Real Madrid Reshapes Its Financial Model With New Investment Push

- Real Madrid explored a major restructuring move that included selling a stake in a new commercial entity

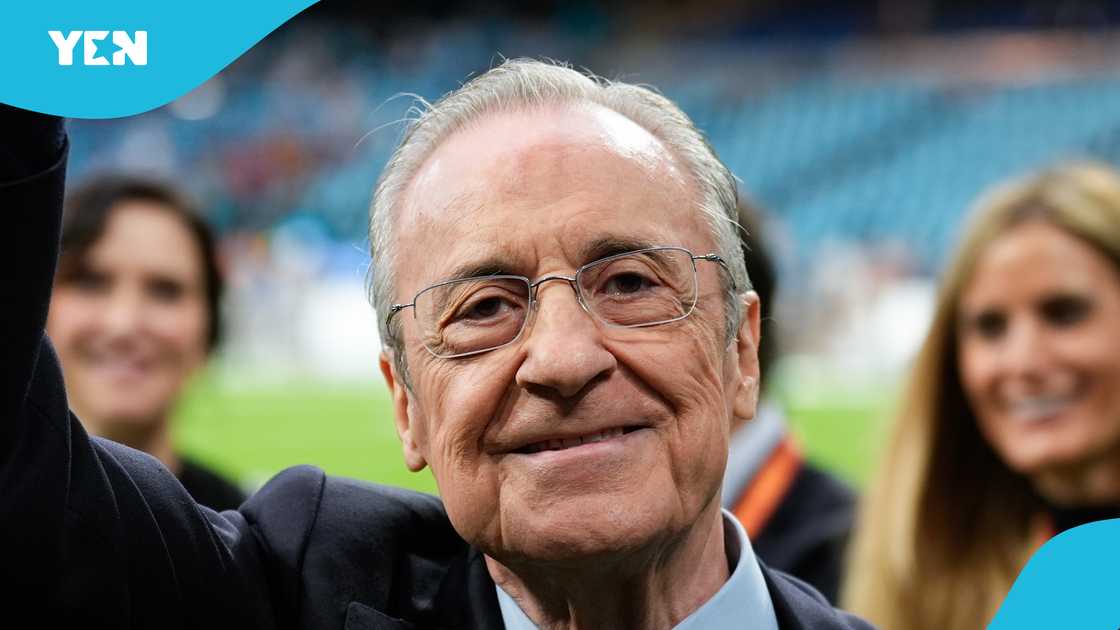

- Florentino Perez has introduced a fresh investment model designed to raise to €1 billion

- A planned commercial subsidiary would allow minority investors to join without influencing football decisions

Real Madrid are reportedly preparing for another major shift in their financial structure as president Florentino Perez sets the stage to sell a stake in a newly created commercial company.

This move comes after the club already secured €360 million through a previous deal involving future Santiago Bernabeu profits, and it marks the continuation of a long-term plan to strengthen the club without compromising its member-owned identity.

Source: Getty Images

Real Madrid to sell 10% stake in club

According to El Periodico, Florentino Perez presented the blueprint to club members, outlining a strategy that raises new capital while preserving the institution’s traditional governance model.

Read also

UK allows student-to-founder visa switch: Key things Ghanaians need to know before applying

As such, Perez has begun laying the groundwork for the sale of a 10% stake in a newly established commercial company designed to secure fresh investment for Real Madrid’s future.

According to Mundo Deportivo, the initiative is widely seen as Madrid’s second financial lever, aimed at generating between €500 million and €1 billion. It builds on the earlier agreement with Sixth Street and Legends, which granted investors a portion of future stadium revenue.

With this new project, Madrid intends to modernise its corporate framework and safeguard its ownership structure at a time when rising construction costs have increased financial pressure.

Source: Getty Images

Central to the plan is the formation of a dedicated commercial company into which investors can buy minority shares. This approach enables Real Madrid to attract fresh funding while keeping all sporting decisions fully under the control of the membership base.

The club’s advisors, including Key Capital Partners and Clifford Chance, are helping shape this model, drawing inspiration from the Real Madrid Estadio SL structure created in 2021 to manage stadium-related activities.

Under the proposed system, investors would gain access to commercial operations such as sponsorships, events, marketing, and stadium exploitation, but would not influence football matters.

Importantly, Real Madrid would remain the majority shareholder, allowing members to retain ultimate authority. The club is also studying a partial separation of its sporting and commercial branches, a step that could lay the groundwork for a long-term hybrid system that still respects the members’ historic role.

Real Madrid are ballooning Bernabeu costs

The escalating cost of the Bernabeu redevelopment continues to shape the club’s financial choices. What began as a €575 million project has soared to €1.347 billion due to inflation, global supply issues, enhanced acoustic systems, and the expensive retractable pitch mechanism.

As of June 2025, stadium-related debt stands at €1.132 billion, making additional liquidity essential for stabilising the club’s finances, as noted by El Periodico.

Therefore, this new move ensures the club remains shielded from market volatility, political pressure, and legal threats, reinforcing Florentino Perez’s long-standing commitment to protecting Real Madrid’s institutional identity while opening the door to controlled and sustainable investment.

Dean Huijsen's injury setback at Real Madrid

Earlier, YEN.com.gh reported extensively on the latest injury setback of Real Madrid defender Dean Huijsen.

The talented central defender had to leave the Spanish national team camp to be further examined by Los Blancos' medics.

Source: YEN.com.gh