List of accounting and auditing firms in Ghana

The advantage of having audits in the company is to identify errors, losses or profits recorded annually from the sales and accounting department. No matter how accurate you maybe, there are still chances of making mistakes while keeping accounting records. To keep such mistakes in check, auditing firms in Ghana will be of help.

In Ghana, accounts are verified during an audit. The audit will show whether the assets of the company are handled properly or not. At the same time, audits help find errors in the book keeping process. Such mistakes come up when keeping accounting records. Once the audit is complete the audit firm will give recommendations. The suggestions will help increase your profit margins and this explains the importance of auditing. Audit firms in Ghana help many businesses improve and expand.

READ ALSO: Best investment bank in Ghana - top 10

Accounting and auditing firms in Ghana

When running any business, it is advisable to keep records to identify losses or gains. Audits ensure the accounts recorded are accurate and correspond with the profits and losses. Auditing firms in Accra can offer their services annually or after 6 months depending on the company. Here is the list of auditing firms in Ghana.

Klinbooks Consultancy Services

Klinbooks Consultancy Services ensure that companies have reached their targets. Experts from this firm also give the way forward after they carry out an audit. Their services include budget management training, tax services, accounting cost consulting, and Quick Books. At the same time, this firm can help when it comes to taxation in Ghana.

READ ALSO: List of top universities in Africa 2018

Possibility World Ltd

Possibility World Ltd offers services like events, business development, training and development. It also deals with telecommunications and auto mobile services in firms in Ghana. Possibility is one of the accounting firms in Ghana that offers solutions to businesses.

Ghana Association of Restructuring & Insolvency Advisors

Ghana Association of Restructuring and Insolvency advisors help identify accounting issues in firms. They also recommend solutions. This firm also provides leadership insights and encourage restructuring in state owned enterprises. This firm offers every Ghana audit service you need.

Marka-Ghana

Marka Ghana offers security solution for assets of firms. This audit firm also offers fixed assets solutions. Its services include inventory management, fixed asset tracking, Asset Management and stock control. This is among the names of auditing firms in Ghana.

Multisoft Solution Limited

Multisoft Solution Limited provides software solutions to businesses. The company also has well-equipped team of consultants, tax and IT experts. As such, their solutions in accounting in Ghana are fast and saves time.

READ ALSO: How to calculate income tax in Ghana 2018

GroConsult Management Consortium

GroConsult Management Consortium is an organization that offers audit solutions to firms. The solutions are human resources, telecommunication, audit and investment planning to clients in Ghana. It is one of the international auditing firms in Ghana that has companies in the United Kingdom, United States, Cyprus, South Africa, Cote D’Ivoire, Switzerland, Nigeria and Ghana.

Streamline Africa Ltd

Streamline Africa Ltd is one of the registered auditing firms in Ghana. The firm offers services to small and medium businesses in accounting and booking keeping. Streamline is one of the convenient accounting companies in Ghana since you do not need to have an office to enjoy its services.

De-Genesis Global Consulting Ltd

De Genesis Global Consulting Ltd is one of the types of auditing companies in Ghana. They are in the position of helping businesses grow rapidly and by working smart. This firm understands how businesses run and can provide quality accounting and auditing.

READ ALSO: Best investment companies in Ghana

Abstracus Chartered Accountants

Abstracus Chartered Accounts satisfies clients by providing advisory services, audit, tax and accounting. It is one of the licensed auditing firms in Ghana. It also has a license from the Institute of Chartered Accountants Ghana. This firm only licenses qualified audit firms to offer services to clients.

LIMS Accounting

LIMS Accounting offers internal auditing, accounting, book keeping, and tax advisory. These services allow you to manage and understand the losses or profits of your business. Audit helps in controlling and avoiding fraud and reduce lose and increase profits. Accounting helps in recording and keeping records of the business internally and externally.

Emefs Microfinance Limited

Emefs Microfinance Limited is a public sector accounting firm. This firm helps businesses save money. It also advises businesses on how to deposit money. Further, this accounting firm also gives credit to Micro businesses. This accounting company works as Beige Capital branches, which offer savings and loans in Ghana.

READ ALSO: Meet talented Adebisi Aderonke who makes soap to earn a living (photos)

Mikan Consulting Services

Mikan Company takes roles in giving secretaries to companies and also offers taxation, auditing, accounting. Also, this company helps in processing work permits, annual returns, and Ghana Revenue Authority. If you need a firm to do all that for you then you should get in touch with Mikan Company.

Accountia

It is one of the private auditing firms in Ghana that specializes in accounting services. As a businessman, you can call them and they will give the best services. They will also give you a free one hour of consultancy and business analysis report and advise you how to improve and achieve your business goals.

READ ALSO: Ghana education service syllabus for all subjects

Gormotil Consulting

It is one of the oldest consulting firms since it has been around for more than 25 years. They offer various services to businesses and ensure their clients are well served. The services include taxation, auditing, consultants in accounting and also business consulting services.

Ayesu & Ayesu Consult

Ayesu and Ayesu Consult is one of the firms that satisfy their clients and has well-trained experts. Here are the company accounting and financial services:

- Stock taking

- Recording of transactions

- Tax computation

- Financial reporting and documentation

- Financial advice

- Also if it’s a private face to face training in;

- Business Management

- Financial Accounting

- Cost Accounting

- Business Management

Prestige Business Solutions Ltd

Prestige Business is located in Accra. It offers Business Management consulting business activities, accounting and auditing. You can try them out and they will not disappoint.

