Bank of Ghana Receives $750 Million Afreximbank Loan To Strengthen Cedi Against Dollar

- The cedi is expected to see some respite as the Bank of Ghana receives $750 million from the Afreximbank

- The cash is for infrastructural projects, however, the central bank is expected to hold on to it and pay contractors its equivalent in cedis

- The move is expected to boost the strength of the cedi and make it stable in the coming days

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

The Bank of Ghana has received $750 million from the African Export-Import Bank (Afreximbank), as a scarcity of the American green buck in Ghana puts pressure on the cedi.

The Afreximbank loan hit the BoG account on Thursday, August 25, 2022, and is intended for infrastructure projects.

However, the central bank is expected to give out the cedi equivalent to the contractors and keep the dollars. This will firm up efforts to hold the cedi fall against the dollar.

The finance ministry has already assured that the cedi, which is selling at almost GH¢10 to the dollar, will begin stabilising by next week.

PAY ATTENTION: Click “See First” under the “Following” tab to see YEN.com.gh News on your News Feed!

Minister of State at the ministry, Charles Adu Boahen, said the government had taken steps to make the dollar available to importers.

Currency Board: How It Operates And Why Professor Hanke Thinks It's Ghana's Only Way Out To Save The Cedi

Meanwhile, for some time now, US-based economist, Professor Steve Hanke, has been nudging Ghana to consider mothballing the Bank of Ghana's Monetary Policy Committee (MPC) decisions to control inflation and set up a currency board.

YEN.com.gh has broken down how a currency board operates and if it is Ghana's answer to rising inflation and depreciating cedi.

Economist Backs Injection Of $2 Billion To Strengthen Struggling Local Currency

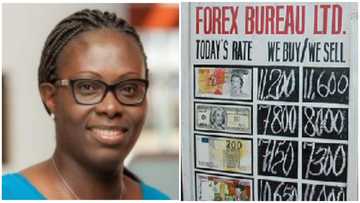

Also, Economist with Centre for Social Justice, Dr Mannah-Blankson has said the plan of government to inject $2 billion into the Ghanaian economy should balance the demand and supply of dollars, and possibly hold the cedi depreciation.

She said the strategy by the government could yield some possible results for the struggling cedi. She noted, however, that the effectiveness of the move would depend on the actual shortfall of dollars in the economy.

"As was noted in the press release from the Bank of Ghana on the depreciation of the Cedi, some factors for the cedi's depreciation include the exit of non-resident investors from our bond market and increases in import bills from crude oil et cetera. Which means there is a need to provide more dollars to the market to meet the current demand," she told YEN.com.gh in an exclusive interview.

New feature: Check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: YEN.com.gh