2026 Budget: Mahama Administration Set to Scrap Covid-19 Levy

- The Mahama administration is finally set to scrap the COVID-19 Levy, among other tax reforms

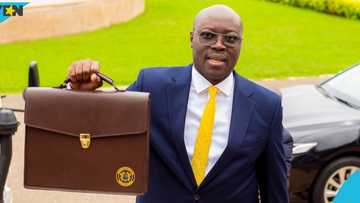

- The Minister of Finance, Dr Cassiel Ato Forson, will capture this in the 2026 Budget and Economic Statement of the government

- In the 2025 budget, the government scrapped other controversial taxes like the Electronic Transfer Levy (E-levy)

Ghana’s top stories, now easier to find. Discover our new search feature!

The 2026 budget is expected to see the scrapping of the COVID-19 Levy and some other tax reforms as the Mahama administration prepares for its second year.

The Minister of Finance, Dr Cassiel Ato Forson, will present the 2026 Budget and Economic Statement of the government to Parliament late on November 13.

Source: Facebook

The budget, the second of President John Dramani Mahama in his second term, is expected to allocate significant resources to many flagship programmes while meeting the demands of labour, some of whom have either embarked on strike or issued notices of impending industrial actions if their demands are not met.

Graphic Online reported that the government is expected to allocate about GH¢30.8 billion for the implementation of the flagship infrastructure programme, Big Push, up from the GH¢13.85 billion allocated in the 2025 budget.

The $10 billion Big Push infrastructure project is expected to draw on all the oil revenue allocation to fund the annual budget.

Other initiatives that would receive attention would be the 24-hour Economy Programme, the establishment of the Women’s Development Bank, the National Apprenticeship Programme, the ‘Adwumawura’ Programme, the Digital Jobs Initiative, the Agriculture for Jobs Programme, and the Rapid Industrialisation for Jobs Programme.

The President, during the meeting with civil society organisations more than a month ago, gave the assurance that the National Anti-Illegal Mining Operations Secretariat would be allocated substantial resources to enable it to function more effectively.

Among the key measures expected in today’s budget is the removal of the controversial COVID-19 Levy.

The Budget Statement is also expected to detail a full restructuring of the value-added value added tax (VAT) regime, simplifying it from the current complex formula.

Dr Forson is also expected to announce massive injections into the energy, road and agriculture sectors, with major policy directions on the cards.

Earlier removal of so-called nuisance taxes

In the 2025 budget, the government announced the scrapping of the controversial Electronic Transfer Levy (E-levy). Other taxes to be jettisoned were the betting tax and the emissions levy.

As part of the VAT reforms, there was also the reversal of the decoupling of the Ghana Education Trust Fund and the National Health Insurance Levy, reducing the effective VAT rate for households and businesses; reversing the VAT flat rate regime and upwardly adjusting the VAT registration threshold to exempt micro and small businesses from the collection of VAT.

Source: YEN.com.gh