READ ALSO: Mobile money transactions see substantial gains

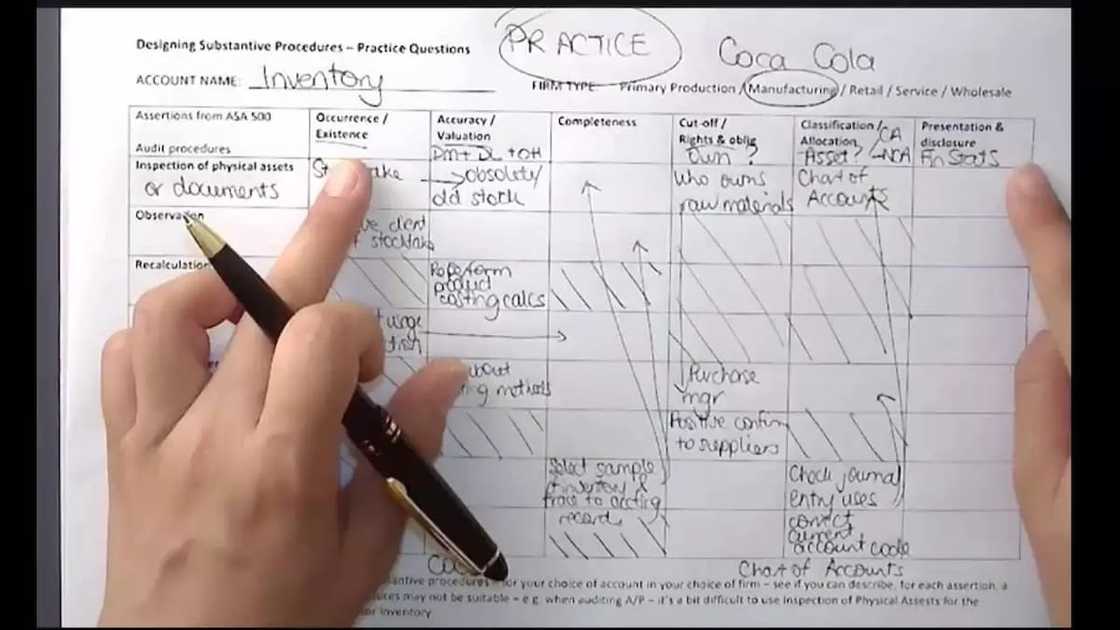

Auditing procedures

Auditors use auditing procedures to determine losses or gains in businesses. Financial information is crucial because it shows if the business is growing or failing. Audits depend on book keeping information from the accounting department. Here are the outlines of the auditing procedures done in Ghana that are also used in international standards on auditing.

1. Valuation testing

Valuation testing helps audits to resolve the assets and liabilities of the business recorded during book keeping. The information is important in avoiding the mishandling of the business assets and finances. One of the procedures is to confirm if the market cost has increased so they can record the ending value.

2. Existence testing

Auditors would go through the inventory to check if all the listed items are available. Missing items should have records of their current locations. This will ensure that all the business assets exist.

3. Rights and obligations testing

Audit procedures in this area ensure that the assets held by the clients belong to them. Correct records showing the real owners of assets help in reducing corruption and theft in Ghana.

READ ALSO: Importance of scale of preference in economics

4. Occurrence testing

Audit procedures in occurrence testing determine if the client has received the right documents after processing any transactions for their customers. The client should present all the invoices as proof for the transactions.

5. Cutoff testing

One of the procedures is to ensure that if all the transactions have been recorded properly with the correct reporting time. One of the examples is to see if the export to a customer was recorded at the right time according to the export period stated.

6. Completeness testing

Auditors can check if there is any transaction missing from the record books. For instance, all customer purchases should be recorded. As such, the work of the auditor will be to confirm the same and find any missing records.

READ ALSO: Central University College courses offered and cut-off points

7. Classification testing

Classification testing procedure tries to determine whether the accounting records were correctly classified. Example, the auditors will check if current and fixed assets recorded separately.

When a complete auditing has been done, the client will find out if their financial statements represent their true financial position. A reputable firm like PWC Ghana can help in such situations by getting Ghana back to work.

Deloitte Ghana helps in collecting tax and, therefore, Ghana Revenue Authority has selected some of its agents who will be withholding entries on VAT. Those agents are appointed as institutions to act as VAT withholding bodies, which improves one aspect of Ghana economy.

If you are looking for ways to get quality services and advisory services in Ghana then get in touch with Ernst and Young Ghana. This firm has well-trained and committed experts. While doing their work, these experts have ensured that they have built better working places for businesses and the entire world at large.

There are also some institutions that offer accounting and auditing service like ICA Ghana. It also trains people in accounting and auditing. If you are looking for qualified candidates for auditing and accounting in your organization then ICA will give you the best. They train their teams to make sure their clients have received all the services and are satisfied. Satisfaction is all that matters for clients. As a businessman, you would like to know how your business is running in terms of profits and losses. They will provide both auditing and accounting and they will also ensure you have all the records for your assets.

READ ALSO: Central university college fees, hostel prices, and admission requirements

In Ghana, auditing and accounting have really improved the economy. The improvement has created job opportunities because most businesses are looking for qualified auditors and accountants. Audits help businesses improve and start making profits. After the auditing and accounting, the client can understand the position of the business and apply the recommendations from the auditors.

Fixed assets should be recorded properly for documentation. All transactions in the business will be determined after the auditors receive all invoices. The client will also know about all the existing inventory after the audit. Such information helps reduce theft and errors in the business.

Auditors should also follow auditing procedures to ensure they do not miss anything. So the auditor will go through all the documents to check all the recorded transactions and come up with a report. Most businesses owners in Ghana make profits and learn how to handle their businesses thanks to auditing firms in Ghana.

READ ALSO: Microfinance companies in Ghana

Source: YEN.com.gh