‘Haircut’ Costs Franklin Cudjoe Over GH¢100K: “It Will Take At Least 8 Years For The Current ‘Economic Mess’”

- Franklin Cudjoe has shared his moving story about how he lost over GH¢100,000 on his investment due to the debt restructuring programme

- The founding president of IMANI Africa said the country is in for a long period of disruptions to investments

- He said on Facebook that it could take as long as eight years for the current economic disruptions to normalise

Founding president of influential think tank IMANI Africa Franklin Cudjoe has said he lost more than GH¢100,000 to the haircut triggered by finance minister Ken Ofori-Atta's domestic debt exchange programme.

He told the hundreds of Ghanaians following him on Facebook that he lost the funds to the marked-to-market value currently being implemented.

Source: UGC

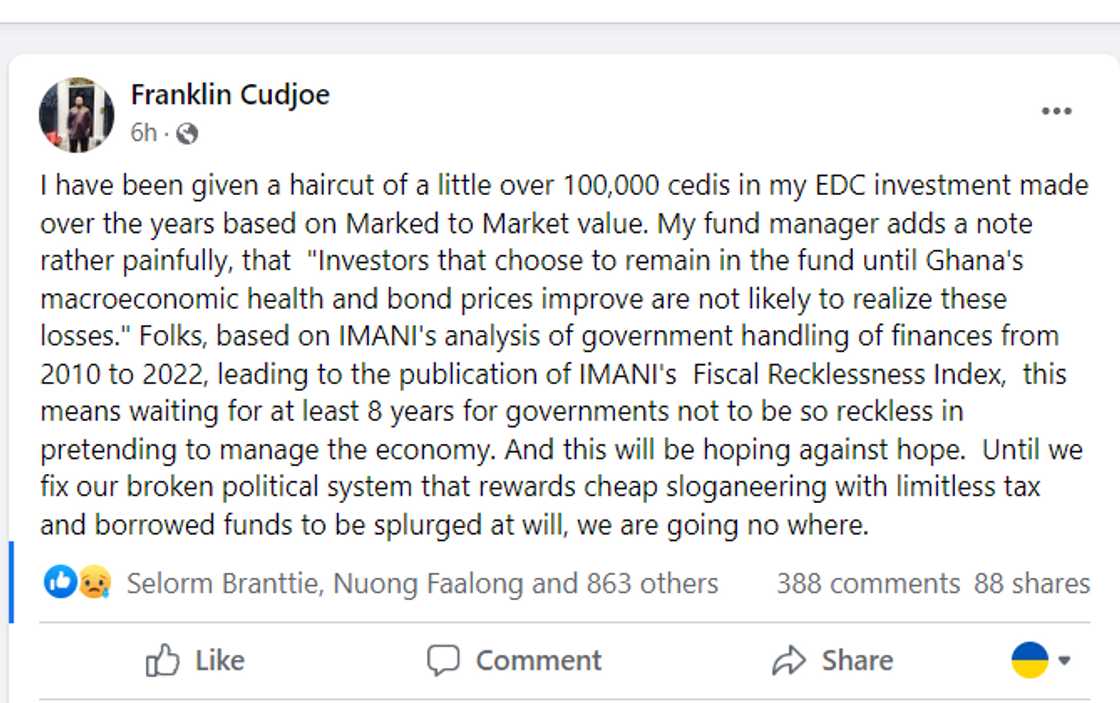

"I have been given a haircut of a little over 100,000 cedis in my EDC investment made over the years based on Marked to Market value.

Read also

Nurse-for-cash agreement: Ghanaian lady questions whether clinics in rural areas have adequate nurses

“My fund manager adds a note rather painfully, that ‘Investors that choose to remain in the fund until Ghana’s macroeconomic health and bond prices improve are not likely to realise these losses," he said on Facebook.

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

A "haircut" is common jargon in finance used to describe a financial loss on an investment. To “take a haircut” corresponds to accepting or receiving less than what was owed.

Cudjoe added that based on forecasts by astute policy analysts at his think tank of how governments have handled the state's finances from 2010 to 2022, it will take at least eight years for the disruption caused in the investment market by the country's debt situation to be rectified.

“Until we fix our broken political system that rewards cheap sloganeering with limitless tax and borrowed funds to be splurged at will, we are going no where," he said.

Source: Facebook

Finance Minister Announces Plans To Swap Cedi Debts for New Bonds In Domestic Debt Exchange Scheme

Meanwhile, YEN.com.gh has reported in a related story that finance minister Ken Ofori-Atta on the evening of Sunday, November 4, 2022, announced to local bondholders that there would be losses on interest payments under the Domestic Debt Exchange programme.

The exchange programme is the debt restructuring programme that the government needs to introduce in order to get the $3 billion bailout loan from the International Monetary Fund (IMF).

Ofori-Atta explained Ghana will swap existing local-currency debt with four new bonds maturing in 2027, 2029, 2032, and 2037.

New feature: Сheck out news that is picked for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Source: YEN.com.gh