BoG Reportedly Rules Out Restoring Licence to Nduom's GN Bank

- The Bank of Ghana has reportedly ruled out restoring the licence of GN Bank, owned by Ghanaian politician Dr Papa Kwesi Nduom

- A court ruling in January 2024 upheld the BoG’s 2019 decision to revoke GN Bank's licence over insolvency and governance failures

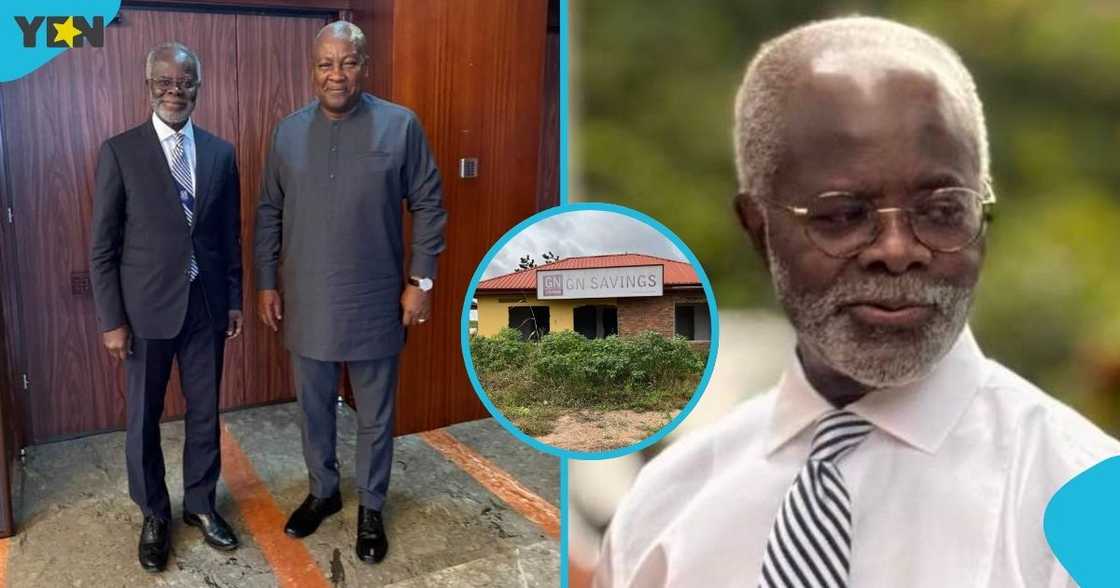

- Speculation about the bank’s return intensified after President John Mahama’s swearing-in and a visit to his residence by Dr Nduom

The Bank of Ghana (BoG) has reportedly ruled out restoring the licence of GN Bank, owned by renowned Ghanaian politician and entrepreneur Dr Papa Kwesi Nduom.

This is according to a news card shared on Instagram by Angel TV (@angeltvgh) on Friday, 6 February 2026.

Source: Facebook

Angel TV's post on Instagram read as follows:

"Bank of Ghana rules out restoring licence to Nduom's GN Bank."

How GN Bank lost its operating licence

In August 2019, the Bank of Ghana revoked the operating licences of 23 savings and loans companies and finance houses, including GN Bank, a Groupe Nduom brand, as part of a ruthless clean-up of the country's financial sector.

Read also

Prof Lumumba weighs in on Kotoka International Airport renaming saga: "Name It after Nkrumah"

The BoG determined that the bank was insolvent under Section 123 (4) of the Banks and SDIs Act, 2016 (Act 930).

Additionally, the central bank stated that GN reported a Capital Adequacy Ratio (CAR) of -61 per cent, which was significantly below the minimum regulatory requirement of 13 per cent.

Earlier in 2019, the bank was downgraded from a universal bank to a savings and loans company because it could not meet the new GH¢400 million minimum capital requirement.

The BoG also observed governance failures that left GN Bank unable to meet its debt obligations to depositors and other creditors.

See the Instagram post below:

GN Bank management files suit against BoG

The management of GN Bank subsequently filed a lawsuit at the Accra High Court challenging the legality of the central bank's actions.

The court, presided over by Justice Gifty Addo Adjei, reaffirmed the decision of the Bank of Ghana in a ruling delivered in January 2024.

Before the revocation of its licence, GN Bank was one of the top performers in Ghana, with offices dotted across the country, even in the most rural areas.

Rumours about GN Bank licence restoration swirl

Since the swearing-in of President John Dramani Mahama on January 7, 2025, there have been countless rumours about the BoG restoring GN Bank's operating licence.

The rumours intensified when photos of Dr Papa Kwesi Nduom visiting Mahama’s residence surfaced on social media.

It was widely alleged that the president had promised to restore the licence of Dr Nduom's bank, which had branches in every district across Ghana.

However, the central bank's purported response to the matter would likely put speculation about GN Bank's licence being restored to bed.

Source: Facebook

Ndoum gets emotional over GN Bank collapse

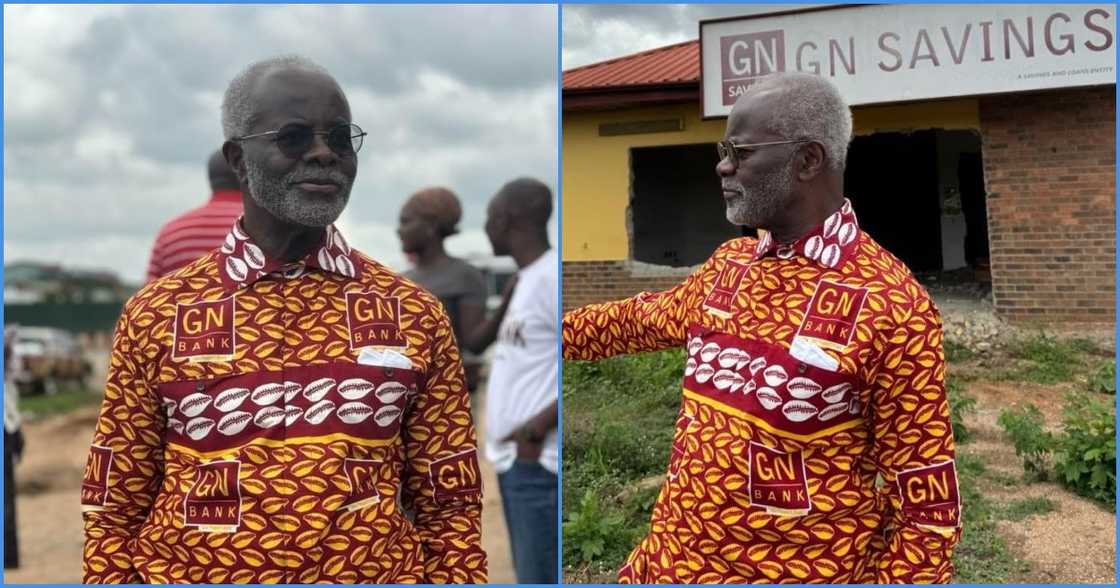

YEN.com.gh also reported that Dr Paa Kwesi Nduom nearly broke down in tears after he visited one of the numerous branches of the defunct GN Bank.

Touring the facilities, he could not believe the ruins of his properties, worth millions of cedis, and shared the clip online in an attempt to restore his business.

Proofreading by Bruce Douglas, copy editor at YEN.com.gh.

Source: YEN.com.gh