Currency Board: How It Operates And Why Professor Hanke Thinks It's Ghana's Only Way Out To Save The Cedi

For some time now, US-based economist, Professor Steve Hanke, has been nudging Ghana to consider mothballing the Bank of Ghana's Monetary Policy Committee (MPC) decisions to control inflation and set up a currency board. YEN.com.gh breaks down how a currency board operates and if it is Ghana's answer to rising inflation and depreciating cedi.

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

Professor of Applied Economics at the John Hopkins University in Baltimore, United States, Professor Steve Hanke, has been grabbing headlines in Ghana for his blunt but brief analysis of Ghana's economic challenges.

His Twitter page is constantly buzzing with titbits about distressed or struggling economies worldwide, and Ghana has recently been featuring regularly. His popular "Hanke Inflation Dashboard" usually gives a measure for a country that is always higher than official figures. For instance, his dashboard puts Ghana's real inflation for July 2022 at 77%, 45.3% higher than the Ghana Statistical Service figure of 31.7%.

The "Hanke Inflation Dashboard" always gives higher inflation figures than the official figures because he compiles them using high-frequency, free-market, exchange-rate data combined with a more comprehensive Purchasing Power Parity (PPP) theory. Official figures only use the PPP theory.

Prof Hanke's Currency Board Proposal

Prof Hanke's tweets are usually in three sections: a short description of a country's economic predicament, a non-conventional and higher figure for exchange rate or inflation measured and then a short suggestion on how to solve the problem.

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

For Ghana, he has consistently proposed that the country get rids of its central bank, the Bank of Ghana, and install a currency board. He has signed off his tweets on Ghana with that suggestion so often that it has gotten the attention of Ghanaians among the over 522,000 people following him.

What is a currency board?

