MTN CEO Explains Reason E-Levy Will Remain On Transactions In Short Term Despite Being Abolished

- The MTN Ghana CEO, Stephen Blewett, has indicated that the Electronic Transfer Levy charges will remain in the short term

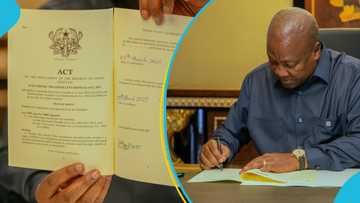

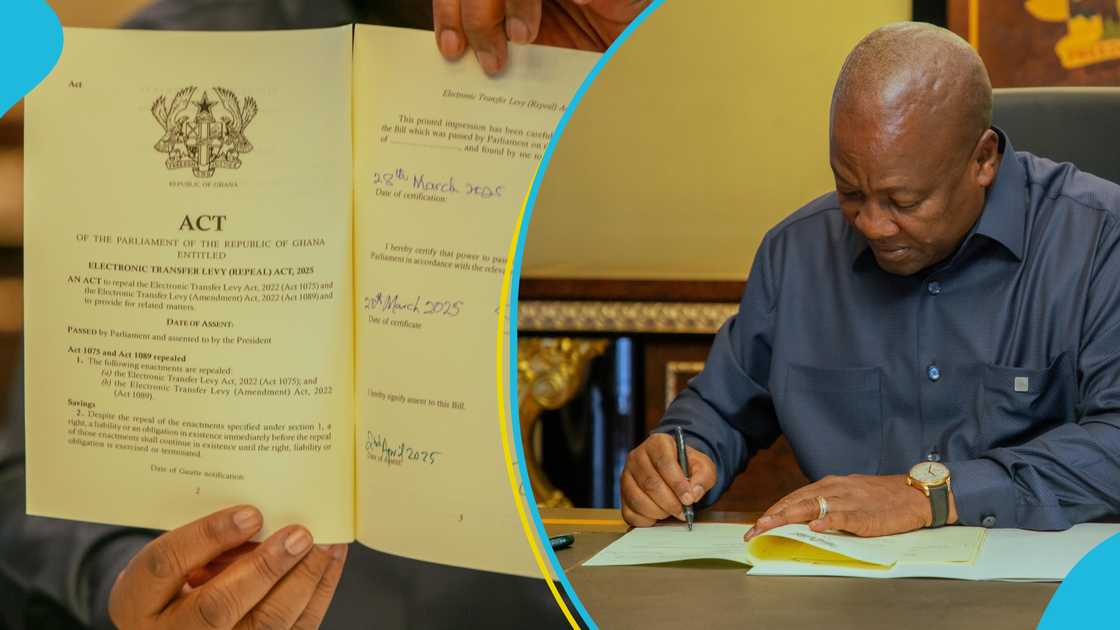

- President John Mahama signed the Electronic Transaction Levy (Repeal) Bill to scrap the tax implemented by the Akufo-Addo administration

- The controversial e-levy was a 1% tax on all electronic transactions, with a daily free limit and certain exemptions

MTN Ghana CEO Stephen Blewett has clarified that the scrapping of the Electronic Transfer Levy (E-Levy) as promised by the Mahama government cannot take immediate effect.

Blewett explained on April 2 that the company must go through regulatory approval before taking away the levy.

Source: Facebook

“There is a process that has to be followed. I can’t abolish E-Levy until I’m told to do it. If I do it ahead of time, the Bank of Ghana will catch me."

His remarks at MTN House follow President John Mahama’s assent to legislative bills aimed at scrapping several taxes.

Earlier on April 2, Mahama assented to the Electronic Transfer Levy (Repeal) Bill, 2025; Emissions Levy (Repeal) Bill, 2025; Income Tax (Amendment) Bill, 2025; and the Earmarked Funds Capping and Realignment (Amendment) Bill, 2025, among others.

Blewett emphasized that while the government has signalled its intention to remove the levy, telecom operators like MTN must follow official directives before making changes.

Blewett also lamented the negative impact of the E-Levy on mobile money transactions.

He is hopeful the scrapping of the tax will boost mobile money transactions.

GRA orders halt to e-levy collection

The Ghana Revenue Authority subsequently instructed all e-levy charging entities to immediately reconfigure their systems to reflect the abolition of the levy.

In an official communication, the Authority informed all stakeholders that the Electronic Transfer Levy Act, 2022 (Act 1075) and the Electronic Transfer Levy (Amendment) Act, 2022 (Act 1089) had been signed into law, abolishing the 1% E-Levy, effective April 2, 2025.

“In accordance with our previous communication regarding implementation guidelines, this letter serves as formal authorization for you to proceed with the deployment of the ‘no charge’ configuration on your platforms."

It noted that the Electronic Transfer Levy Management and Assurance System (ELMAS) will automatically return a “no charge” on all transactions posted to it by entities from midnight.

The authority also said entities must immediately process refunds for any e-levy amounts deducted from customers effective today 2nd April 2025.

The entities are to establish an expedited refund process to handle such cases promptly and maintain proper documentation of all refunds processed.

The GRA warned that failure to comply with these directives constitutes an offence and will attract sanctions as prescribed by law.

The authority also announced that regular compliance checks will be conducted to ensure full adherence.

About the e-levy

The e-levy is a 1% tax on all electronic transactions, with a daily free limit of GH¢100 and specific exemptions.

It was initially introduced in May 2022 as a 1.75% tax and was met by protests. It was later reduced to 1.5% and then the 1%.

When implemented, the Akufo-Addo government said this was part of a seven-point agenda aimed at restoring macroeconomic stability and accelerating economic transformation.

The levy is charged by the entities listed in the First Schedule to the Act.

The Ghana Revenue Authority (GRA) is responsible for collecting the Levy and paying the Levy into the Consolidated Fund.

Source: Twitter

The Commissioner-General is responsible for the administration of the Levy in accordance with the Revenue Administration Act, 2016 (Act 915).

The e-levy was found to have met only 12% of the initial wildly optimistic revenue target of GH¢6.96 billion. This amounted to 1% of total tax revenue.

Critics feared the levy would negatively affect financial inclusion but though Mobile Money transactions initially fell, they soon rebounded and continued to grow.

Finance Minister Ato Forson's promise on taxes

YEN.com.gh reported that during his vetting, Cassiel Ato Forson pledged to remove both the 1% e-Levy and the betting tax from the government’s first budget.

He argued that both taxes hinder economic progress.

Specifically, the Finance Minister said that the e-Levy discouraged digital transactions and obstructed the country’s move towards a cashless economy while betting tax generated minimal revenue.

Proofreading by Samuel Gitonga, copy editor at YEN.com.gh.

Source: YEN.com.gh