Traders Association (GUTA) over its decision to bring back the 50% Benchmark value policy. The policy was introduced in 2019 by the government to make the Ghanaian ports competitive, reduce smuggling and increase the government's revenue from the port. The policy provided a discount of 50% on the delivery of benchmark values of imports except for vehicles.

The government reversed the policy to shore up revenue and discourage excessive importation that disrupts the activities of local industries.

The E-Levy was implemented on May 1, 2022, amid huge public uproar and lawsuits against the way it was passed. The 1.5% tax on electronic transactions is expected to bring the government at least GH¢4.5 billion every year.

Ghana’s Power Supply Situation And Fears About Return Of Dumsor

Meanwhile, YEN.com.gh has reported in separate story that in the last couple of days, fears of a possible return of dumsor, i.e. constant and sometimes scheduled power cuts, have increased due to the growing unannounced cuts in electricity supply to parts of the country.

These unannounced power cuts in the Greater Accra Region alone shows that since Sunday, May 8, 2022, at least one heavily populated area experiences a power outage for a minimum of one hour and a maximum of up to 12 hours.

These unexpected power outages, according to some experts in the sector, are early signs of the return of dumsor, a term that brings back dark memories of the 2009 to 2011 debilitating power situation in Ghana.

Our manifesto: This is what YEN.com.gh believes in

Source: YEN.com.gh