Debt Exchange: Individual Bondholders Show Ofori-Atta How He Can Make GH¢83 Billion In Fiscal Re-adjustments

- Individual bondholders believe there are better ways the finance minister can adopt to raise a whopping GH¢83 billion for the state without touching their investments

- In a report compiled after meeting with some government representatives, the Individual Bondholders Forum made some 18 proposals to Ken Ofori-Atta

- One of the proposals is for government to review the regulatory and fiscal environment in the oil production other extractive sectors

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

Individual bondholders have proposed easy strategies and fiscal adjustments the finance minister can implement to raise close to GH¢83 billion without touching their investments in the ongoing Domestic Debt Exchange Programme (DDEP).

The proposals for raising the huge cash are contained in a report compiled by a technical committee of eminent members of the Individual Bondholders Forum (IBF) and government representatives.

The committee was formed after the finance minister Ken Ofori-Atta met with the members of the IBF on their exclusion from the DDEP.

Read also

No more luxury jet travels and 4 other steps Akufo-Addo has taken to tackle economic crisis

Source: UGC

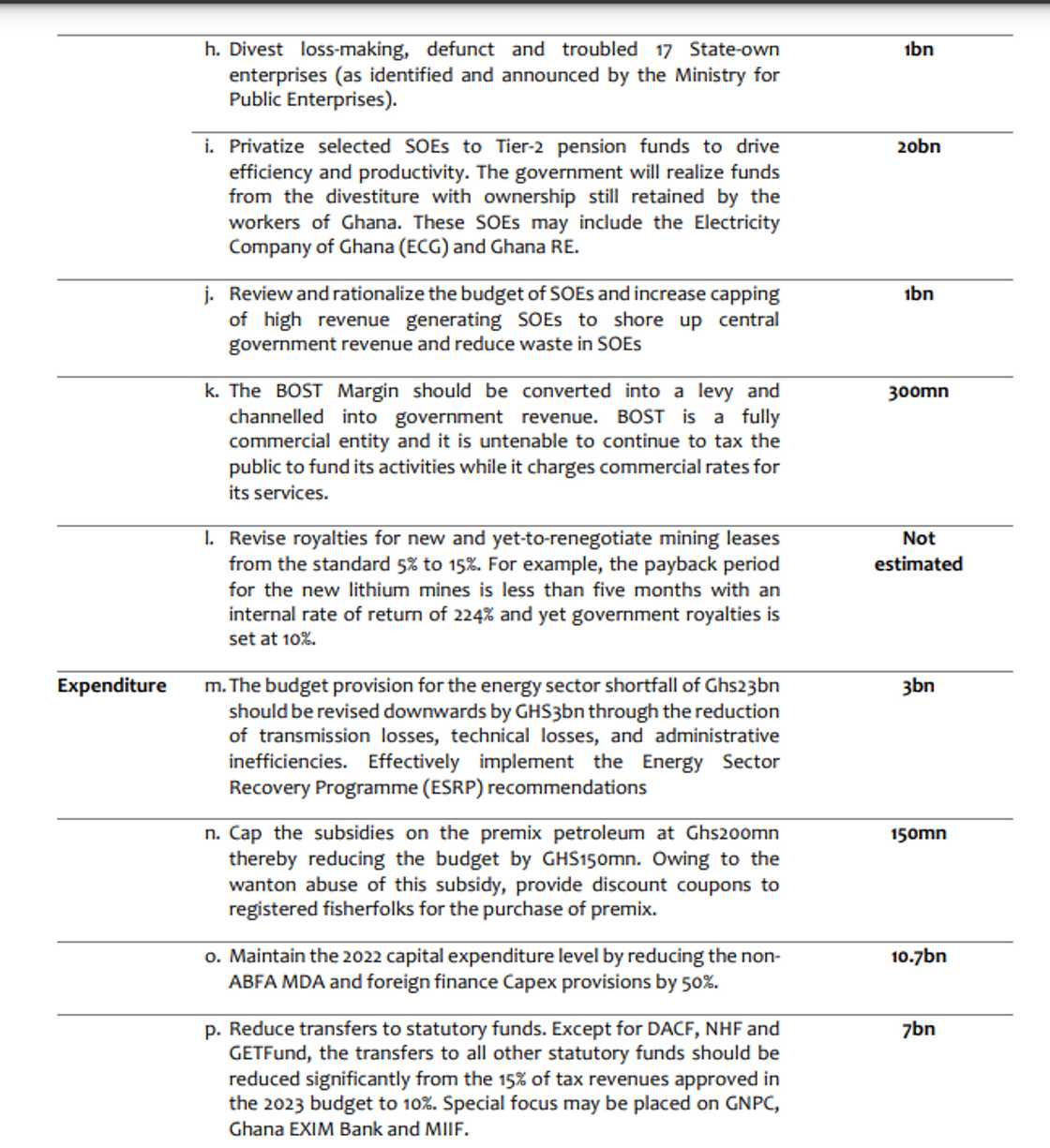

The recommendations, 18 in all, includes prudent expenditure cuts and strategies to raise revenue within the 2023 fiscal year.

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

The committee believes that should Ken Ofori-Atta and his team of economists decide to implement the proposals, he would not have to touch their investments.

"The individual bondholding and holdings through collective investment schemes stand at about GHS15.5bn, representing about 11% of the eligible bonds and the capitalized interest. With the set target of 80% of eligible bonds, Individual Bondholders are not a critical success factor to the viability of the DDE programme as you envisage, yet the impact of their inclusion has incalculable consequences," the individual bondholders said in the report.

Source: UGC

How government can raise GH¢83 billion in fiscal re-adjustments

In a nutshell, the committee explained the finance minister will achieve better results and spurring growth by revising his DDEP to focus on structured groups like banks and insurance companies.

“Reduce the crowding-out effect of the government’s excessive net domestic borrowing to pave access for real sector financing to spur growth,” was another advise by the eminent members of the IBF.

The experts further urged the government to review its posturing to investors interested in the extractive sectors, particularly in the upstream and mining sectors.

“Oil production has dropped from over 200kbpd to below 160kbpd yield revenue loss more than $300mn (GHS3.6bn) in 2022. The government should, as a matter of urgency, review the regulatory and fiscal environment to encourage existing producers to ramp up production and develop new fields,” the committee recommended.

Source: UGC

The committee believes for instance that close to GHS14 billion can be saved if the finance minister pursues the recovery of funds lost through financial irregularities of MDAs in the Auditor-General’s reports of 2015 to 2022.

Finance ministry and Ghana Association of Bankers reach agreement

Meanwhile, YEN.com.gh has reported in a separate story that the Ghana Association of Bankers (GAB) and the finance ministry agreed on modifications to some of the controversial proposals in the DDEP.

Read also

Alan Kyerematen urges government to exclude Individual Bondholders from Debt Exchange programme

For instance, the finance ministry has now agreed to begin to pay a 5% coupon on investments from 2023 and not 2024 as it had earlier proposed.

GAB has urged its members to support the programme because it is critical to solving the country's debt challenges.

New feature: Сheck out news that is picked for YOU ➡️ click on “Recommended for you” and enjoy!

Source: YEN.com.gh