Domestic Debt Exchange: Investors Oppose Ken Ofori-Atta's Plan To Deal With Ghana's Debt Crisis

The domestic debt exchange programme is a plan by Ghana's finance ministry, led by Ken Ofori-Atta, to prevent an economic collapse due to the government's inability to pay domestic lenders. However, the plan, which has been described as insensitive because it proposes to erode investments of thousands of Ghanaians, is facing fierce public resistance. Individual bondholders, banks and other interest groups have rejected the proposals under the voluntary debt exchange programme. This article breaks down the issues.

PAY ATTENTION: Enjoy reading our stories? Join YEN.com.gh's Telegram channel for more!

Debt restructuring and domestic debt exchange were unfamiliar terminologies in Ghana. But they have become popular, months after the government belatedly decided to approach the IMF for help because the country was in economic distress. It is a critical agreement that the government must secure with creditors to facilitate the success of the $3 billion bailout loan application from the International Monetary Fund (IMF).

What is debt restructuring?

Debt restructuring, according to Haruna Alhassan, a finance expert attached to the Centre for Social Justice (CSJ), is generic to any strategy to ease the burden of a debtor in a way that allows the debtor to eventually pay its debt obligations which, at the point of restructuring, is struggling to pay.

Source: UGC

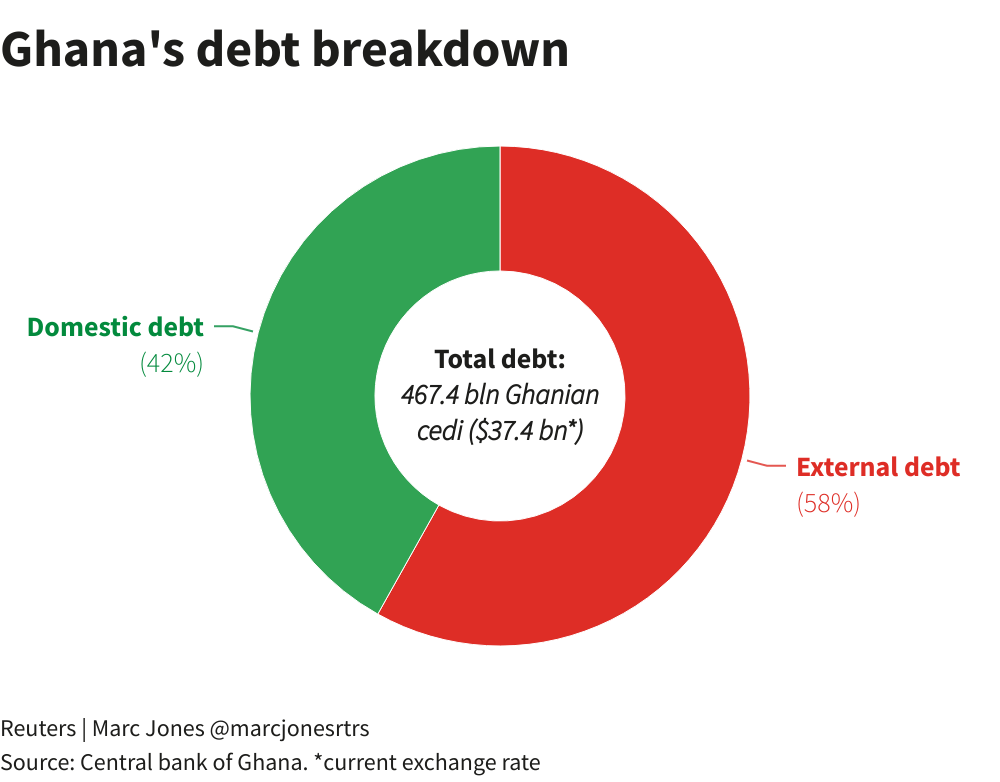

He explains to YEN.com.gh that because Ghana's economic crisis is significantly a debt crisis, it has become imperative for the government to "restructure" its debt with local and foreign creditors. Ghana's total debt as of December 2022 stood at GH¢467.4 billion. A chunk of this debt (some 58%) is external debt, while the remaining 42% is domestic debt.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

Source: UGC

What is Ghana's domestic debt exchange programme (DDEP)?

The Domestic Debt Exchange programme (DDEP) is specific to domestic lenders. Commercial banks hold the largest percentage of all loans made out to the government by domestic lenders. This is followed by other firms and other types of financial institutions, the Bank of Ghana, foreign investors, individual investors, rural banks, insurance companies and then SSNIT in that order.