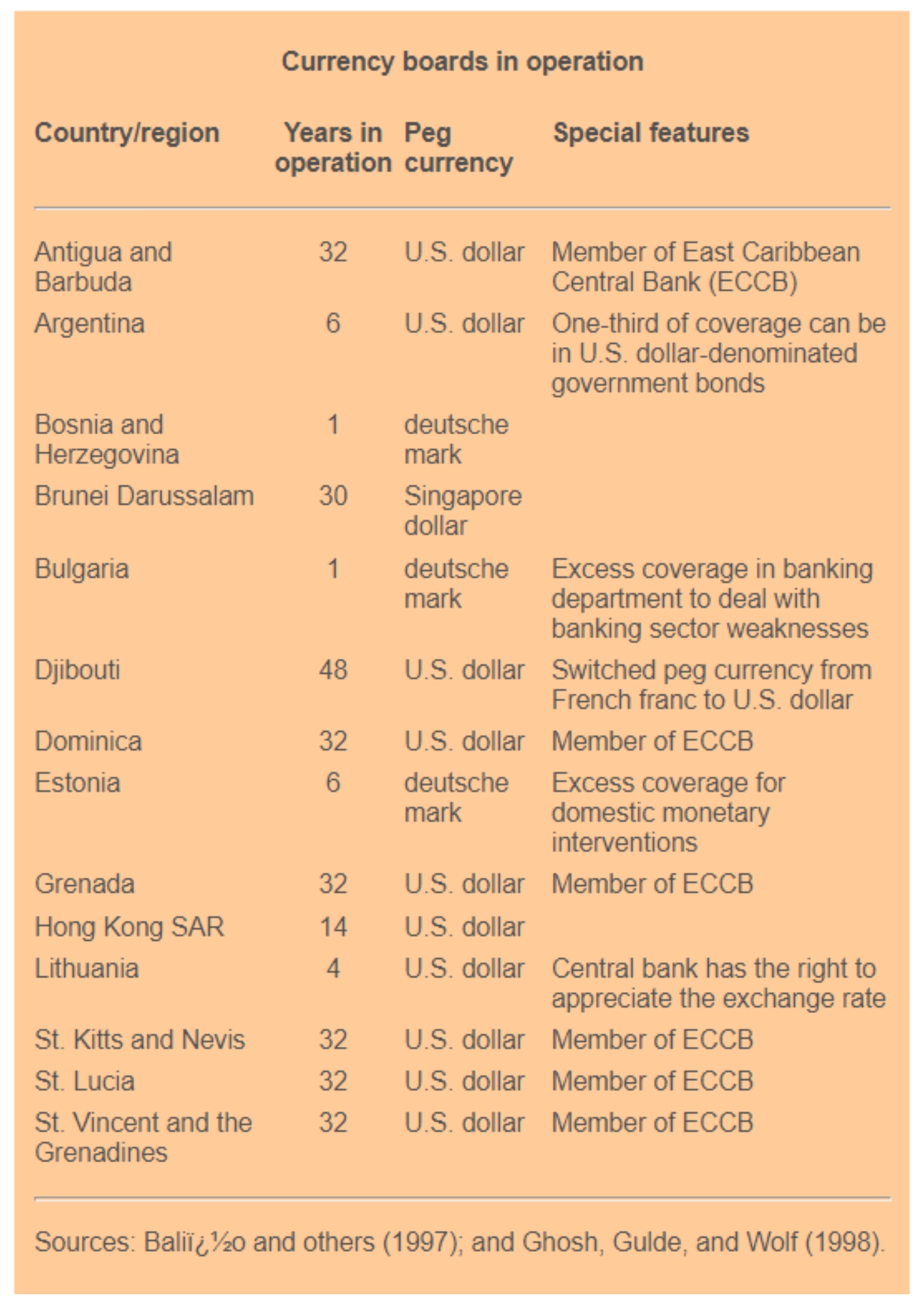

Currency boards are usually the last resort for pursuing a visible anti-inflationary policy. When installed, they act as a central bank and typically become a country's monetary authority that issues notes and coins.

A currency board combines three elements in its operation: an exchange rate that is fixed to an "anchor currency," automatic convertibility (that is, the right to exchange domestic currency at this fixed rate whenever desired), and a long-term commitment to the system.

Source: UGC

Just like the central bank system, credibility is key to its effectiveness. Financial markets consider a currency board credible if it holds sufficient official foreign exchange reserves to cover the narrow money supply.

Will A Currency Board Help Ghana's Falling Cedi?

Not every economist supports Prof Hanke's proposal. For example, Dr Theresa Mannah-Blankson does not think Ghana needs a rigid system that rigidly fixes its exchange rate.

Dr Mannah-Blankson, an economist with the finance and economics pillar of the Centre for Social Justice (CSJ), is convinced Ghana's central bank is capable of easing inflation and holding the cedi fall without political interference.

She told YEN.com.gh that the reason the Bank of Ghana seems helpless amid the current economic distress boils down to political interference in its operation.

"Establishing a currency board with the likelihood of the same interference will yield the same result. Ghana needs a credible and independent central bank," she countered Prof Hanke.

Currency Boards Must Not Be Installed In Haste

Source: Original

IMF economists, Charles Enoch and Anne-Marie Gulde, warned in an article that while currency boards have achieved impressive economic results in many countries, national governments must tread cautiously on that path.

"…the successful establishment of a currency board arrangement requires time for building consensus, as well as for careful planning and implementation of important legal and institutional changes," they advise.

They also observed that the success stories of currency boards come from the experiences of smaller countries, noting that their applicability to larger countries is murky.

Finally, if a country is moved to consider setting up a currency board, it must do well to rehabilitate weak banks in its countries before changing its monetary regimes.

"These prerequisites to establishing a currency board may, in many cases, be too involved and take too much time to make it advisable for a country to attempt to do so during a macroeconomic crisis," Enoch and Gulder wrote.

Currency boards seem a long way off for Ghana, and not everyone may agree with Prof Hanke, but everyone else is certain about what must be done about Ghana's economy now: beat inflation and make the cedi strong.

Cedi Depreciation: Economist Backs Injection Of $2 Billion To Strengthen Struggling Local Currency

Meanwhile, Dr Mannah-Blankson has said the upcoming injection of $2 billion into the Ghanaian economy should balance the demand and supply of dollars, and possibly hold the cedi depreciation.

She said the strategy by the government could yield some possible results for the struggling cedi. She noted, however, that the effectiveness of the move would depend on the actual shortfall of dollars in the economy.

"As was noted in the press release from the Bank of Ghana on the depreciation of the Cedi, some factors for the cedi's depreciation include the exit of non-resident investors from our bond market and increases in import bills from crude oil et cetera. Which means there is a need to provide more dollars to the market to meet the current demand," she told YEN.com.gh in an exclusive interview.

New feature: Check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: YEN.com.gh