Read also

Christian Council demands immediate suspension of Domestic Debt Exchange programme to allow for broader consultations

The chart below paints a representative picture of which categories of lenders the Ghana government is indebted to the most.

Ghana's provisional nominal debt to GDP as of the end of November 2021 was 78.4%. This means Ghana uses close to 80% of its national income to settle loans and only 20% to run the country. The World Bank has always cautioned against a debt-to-GDP exceeding 70% because it stifles growth and amplifies challenges within an economy.

What does the domestic bond exchange entail and what prompted its introduction?

The DDEP in simple terms is a plan by the Ken Ofori-Atta-led finance ministry to reduce the debt burden to manageable levels by telling local bondholders that they must accept losses in interest payments on their investments because Ghana is broke. It aims to swap some bonds for longer maturities, cut interest rates and temporarily stop interest payments until 2024.

It is the "domestic leg" of the restructuring programme that the government needs to secure with creditors to facilitate the success of the $3 billion bailout loan application from the IMF.

The debt restructuring deal with foreign creditors has been smooth. Ghana has been able to convince foreign creditors that it is temporarily suspending interest payments on Eurobonds pending a well-structured repayment proposal. But it has been a daunting task for holders of the domestic debts, intensified by the U-turn inclusion of individual bondholders in the DDEP.

Who are the individual bondholders and why do they oppose the debt exchange programme?

Source: UGC

The DDEP proposals that the government is pushing through and inviting creditors to voluntarily join have been described as "insensitive".

Individual bondholders are currently putting up the fiercest fight to the DDEP proposals. Individual bondholders have currently organised themselves into the "Individual Bondholders Forum" represent over 180,000 individuals with investments Government of Ghana Local Cedi Bonds, Government of Ghana Local USD Bonds, ESLA Bonds, Daakye Bonds, Eurobonds and Collective Investment Schemes (i.e., Mutual Funds, Cash Trusts, Balanced Funds).

Below is a summary of the proposals contained in a document released by the finance ministry on the DDEP and which the individual bondholders are opposing:

- Interests on the money that domestic lenders have given to the government through government securities will not be paid for the whole of 2023.

- But In 2024, 5% of interest will be paid, and 10% in 2025. This means that if the expected annual interest on an investment is, say, GH¢10,000. The investor/individual bondholder gets only GH¢500 in 2024 and GH¢1,000 in 2025.

- This 10% rate is what will be paid out to the investor every year until the coupon rate has been fully repaid. If an investor/individual bondholder wants their principal back, the government has put forth a proposal that many say is difficult to accept.

- For people whose coupon would be maturing in 2023, the finance ministry's proposal is that between 2023 and 2025, it will not be able to pay any part of the principal -- assuming investors want out. But from 2026 and 2027, the government will pay only 15% for each of the years of any principals. Then from 2028 to 2033 the government will pay only 14% of the principal.

Read also

Dr Ato Forson predicts Debt Exchange programme will lead to collapse of 5 commercial banks in Ghana

Individual bondholders are putting up the big fight with the government over the proposals in the DDEP because they believe they present major uncertainties. The Individual Bondholders Forum have so far obtained over 182,570 signatures asking the government to exclude them from the DDEP.

The Forum claims there are over 1.3 million Ghanaian individual bondholders who will be affected by the government’s debt restructuring programme. According to them, there are better alternatives to adding their relatively paltry investments to the DDEP.

Why commercial banks are fighting the DDEP

The Ghana Association of Banks has also directed commercial banks not to sign on to the debt exchange programme until its members’ demands are met. The association said there are uncertainties regarding the impact of the debt restructuring on the banking industry.

While it is common for debt-distressed economies to pursue debt restructuring to deal with their problems, the very clear message from all the domestic lenders to the finance ministry is that the proposals are unacceptable. Many of the domestic lenders believe government must make concessions -- cut spending and the size of government -- to reduce the impact of the debilitating debt situation.

Gabby Asare Otchere-Darko Tells Individual Bondholders DDEP Is "Necessary Evil"

Meanwhile, YEN.com.gh has reported in a separate story that a stalwart of the governing New Patriotic Party (NPP) has described the Domestic Debt Exchange programme as a necessary evil.

Gabby Asare Otchere-Darko thus wants all individual bondholders to embrace the programme to save the Ghanaian economy This comes amid intense opposition to the programme in its current form Read more: https://yen.com.gh/politics/226235-domestic-debt-exchange-gabby-asare-otchere-darko-tells-individual-bondholders-programme-a-neces/

New feature: Сheck out news that is picked for YOU ➡️ find “Recommended for you” block on the home page and enjoy!

Source: YEN.com.gh